Analyst Insight: What does a big oat crop mean for new crop pricing?

Tuesday, 21 April 2020

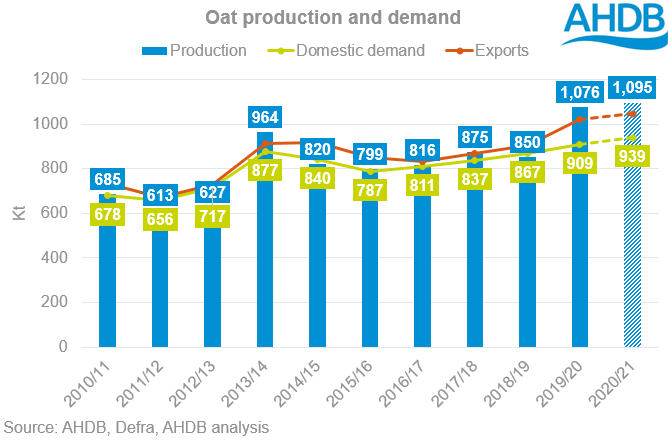

In 2019/20 the UK produced its largest oat crop of the 21st century, at 1.08Mt, a record that could seemingly be broken this season. A torrid winter for many has seen expectations of spring plantings increase exponentially. For oats the February re-run of the early bird survey suggested that oat plantings in the UK could reach as much as 229Kha, the largest area planted to the crop since 1976.

In this outlook, I will piece together the scenarios for oat production in 2020/21, outline the picture for domestic and international trade and some of the particular challenges a huge crop presents. I will also highlight a few challenges that are inherent in the oat industry, concluding that we could well see a significant oat price risk for some, but not for all!

How big is the 2020/21 oat crop?

Obviously, it is too soon to say with any form of certainty how big the oat crop is likely to next season. But we can begin to piece together the information available in the market and produce some scenarios of the size of the crop come harvest 2020.

My colleague Alex has already produced some work in this area, giving a crop range from a “worst case” 916Kt, through to a “best case” 1.28Mt. Delving further into the detail of this crop we can start to lay the foundations for some of the challenges further ahead.

With a wet winter hampering cereal planting, it is likely; weather permitting, that we will see sizeble spring crop planting. The AHDB early bird survey of planting intentions re-run, conducted in February, suggest that the area planted to oats in the UK could reach 229Kha, split 66/33 in favour of spring planted oats.

Given the time of sowing it is entirely possible that a proportion of the winter crop will not now get sown. Taking 20% off the winter wheat area figure would suggest a total oat acreage of 213Kha.

Oat yields for winter crops are also likely to be down given the challenging winter we have had, although this will vary greatly by region. Spring yields are still very much to be determined. For this reason I have suggested two yield scenarios, “low winter-average spring” and “low winter-low spring”.

Under the two scenarios there is a range in production from 1.10Mt to 1.25Mt.

How much of this can be consumed domestically?

Since 2015/16 domestic oat consumption has grown steadily, and is forecast to reach 909Kt in 2019/20. The growth in consumption has been driven primarily by a rise in perceived animal feed consumption.

The true figure for animal feed consumption is difficult to determine due to the vast majority of consumption being “fed on farm”. I would anticipate given the likelihood of a large oat crop pressuring prices, we may see further rises in the volume of oats being fed in ruminant diets. Consumption in monogastric diets is limited by the difficulty pigs and poultry have in breaking down the oat husk.

Milling consumption will be heavily dependent on the quality of the oats. The UK milling industry define the difference between milling and feed oats based on a number of criteria including specific weight and “hullability”. Further, the requirements for milling oat quality are described below;

Good quality milling oats are heavy, dry and clean (no other grain contamination, weeds or seeds). There is zero tolerance of heated oats, bug infestation and high mycotoxins. In short, only quality milling oats are used to produce good quality finished products for the consumer for which a premium is paid.

