Analyst insight: Where has the malting premium gone?

Thursday, 26 September 2019

Market commentary

- Global wheat futures drifted for the most part yesterday, with UK wheat futures (Nov-19) closing unchanged at £135.75/t.

- Paris wheat futures end the day marginally up, closing at €170.25/t (+0.29%). Chicago wheat futures eased to $175.34/t (-0.93%) by yesterdays close.

- Currency remains key with Brexit driven FX volatility heavily influencing domestic markets. Yesterday saw the value of sterling dip against the Euro falling to £1=€1.1278. Now that Parliament has resumed we could see some big shifts in currency as the end of October comes closer.

Where has the malting premium gone?

This season UK barley production looks on track to hit c.7.3Mt, the highest level of production since 2015/16. With a large surplus to shift feed barley values have been under pressure to price competitively on the global stage.

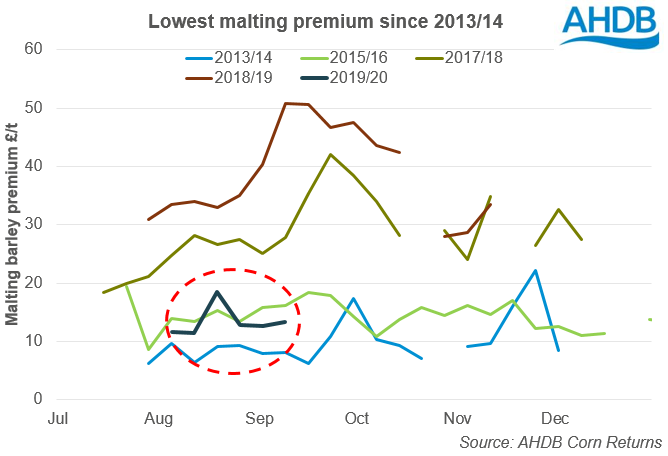

The large crop size has pressured malting premiums as well with ex-farm malting prices only £13.30/t above feed values two weeks ago. This is the lowest premium for this point in the season for the past 5 years and below levels in 2015/16, despite expectations for similar levels of production.

Production and quality looking good

The initial Cereal Quality survey results suggest that nitrogen levels are coming in lower than in 2018 (1.73%), at 1.65% so far. While screenings are coming in slightly higher than normal and there has been some concerns over low bushel weights, generally quality appears to be looking good. The second CQS release next week will give us a further insight into the quality of the crop.

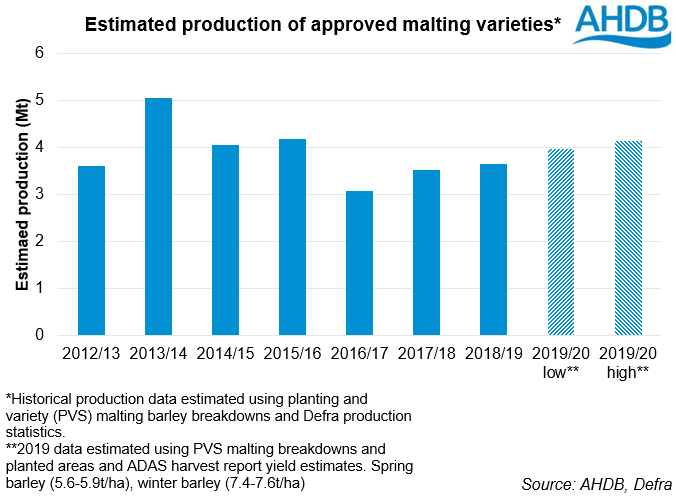

The good quality seen so far means that a larger proportion of the area grown to varieties with malting approval seem likely to hit specification this season. A rough estimate using the planting and variety survey data and yields from the harvest survey suggests that there could be a tonnage of c.4Mt of varieties approved for malting produced this season, roughly in line with 2015/16.

While this is a fair jump, from the past few seasons, domestic demand looks relatively stand on. The Maltsters Association of Great Britain (MAGB) has stated its members are wanting to purchase 1.9Mt of malting barley this season. While this is slightly up from final purchases over the past two seasons, where members have purchased c1.8Mt, it would be insufficient to absorb the volumes that we are likely to see coming through.

Where else could the crop go?

In the short term buyers seem covered ahead of Christmas with many in the trade reporting little movement. There is also a big question mark from October onwards, the period when malting barley exports would traditionally ramp up. Whether or not this market will be there at all is doubtful with the potential weight of tariff dissuading purchasers to committing to any significant volumes.

With limited domestic and export demand we could see volumes being pushed into the feed market. Any deal being reached in Parliament could see a revival in interest for exports and support prices, but with nothing but uncertainty ahead the outlook isn’t looking rosy for barley.

Large crops across the EU

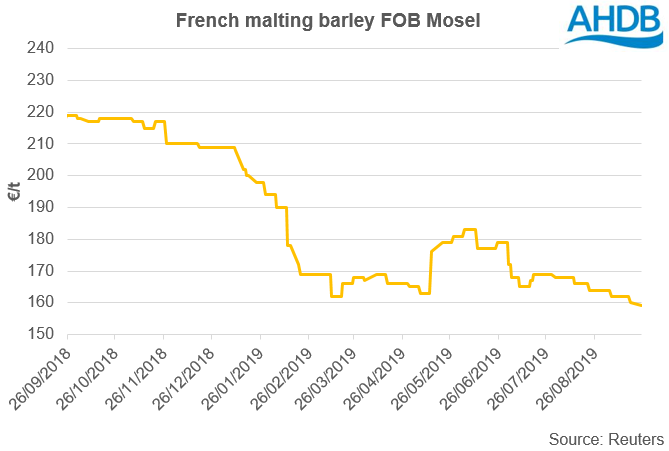

This season the barley market within the EU seems amply supplied with production expected to reach north of 60Mt for the first time since 2015/16. This has translated into subdued feed barley prices across the EU.

There are some concerns around quality for malting crops in France and Germany. In France lower Nitrogen levels have been reported with decent volume of malting barley already having been sold into the feed pool. Equally across Germany reports have come forward that this summer’s heatwave negatively affected quality. Figures released by the German industry association Braugerstein-Gemeinschaft on Tuesday indicated that they expected around 61% of this season’s spring barley crop to meet premium malting spec, around 9 percentage points below average.

However, these concerns have not been translated into support for prices with barley a premium in sight. The sheer size of the crop in the EU means that regardless of some quality issues there will likely be enough malting barley for purpose this year. Equally reports of limited trade across the continent and intermittent FOB quotes would indicate that many maltsters have sufficient cover for now.

With what seems to be more sellers than buyers across the EU, even if tariff free access is preserved, will mainland Europe take enough of the UK crop to provide any upside?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.