Analyst Insight: What does an increased oat area mean for 2020/21?

Thursday, 12 December 2019

Market Commentary

- UK wheat futures (May-20) closed yesterday at £146.50/t, up £0.50/t. This is the first gain in price this month. However, the Nov-20 contract remained unchanged on the day before closing at £154.00/t.

- Chicago wheat futures (March-20) closed yesterday at $190.77/t, down $1.66/t. This contract is trading near a three-week low, reasons for this is due to a large amount of global supplies offering more competitive pricing on the world market.

- Paris wheat futures (March-20) closed yesterday at €182.00, down €1.00/t on the day before. Recent crop forecast confirms that France is set to produce a significant export demand.

What does an increased oat area mean for 2020/21

The consistent wet weather has caused major delays to drilling for 2020 harvest. Farmers are likely to be weighing up alternative spring options at present, of which oats could be one.

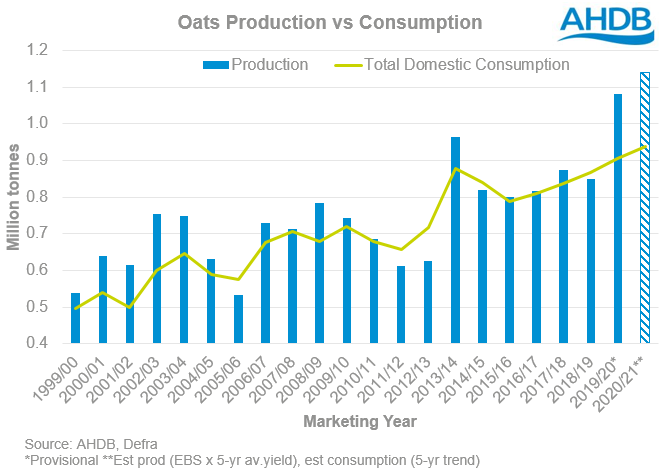

Autumn 2012 was similar and led to a 45% increase in the area of oats. Coupled with improved yields, production increased by 54% to 964Kt.

It’s critical to analyse whether opting for spring oats is a wise agri-business option for the 2020/21 marketing year. Since harvest 2015, the planted area of oats has been increasing, with an average growth of 8.5% per year. The oat area for harvest 2019 increased by 6.1% year-on-year (182Kha) and the provisional production estimate is 1.08Mt. This is the largest oat production since the 1970’s.

The Early Bird Survey (EBS) of planting intentions currently pegs the oat area for 2020 harvest at 200Kha, the largest oat area on record. There’s potential this could increase further if wet weather persists. The current EBS area figure, combined with a 5-year average yield, could see 2020 oat production at over 1.0Mt for a second year running.

Demand

Although the UK demand for oats has been generally increasing for the last 20 years, production has also followed suit. Despite lower opening stocks (-16%) and imports (-47%) predicted for 2019/20, a production of over 1.0Mt bolsters oat availability.

A slight increase in demand of domestic oats is primarily driven by a 14% increase in estimated usage in animal feed, but this still leaves demand well below supply. Oat exports in the first balance sheet are estimated at 70Kt, the largest surplus since the 2014/15 marketing year.

Harvest 2014 produced an 820Kt oat crop despite a lower area but opening stocks were significantly up following a 964Kt 2013 harvest.

A need for exports…

Based on a five-year average, 95% of the UK’s oat exports move into the EU. With uncertainty surrounding Brexit there has been a real push for exports at the start of this season.

In the first four months of the season (July-October), 52Kt of oats were exported and 99% of these went into the EU. Compared to 2014/15 oat exports (July-October), this is an 80% increase, showing a huge push for early exports most probably driven by the uncertain trade situation post-Brexit.

With the current prediction of 70Kt, this means that by the end of October 75% had already been exported. However, the balance of oats currently sits at 310Kt and therefore there could be room for more exports than currently predicted. Moreover, based on previous trends, Brexit uncertainty and the fact that Europe only has a finite demand, it is likely that exports will tail off significantly in the latter half of the season. This could mean that the carry-over into 2020/21 will be relatively large, currently estimated at 240Kt.

What does this mean for the domestic oat market?

Despite impressive early season exports, a large carry-over of oats into 2020/21 could occur. In addition, the potential for another 1Mt+ crop for a second year running will add to stocks and could continue to pressure prices, notably those not on contract.

Traditionally contracted, milling oats are priced off UK feed wheat futures. These could remain supported if adverse weather continues into January. If this is the case, contracted milling oat prices could remain firm.

However, at this stage contract availability will be limited at best and therefore an increased area in oats will likely be non-contracted. This could put ex-farm prices under pressure as a large carry-over and a second large production is met with limited demand.

With oats markets potentially under pressure, it’s important to weigh up economic as well as agronomic factors when making planting decisions. Our Farmbench tool can help to deliver a detailed breakdown of the cost of production and margins, along with allowing you to compare your own business against others.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.