Analyst Insight: UK maize – what are the options?

Thursday, 17 March 2022

Market commentary

- The UK May-22 wheat contract followed global trends yesterday, dipping £4.50/t to close at £297.05/t. The Nov-22 contract followed suit, falling £7.50/t to close at £247.50/t

- The more positive noises coming from Black Sea talks provided a slightly softer tone to markets. In addition, Stratégie Grains has raised its forecast for EU-27 wheat exports by 2.0Mt, to 32.5Mt, as a result in reductions of shipments coming from the Black Sea.

- With announcements that Indonesia might be replacing palm oil export taxes with a levy, palm oil prices have taken a dip after recent highs. The benchmark Malaysian futures price (delivery in three months) fell 2.1% yesterday to $1,416.48/t (Refintiv).

Analyst Insight: UK maize – what are the options?

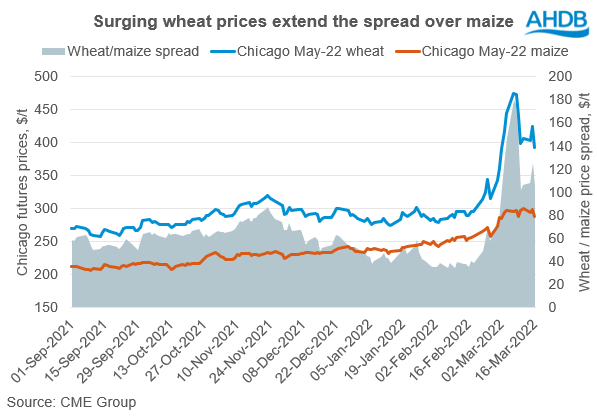

With the recent surge in global wheat prices to record highs, the spread between wheat and maize has extended significantly.

Prior to conflict breaking out in the Black Sea (23 Feb), Chicago wheat (May-22) was at a $56.85/t premium to maize (Chicago May-22). This spiked to $179.85/t on 7 Mar, although has since dropped back to $105.44/t yesterday (16 Mar).

In more liquid times, such a price spread would incentivise the use of maize over wheat. However, the current conflict has severely restricted the volume of maize onto global markets. Exports of maize effectively ceased from Ukraine since the outbreak of war.

Prior to the turmoil, Ukraine was forecast to export 33.5Mt of maize (USDA). Up to 21 February, Ukraine had shipped 19.8Mt of this volume (60%). This left 40% of the estimate to export. The USDA has since (in its March World supply and demand report) revised the full season estimate back to 27.5Mt. However, this would mean that over 7.7Mt is still expected to leave the country before the end of the season. Obviously much depends on the conflict as to how much of this volume will be realised.

But what does this mean for the UK?

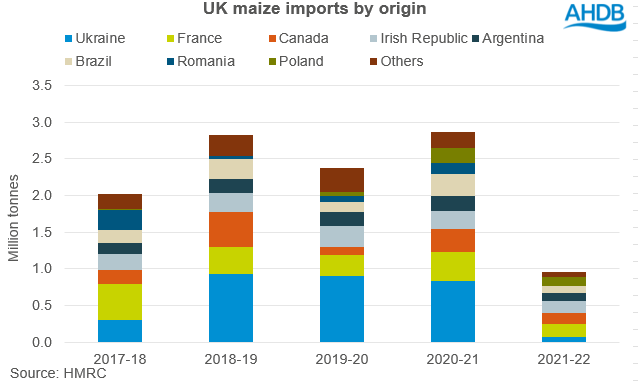

Over the past five seasons (2016/17 – 2020/21), an average of 26% of UK maize imports originated from Ukraine. So far this season (Jul-Dec), the nation has accounted for just 7%, with shipments being well behind the pace of previous seasons.

With the very real possibility that Ukrainian shipments will be hampered for some time yet, what other origins be found? France and Canada have also been significant origins of maize for the UK. However, European maize has also seen prices surge since conflict broke out and are significantly stronger than Brazilian, Argentinian and US levels. In its latest report, Stratégie Grains pegged EU-27 maize exports up 0.1Mt to 4.7Mt. This included projected Polish imports to the UK, to cover some of the Ukrainian shortfall. So, while this could go some way to covering UK requirements, it will come at a cost.

Canadian maize production in 2021 escaped the worst of the drought conditions. Statistics Canada pegged the crop up 3.1% on the year, to 14.0Mt. This could provide an option for the UK. However, imports of US maize are subject to a 25% import tariff, so the trade-off between that, and rising European prices, needs to be monitored closely.

Conclusion

While there will be options for UK maize requirements, these are all likely to come at a price given the global near-term tightness. On top of this, high freight costs remain a significant factor. This will provide further support to the UK feed wheat price, as maize prices provide the floor for the grain complex.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.