Analyst Insight: Surplus grain without the sustained export campaign

Thursday, 7 May 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £161.40/t down £0.20/t on the day before. While the Paris wheat futures (Dec-20) gained €0.25/t to close at €188.00/t.

- US soyabeans futures (Jul-20) closed yesterday at $305.89/t, down $2.57/t from the day before; Lacklustre demand from the coronavirus pandemic and reignited tensions between the US and China offseting the recent purchases by China.

- The AHDB latest UK human and industrial cereal usage and GB feed production data sets have been published today, showing consumption of cereals in March 2020.

Surplus grain without the sustained export campaign

Producing both a large barley crop of 8.1Mt and wheat crop of 16.2Mt for 2019, it was anticipated that the UK would have a large export campaign for the 2019/20 marketing year.

However, throughout this marketing year farmer selling of wheat has been subdued, as adverse weather in autumn derailed planting intensions this combined with the fact there has been an incentivising financial gain from storing your old crop and selling into the 2020/21 marketing year.

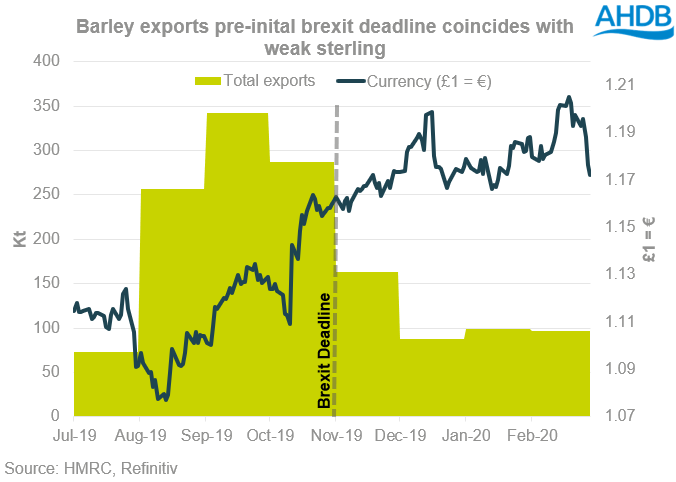

Much of the export campaign for this marketing year was front loaded before the initial October Brexit deadline. However, as the EU and UK were unable to come to an agreement that deadline was moved to January.

With heightened optimism around Brexit sterling gained strength from the middle of October until the end of February, which further constrained exports. Additionally, new crop UK wheat futures started trading at import parity as precipitation controlled much of the autumn and winter.

Could the currency devaluation support the UK’s exports?

There is a degree of uncertainty that exists within export markets at the moment. Up until the end of February exporting at large for this marketing year seemed subdued, with only indicative export (FOB) prices reported for successive weeks, and little volume actually moved.

However, as a result of coronavirus, from early-March we witnessed the fast devaluation of the pound as demand for the dollar surged. Value was removed from equities and commodities, and holding physical cash was seen as a safe haven during financial market downturns.

Between the 9 and 19 March, sterling fell 12.4% against the dollar, reaching its lowest level since the 1980s. As sterling fell UK wheat exports looked more attractive, and domestic prices rose, further incentivising farmer selling.

Moreover, global wheat markets gained significant ground as global panic buying ensued at a retail level, this combined with a weakening sterling, supported UK wheat futures significantly which encouraged farmer selling. With a large proportion of grain in merchant ownership this could have posed the perfect recipe to potentially kick-start and energise the UK’s exports for the rest of the marketing year.

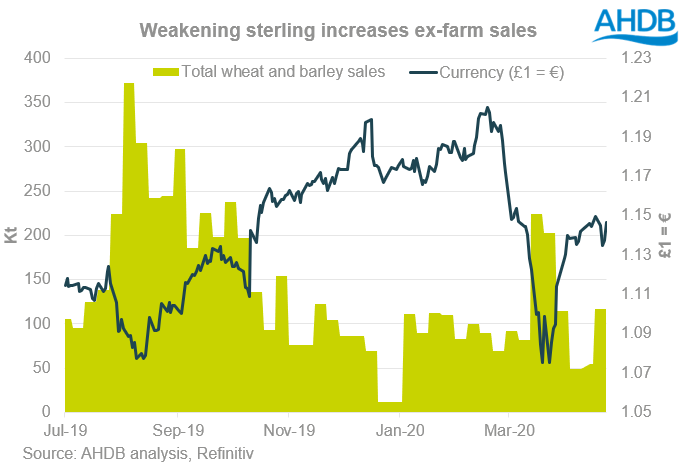

From the latest corn return data we can see a large uptick in ex-farm sales of wheat and barley around the period of when there was a surging demand for at retail level and a significantly devalued currency.

