Analyst insight: UK wheat tough competition from Canada and Germany?

Tuesday, 14 October 2025

Market commentary

- UK feed wheat futures (Nov-25) finished £0.80/t (0.5%) higher at yesterday’s close at £165.85/t. The decline of sterling against the dollar buoyed domestic prices compared to global values with £1 = US$1.3320 (-0.2% vs Friday)

- The euro also saw a decline against the dollar, but it failed to lift European prices. Paris milling wheat futures (Dec-25) ended at €189.00/t, down €0.25/t (0.1%) from Friday amid news of increasing exports from Russia. With prices under pressure, multiple countries are coming out to tender including Saudi Arabia, which bought around 0.5 Mt for delivery in mid-2026

- Farmers group AGPM expect France to produce 12.9 Mt of maize this year, 3% below the five-year average

- Chicago wheat futures hit new contract lows across all contracts until May-27, including the Dec-25 contract, which fell 0.5% from Friday’s close. The increase in the value of the US dollar drove the downward shift. Chicago maize futures also saw the impact of the currency movements, as well as beneficial weather that looks to keep the maize harvest moving well

- Oilseeds found support from tighter sunflower seed prospects. Paris rapeseed futures (Nov-25) gained €3.50/t (0.8%) to finish at €470.00/t, also lifted by the rise in the value of the euro

- Unofficial reports suggest that the soyabean harvest is 58% complete as of the 13 October (based on a Reuters poll of 10 analysts). Chicago soyabean futures (Nov-25) gained 0.1% from Friday’s close, with rhetoric around a US China deal still a swing point for the market but helping to bring a slight lift to prices

UK wheat tough competition from Canada and Germany?

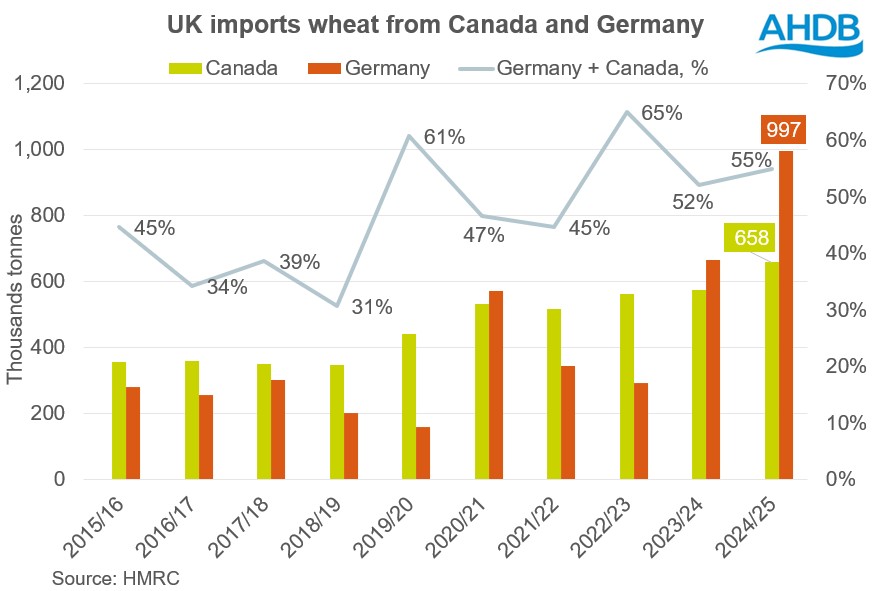

During the 2024/25 season, the UK imported a record 3.02 Mt of wheat (electronic records). The biggest wheat exporter was Germany (0.99 Mt), followed by Canada (0.66 Mt).

These two countries have dominated the market for the last ten years, reaching 55% in the 2024/25 season. The lowest level was 31% in the 2018/19 season, while the highest was 65% in the 2022/23 season.

So, what are the prospects for importing wheat into the UK from Germany and Canada in the 2025/26 season?

