Analyst insight: Steadier start for wheat imports in 2025/26

Friday, 21 November 2025

Market commentary

- UK feed wheat futures (May-26) closed at £176.00/t yesterday, down £1.00/t (0.6%) from Wednesday. The new crop contract (Nov-26) ended at £177.40/t, down £1.85/t (1.0%)

- Domestic wheat futures declined in line with global markets yesterday. Recent gains were pared back as support from anticipated Chinese demand for US soyabeans faded. Chicago wheat and Paris milling wheat futures (May-26) fell 1.6% and 0.8% respectively

- In addition, the supply outlook remains ample. The International Grains Council (IGC) raised its 2025/26 global wheat production forecast to 830.0Mt, up 3.0Mt from its previous estimate in September and above last year’s 799.0 Mt. Global maize output in 2025/26 is forecast at 1,298 Mt, an increase of 60.0 Mt year-on-year

- In Russia, SovEcon raised its 2025 wheat production estimate by 0.8 Mt to 88.6 Mt, slightly above the USDA’s 86.5 Mt. In addition, SovEcon has set its first forecast for Russia’s 2026 wheat crop at 83.8 Mt

- The oilseeds market was mixed yesterday. Paris rapeseed futures (May-25) edged up €1.00/t (0.2%) to close at €480.50/t. In contrast, Winnipeg canola futures (May-26) were broadly unchanged, while Chicago soyabeans futures (May-26) slipped by 1.0%. Overall prices remain weighed down by abundant global supply and subdued demand

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Steadier start for wheat imports in 2025/26

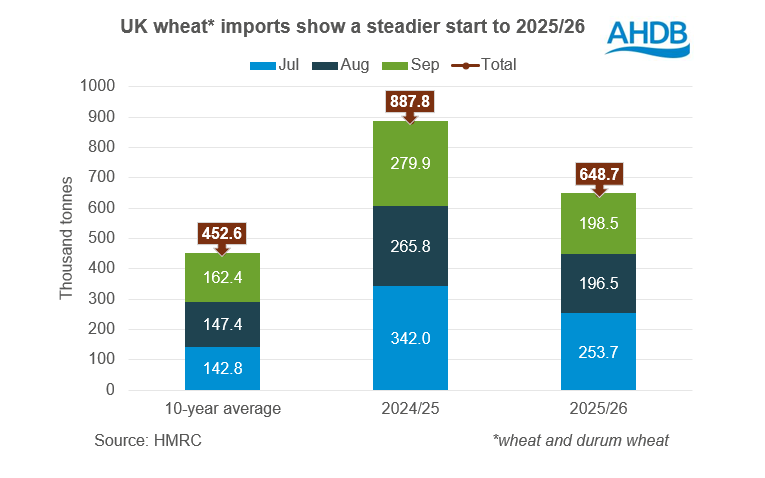

The latest HMRC UK trade data shows September wheat imports at 198.5 Kt, sitting above the 10-year average for the month (162.4 Kt) but well below the unusually high 279.9 Kt recorded in September last year.

This suggests a more settled start to the season compared with the sharp rise in imports seen in 2024/25.

Looking at the season so far, July to September wheat imports totalled 648.7 Kt. This remains higher than the long-term average, but lower than the strong pace recorded last year.

This indicates that imported wheat is still helping to support UK supply and meet quality needs, though not to the same extent as last season.