There has been a 197% increase in recorded ex-farm sales of wheat and barley in the month of March compared to the 3-year-average. With this period of high ex-farm sales and weak currency, it is possible that there was an increase in the volume of exports booked for movement through to the end of season.

In reality, it is more likely that a large proportion of the increase in ex-farm sales have moved into stores.

Re-energising the UK’s export campaign?

Looking ahead to the remainder of the season we can estimate the volume of wheat and barley still to be exported in March to June.

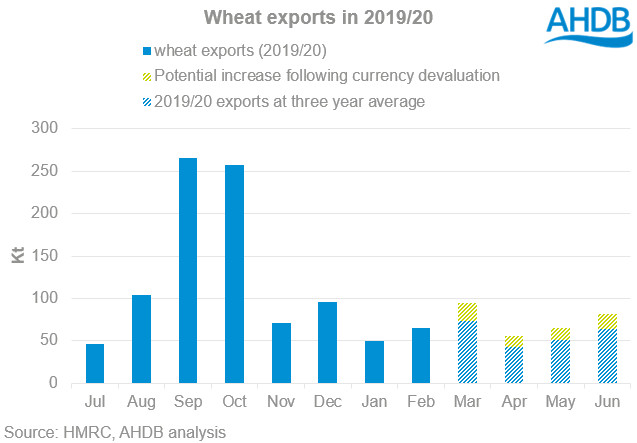

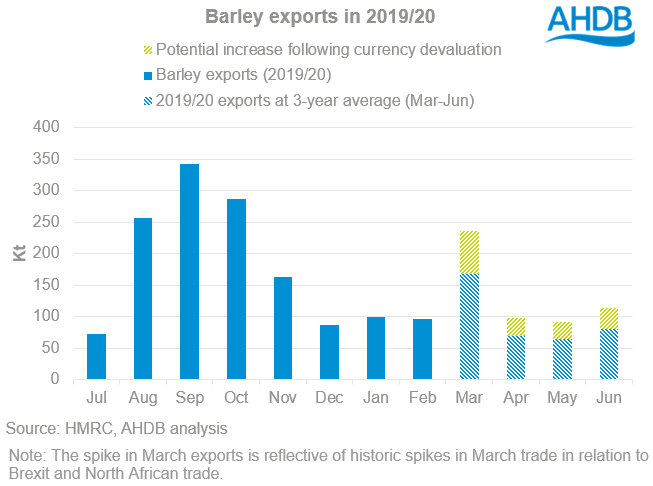

To formulate this forecast for the UK’s exports from Mar-Jun, I took the three-year average of the percentage of wheat and barley that the UK exports for each month from March to June. Using this average against the season so far sets a baseline for 2019/20 exports pre-currency devaluation of 1.19Mt of wheat and 1.79Mt of barley.

We can also look at the possible impact of currency devaluation on exports, taking the increase in ex-farm sales in March and April, relative to the three-year average and applying this to the forecast export figures. This suggest that there could potentially be an additional 66Kt of wheat and 159kt of barley that was exported in the window of weak currency.

It’s crucial to note that this is a very optimist figure and assumes that a large proportion of the additional March and April sales will be exported before June, when in reality some of this will be go into the next marketing year.

If merchant ownership has increased, towards the end of the marketing year and exports do not transpire this could pressure harvest prices significantly, as old crop grain will still be in merchant ownership. On the other hand, we could see our end of season stocks reduce if exports are increased.

Export statistics for March will be published next week, offering the first insight into trade during the coronavirus pandemic. With the full devaluation in currency happening in mid to late-March it is unlikely that there will be a vast increase in volumes shipped in March. Trade data for April will be published in the second week of June.

Key watch points going into the 2020/21 marketing year

Throughout the middle part of this marketing year we have seen farmer selling relatively subdued, therefore the carry-over of wheat could be significant going into the next marketing year.

For barley, we have had a large barley crop in 2019/20 and the UK will be producing a large barley crop going into the next marketing year, therefore the outlook for this could be extremely bearish.

It’s only inevitable that barley will maintain a price that will warrant an export campaign going into the 2020/21 marketing year. Therefore, it is key to ensure that moisture specifications are met for export.

If the UK is uncompetitive due to import tariffs imposed by the EU after December 2020, North Africa could be an export destination where low moisture is paramount. A piece of analysis around the cost of drying will be released in the coming weeks.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.