Analyst Insight: UK wheat balance eases while barley remains tight

Thursday, 26 May 2022

Market commentary

- Following Tuesday’s news that Russia and Ukraine are striking a deal to allow exports of food products, global grain and oilseed markets lost ground yesterday.

- Nov-22 UK feed wheat futures closed down again yesterday, losing £9.00/t from Tuesdays close to settle at £318.50/t.

- Paris rapeseed futures (Nov-22) closed at €794.25/t on Wednesday, down €15.75/t on the day.

UK wheat balance eases while barley remains tight

This morning, AHDB released its latest UK cereal supply and demand estimates for 2021/22. Since the previous forecasts in March, changing trade dynamics and increased market volatility have impacted import and export forecasts for most commodities, as alluded to in yesterday’s Grain Market Daily. Changes to trade, in turn, has led to a shift in cereal usage by some sectors.

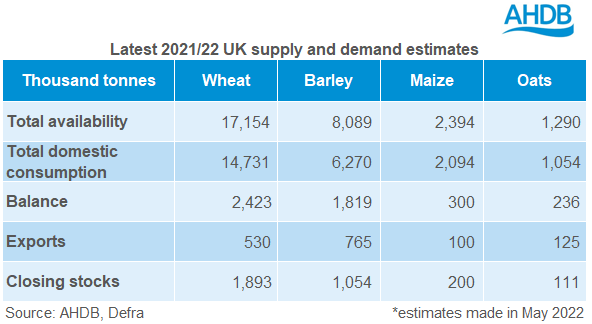

Below is an overview of the latest estimates and changes from previous forecasts for wheat, barley, maize, oats.

A stronger import pace, coupled with relatively stable demand, has led to the wheat balance to be revised up by 259Kt from March, to 2.423Mt. Wheat imports are now estimated to reach 1.750Mt, up 250Kt from March’s forecast. So far this season (Jul-Mar) the UK has imported 1.506Mt of wheat, which superseded the 1.500Mt March full season estimate. Due to extreme market volatility caused by the war in Ukraine, the general consensus in March was that wheat imports would be relatively subdued and at minimum levels during the latter part of the season. However, since those forecasts, we have seen the import pace remain strong. With little liquidity in the domestic market, imports have priced competitively.

In terms of demand, on paper it looks like not much has changed. A marginal decline in wheat usage for animal feed is projected, while human and industrial usage (H&I) remains relatively unchanged from previous estimates. However, there have been changes in usage by the different sectors which make up these totals.

Demand for wheat by flour millers is revised up in line with actual usage, as demand returns to pre-pandemic levels. Likewise, usage of wheat by distillers is higher than previous estimates and on the year, as they switch from maize. On the other hand, wheat usage by the bioethanol industry is expected to be lower than March’s estimates. This is due to maize now pricing more competitively and further delays with the UK bioethanol industry becoming fully operational again.

Exports have been revised up by 30Kt, to 530Kt, on the back of the UK being very competitive on the European market back in late March/April time.

Closing stocks in previous estimates for the season were tight, or ‘on a knifes edge’. However, with the uptick in imports and relatively stable demand and export estimates, closing stocks have been revised up by 229Kt from March at 1.893Mt. Considering an operating stock requirement of 1.500Mt, this gives us a more comfortable amount of free stock to carry into next season of 393Kt.

The barley balance remains tight in the latest estimates at 1.819Mt. For context, if this is realised this would be the smallest balance since 2007/08, when the UK had a c.5Mt crop. Compared with March, total domestic consumption is expected to be down slightly by 18Kt, at 6.270Mt. Animal feed usage is forecast to fall by 22Kt compared to March’s estimates, as other grains have become more price competitive. That said, the decline is halted somewhat as cereal inclusions as a whole have been higher than initially expected, with the slower than expected contraction in the national pig herd driving much of this.

Similar to wheat, UK barley was very competitive on the European market earlier in the spring, which has led to full season exports being revised up to 765Kt. Taking all of this into account, barley carry out stocks are estimated at 1.054Mt, marginally (+3Kt) up from March, but remain the tightest in nearly a decade.

Where are we going to get the maize from? This was a question that was asked earlier in the year when the war broke out in Ukraine. However, with all global grain markets currently experiencing huge volatility, maize has priced itself into the UK market. Compared with previous estimates, maize imports have been revised up by 201Kt, to 2.184Mt. Stronger demand for maize by the animal feed sector during the last couple of months of the season, especially in Northern Ireland, in addition to a rise in bioethanol industry demand has led to the increase.

With a record oat crop this season (based off the official Defra production estimates), there has been a greater supply of the grain domestically. As such, with soaring wheat and barley prices, the oat inclusion in compound feed and the amount fed on farm has increased. Animal feed usage of oats is now pegged at 504Kt, 28% up on year earlier levels. Usage of oats by millers is slightly down on the year, with relatively inelastic demand from this sector. This then leads us to exports; oat exports are forecast at a near 20-year high, of 125Kt. With a strong export market for oats, as well as a rise in animal feed demand, it is expected that the oat pool has nearly dried up. As such, end-season stocks have been revised down to a more typical volume of 111Kt.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.