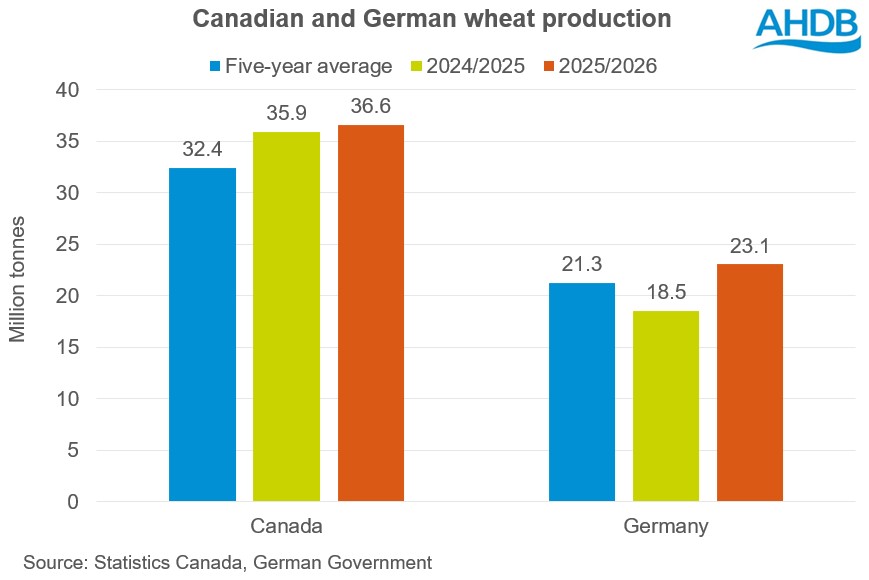

Wheat production prospects in Canada and Germany for the 2025/26 season are higher than in the previous season and than the five-year average.

Meanwhile, early indications of UK domestic wheat production for the 2025/26 season are higher than last season's, but lower than the five-year average. Consequently, competition between UK domestic wheat and imported wheat from Canada and Germany may intensify in the current season.

However, quality and logistical costs must also be considered.

According to the Max Rubner Institute, in Germany the crude protein content, an important measure of the nutritional value and baking quality of the grain, averaged 12.2% this year in winter soft wheat, 0.6 % higher than in the 2024 harvest.

However, rain interrupted the grain harvest for several weeks in many parts of Germany this season. This is reflected in laboratory results showing a lower Hagberg Falling Number (HFN).

The industry sets a HFN of 220 seconds as the lower limit for producing light and airy baked goods. However, a significant 20% of this year's German wheat harvest failed to reach this threshold.

The Canadian Grain Commission revealed that the protein content percentage in the first report for the 2025 wheat harvest was lower than in the previous season.

The main reason for the increased import of wheat into the UK in the 2024/25 season was the realtively poor quality of domestic milling wheat due to unfavourable weather conditions.

In the current 2025/26 season, the quality, according to the AHDB harvest progress reports, is on average better, which could increase competition between the domestic UK market and imported milling wheat.

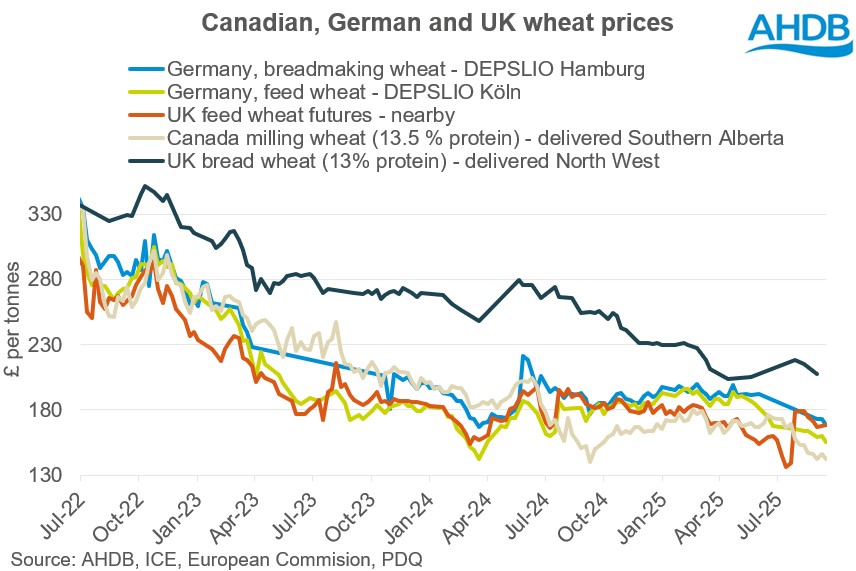

Meanwhile, milling premiums have been under pressure, with the gap between UK ex-farm bread and feed wheat prices the lowest since July 2021 (UK average ex- farm prices).

Comparing domestic delivered price levels with those in Germany and Canada shows that this tendency is widespread, not just a domestic issue.

Due to intense competition from imports of milling wheat from these countries, any rises in UK domestic prices would have to compete with export prices from Germany and Canada.

Looking ahead

An increasing amount of wheat has been imported into the UK in recent years due to production challenges, making the domestic market more dependent on the global market.

The biggest exporters to the UK in the 2024/25 season were Germany and Canada. Therefore, when creating a domestic wheat sales strategy, it is important to consider the wheat availability and quality in these countries.

The price of imported wheat influences the price of domestic wheat in the UK, so price competition is therefore an important factor to consider.

The next UK trade data from HMRC is due on 16 October, with market participants focusing on UK wheat imports in August.

However, despite higher-than-average production for the 2025/26 season in Germany and Canada, issues with the quality of milling wheat (particularly in Germany) and potentially increased domestic quality could reduce exports to the UK.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.