- Home

- News

- Analyst Insight: What could be the impact of Black Sea regions shutting their wheat export shop?

Analyst Insight: What could be the impact of Black Sea regions shutting their wheat export shop?

Thursday, 16 April 2020

Market Commentary

- UK wheat futures (May-20) fell back to close at £152.50/t, down £1.65/t from Tuesday. New crop futures (Nov-20) also fell back slightly, closing down £1.00/t from Tuesday to be at £165.00/t. The drop followed the latest Strategie Grains monthly report, which increased its estimates for soft wheat stocks. The estimate was raised 1.2Mt from last month, to 13.7Mt, accounting for anticipated reduced demand from the coronavirus impact. The drop was cushioned by reductions to EU new-crop soft wheat production forecasts.

- The International Energy Agency (IEA) announced yesterday it expects oil demand this month will fall to its lowest level since 1995 as disruptions from coronavirus continue. Brent crude oil prices fell to the $27.96/bbl mark yesterday, but showed signs of recovery this morning. Paris rapeseed futures also saw declines, with the nearby contract losing €0.25/t from Tuesday, to close at €369.00/t yesterday.

What could be the impact of Black Sea regions shutting their wheat export shop?

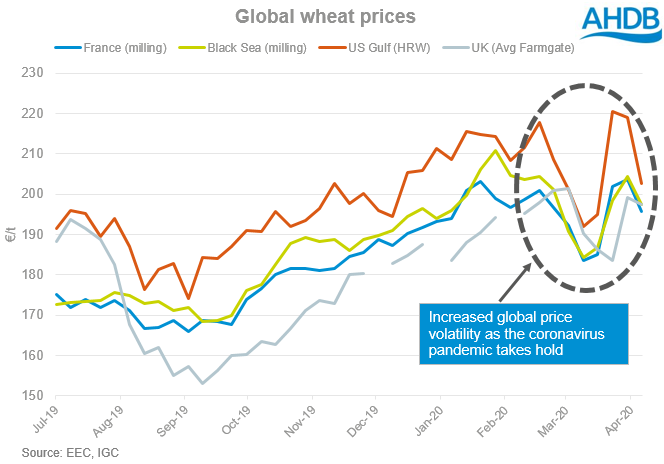

The coronavirus pandemic is resulting in a great many unknowns. One of these is the extent of the economic damage on global markets, as it becomes increasingly likely that many countries will face some degree of recession. As countries across the world enter multiple-week shut-downs, ensuring food supply has become a necessity. Last week, Romania announced it was stopping its wheat exports to non-EU countries. As a result, global wheat markets spiked fearing other countries could follow suit. With wheat demand coming from China of late, export cessation from certain exporting countries could support European grain markets.

Recently, there have reports from other Black Sea countries discussing the possibility of limiting their wheat exports, aiming to dissuade domestic supply worries amidst ongoing lock-down measures. Should this occur, this could have a supporting effect on European wheat prices, albeit likely restricted to the short term. However, the longer-term view of wheat market supply remains bearish, given the present fundamentals.

So what might the potential impact be with Romania restricting its exports strictly to EU countries? This marketing season, Romania is forecast to export 5.6Mt of wheat. According to the latest European trade data, as at 14 April around 79% had already been exported to non-EU countries. The main homes for these exports are likely Egypt and other North African regions. With the disappearance of Romania from non-EU wheat tenders, prices may experience support due to the loss of one supplier. Given that Egypt announced last week that their import requirement would be hefty over their domestic harvest to supplement grain stocks, this demand side of the price equation remains weighted. With global wheat tenders act as good indicators for price direction, this potential tightness could provide support to wheat markets.

At the beginning of April, Russia announced a 7Mt cap to grain exports for the rest of the season. Since then, about one third (2.24Mt) of the quota has reportedly been filled, leaving 4.76Mt for the rest of this season. However, markets view this decision from Russia as a guideline figure, as remaining exports were expected to finish near to that limit regardless.

Another key Black Sea country, Ukraine, announced 2Mt remaining of its estimated 20Mt wheat export target. Once this has been exported, the country said it will close its export programme until the new marketing season in July regardless. As wheat export schedules across these regions are beginning to approach completion, Western Europe could potentially pick up the demand.

As China looks to begin its initial recovery from the pandemic, it has reportedly begun purchases of soft wheat from the EU. This fresh demand is another supporting factor to European grain markets. In its monthly supply and demand forecasts released yesterday, FranceAgriMer increased forecasts for French wheat exports to non-EU destinations this season, up 500Kt from last month to 13.2Mt. If this is realised, it would mean a 36.5% increase on last season, representing a new record for the country. It is likely that this supply will look to head to China, Egypt and other non-EU countries. However, we need to bear in mind any logistical constraints arising from the health crisis that might mute this response.

At this point in the season, the markets are usually a lot more weather driven. The sentiment of positive or negative weather conditions in key growing regions is enough to support or suppress prices. However, this season we also see the uncertainty arising from coronavirus affecting forecasted demand models. Adding this additional uncertainty into the equation, European wheat prices are likely record increased volatility, at least for the near future.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.