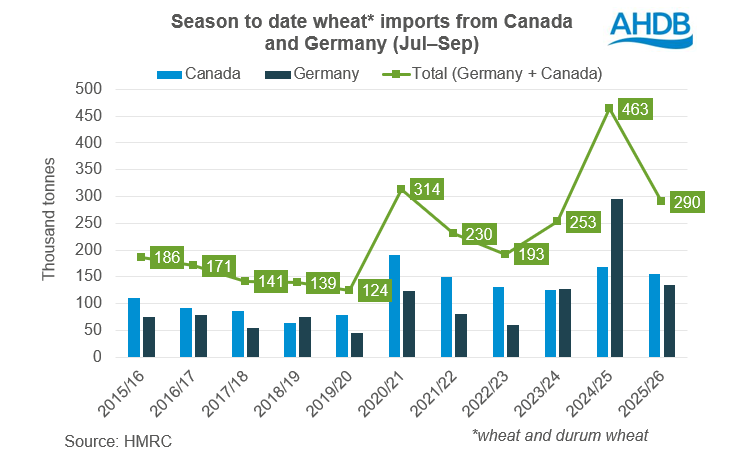

Imports from key suppliers show a similar pattern. Shipments from Canada and Germany reached about 290 Kt, down on last year but still above pre-2020 levels. Canada typically supplies high-protein milling wheat, while Germany provides a range of milling grades.

With greater domestic availability of bread-making wheat in 2025, the UK may rely less on imported grades for blending. However, variations in domestic yields could affect local supply, creating some uncertainty for imports.

The AHDB early balance sheet currently estimates wheat imports in 2025/26 at 2.20 Mt, down 868 Kt compared with 2024/25. With a larger domestic crop in 2025, imports may slow later in the season, but they will still play an important role in keeping supply and demand balanced.

UK maize imports start season lower despite early rise

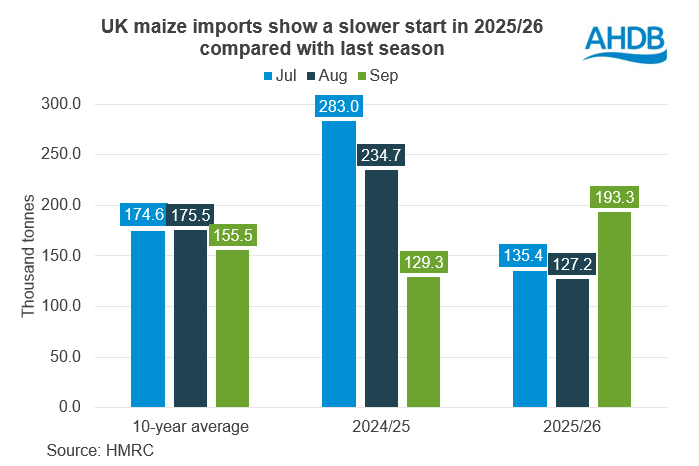

In September, the UK imported 193.3 Kt of maize, up 52% on August and the highest September total since 2022. This increase was mainly driven by higher shipments from Brazil, where a record maize harvest has improved availability and pricing.

So far this season (July–September), maize imports have reached 455.9 Kt, 30% lower than the same period last year and 10% below the 10-year average.

This is the slowest start to the season since 2021/22, when high global maize prices and weaker domestic demand for the human and industrial (H&I) and animal feed sectors kept imports down.

Could UK maize imports rise or fall this season?

UK maize imports in the rest of the 2025/26 season will largely depend on domestic demand. Feed usage has started strongly, with whole and flaked maize in GB compound feed rising by 9.9% year-on-year in July - September, the highest level recorded for that period.

If this trend continues, particularly with signs of recovery in the poultry sector, it could support import volumes for feed later in the season.

However, human and industrial (H&I) demand remains uncertain. The UK’s now only bioethanol plant, Ensus, has yet to restart following planned maintenance. Some grain distillers can also switch between maize and other cereals, adding further unpredictability to demand.

Relative pricing will also be important. UK wheat production is expected to recover slightly, while global maize supply remains strong. The USDA forecasts a record 1,286 Mt of global maize output, driven by a bumper US crop, the UK’s main supplier so far this season.

The high global supply could make imported maize more attractive.

Imports often rise from the autumn as Northern Hemisphere maize supplies become available, then ease as domestic usage patterns become clear.

Futures prices for Chicago maize and UK feed wheat (May-26) show a narrowing gap, which may signal shifting competitiveness later in the season.

Industry expectations currently point to lower maize imports this season. However, the first official balance sheet estimates of the season, due next Thursday (27 November), will offer clearer insight.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.