The milling industry in the UK is formed of two distinct halves. In Scotland and the North of England, it is primarily spring oats which are grown and milled. Conversely in the rest of England winter oats are preferred and demand is heavily geared to contracted supplies. In an ordinary year, this means that an increased volume of spring oats in the “south” would struggle to find a domestic home outside of animal feed.

This year is already far from normal and it is highly likely that “south” mills will need to supplement contracted winter oats with spring oats to ensure there is enough volume. That said, demand from mills in the UK is finite and we are likely to see significant pressure on uncontracted oat prices.

So what does this mean for oat prices?

With the potential for a large carryout in 2019/20, a second huge crop in two years and demand only marginally up on the year, free market oat prices will be pressured relative to other grains.

However, it is important to draw a clear distinction between the price of oats for export and animal feed demand and the oats going into mills. I have already highlighted that the milling market, particularly in England is heavily geared towards contracted supplies. These contracts will have been agreed 12 to 18 months ago, in line with wheat futures markets.

The value of contracted oats will likely be pressure in line with the bearish fundamental sentiment of the global wheat market, but see more support than “free market” oats.

Throughout the course of the next season we will endeavour to publish an oats price wherever possible and look to provide analysis on oat markets. However, it is important to draw a distinction between the price published in the AHDB Corn Returns prices and that being paid by oat millers, which represent two different markets.

What about export demand?

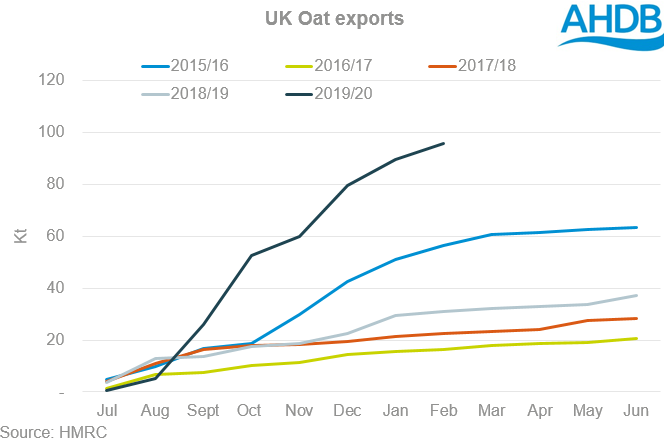

Demand for exports will be crucial to reducing any surplus oats, both this season (2019/20) and next season. UK export is historically centred on EU trade, over the past three season, an average of 92% of UK oat export business has been with the EU.

So far this season, 98% of UK oat exports have been to the EU. Unsurprisingly there was a large build up in oat exports as we neared the October 31 2019 Brexit deadline, with 53% of season-to-date exports shipped in September and October alone. We have seen subsequent shipments and with the prospect of large carryout stocks of oats this season it is entirely plausible that we will still see significant oat trade.

Looking ahead to next season, oat trade is uncertain! The 31 December 2020 is a date that is hanging heavy over agricultural markets. Oat markets will feel particular pressure in relation to end of the transition period.

Should the UK reach 1 January 2021 with third country status with the EU, or should agricultural free trade not form part of any negotiations, UK oat trade with the EU would effectively be curtailed overnight.

Unlike with wheat and barley, there is no Tariff Rate Quota for oats, this means that exports into the EU would be subject to punitive tariffs. The tariff for oats into the EU currently stands at €89.00/t. It is highly likely that if the oat tariff is likely to come into force we will see a high volume of oat exports through the first 5 months of the marketing year. This could lead to a demand pull on farm-gate prices, dependent on the relatively competitiveness of domestic oats in the international market, and relative to substitutable products.

With EU trade potentially curtailed beyond December 2020, third country trade will be crucial. The primary markets for oats are North Africa, Asia and North America. Exporting into these markets the UK would face significant competition from the EU, in particular Sweden and Finland.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.