Analyst Insight: Wheat prices strong, where next?

Thursday, 7 January 2021

Market commentary

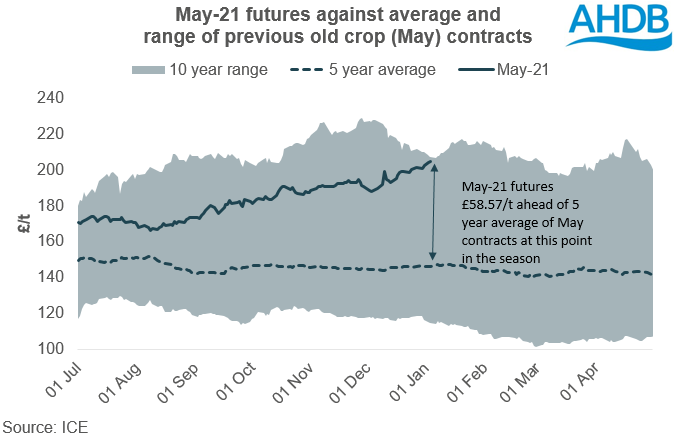

- UK feed wheat markets continued to rally yesterday, with the May-21 contract closing at £204.90/t. Values have fallen back so far today, in line with moves in global markets.

- To an extent, a fall in prices was to be expected following a 17-day streak of gains in US maize futures (May-21). From a technical stand point markets have looked to take a breather. The balance of supply and demand fundamentals and technical trading will be key to where markets go from here (read more below).

Wheat prices strong, where next?

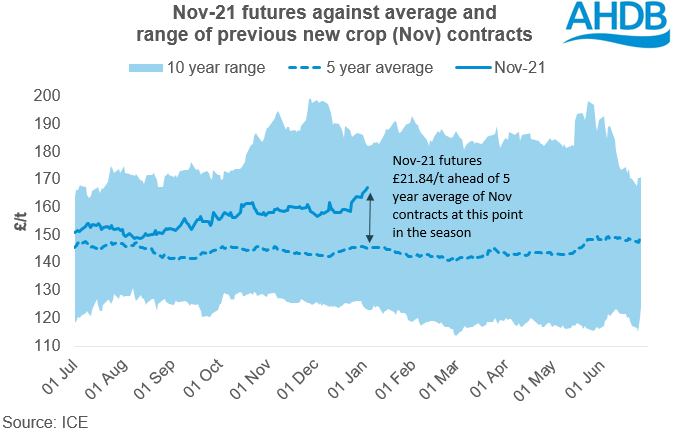

As we move into the New Year, grain markets have continued to rally. Since Monday, old crop UK feed wheat futures (May-21) have gained £3.90/t, closing yesterday at £204.90/t. Equally, new crop (Nov-21) futures have gained £3.50/t over the week so far, reaching £167.00/t yesterday.

The latest rally has been driven by many factors. At the tail end of 2020 we saw export restrictions for both Russia and Argentinian grains. These export caps have tightened the global market, and elevated global prices.

With prices firm it is important to think about the longevity of the gains. What factors exist to support or detract from the current rally.

Where are prices in a longer context?

Looking back on where current old and new crop prices sit in a historical context, it is clear that both are high. The May-21 contract is near to the top of the 10 year range for this point in the season. However, with markets being driven by global tightness as well as domestic, the 10 year maximum price doesn’t necessarily act as a cap on prices.

With a larger domestic wheat area going into next season, new crop markets are understandably trading at a huge discount to old crop values (£37.90/t at yesterday’s close). However, at £167.00/t, new crop prices are at the highest point at this time in the season since January 2013.

What factors do we need to watch?

Knowing prices are “high” only forms a small part of grain marketing decisions, it is also important to understand the possible future direction of travel.

While much of the tightness that became apparent in 2020 will have been factored into market pricing. It is still possible that we see future support for values. With South America still dry we could still see the size of the crop fall in forecasts.

The next significant forecasts for grain markets are due next week, with the USDA supply and demand estimates and Brazilian crop forecasts published on Tuesday and Wednesday respectively. Moreover, while data from the European Centre for Medium-Range Weather Forecasts (ECMWF), does show improved rainfall prospects for South America in the coming fortnight, beyond this conditions are dry. This has the potential to further harm crop prospects.

Another key theme for grain markets in 2020, was food security, which saw a number of Asian and North African nations boost grain and oilseed import programmes. With global health and political instability still at the forefront of markets in 2021, this is a theme which will need to be watched closely this year.

Finally, we need to consider the technical picture for markets, which could cap the gains we see in grain markets. We have seen wheat futures take a breather so far today. And Chicago maize futures take a breather after 17 days of gains. With values strong and momentum falling (the rate of change in markets) we could see a cap on gains, if current fundamental drivers such as South America weather remain unchanged.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.