Analyst Insight: Harvest progression report could quantify some of GB’s production

Thursday, 20 August 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £165.00/t, gaining £0.55/t on Tuesday’s close. Gains were also encapsulated in Paris milling futures (Dec-20), which closed up €1.00/t, to close yesterday at €181.75/t.

- Gains were off the back of Chicago (Dec-20) closing up $1.65/t on Wednesday, to close at $191.80/t from a weaker U.S. dollar which has made wheat more attractive to the world export market.

- Recent adverse weather and precipitation will slow the rapid pace of harvest that we’ve seen in the last few weeks. However, you can still dry your barley for an export market. Check out our revised analysis; can I still dry my barley for an export market?

Harvest progression report could quantify some of GB’s production

The second harvest progress report released last Friday provided an insight into potentially putting some figures for the production of crops for 2020 harvest.

The data within this report is up to the 11th Aug, and from the first harvest report we saw some rapid progression from the dry hot weather that we had.

In this article I am going to focus on three crops: winter barley, oilseed rape and wheat. Reasons for this are due to the latest harvest report providing us a min and max yield nationally.

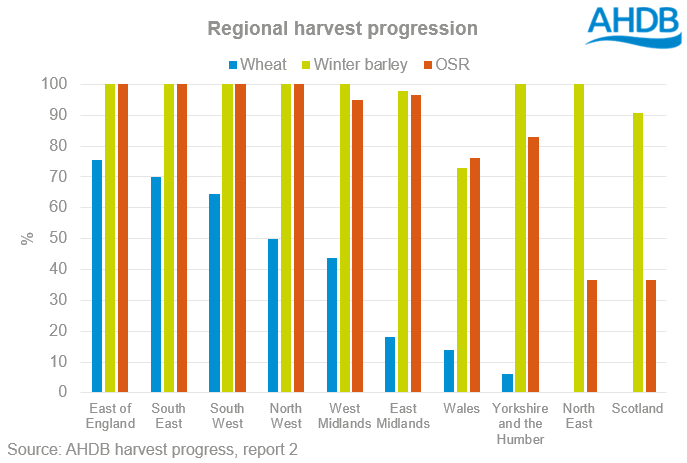

Furthermore, these are the top three crops that have progressed significantly (98%, 89%, 43% respectively) within that last two weeks, especially in southern regions of GB.

Methodology of reporting

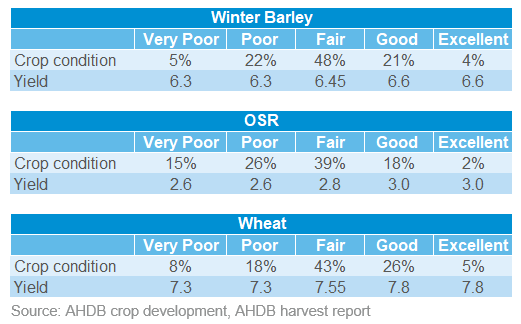

Within the harvest report we have a min and max national yield of winter barley, OSR and wheat. So I am going to take these yields and the AHDB Planting and Variety Survey (PVS) and proportionally apply the yields depending on what the crop conditions were like in the May crop development report, see table below.

Very poor and poor have been applied the minimum report yield, fair has been assigned a median yield, good and excellent have been applied to the max yield.

This has been done to proportionally represent the quality of crops going into harvest and how this could actually link to the yields we are seeing.

Winter barley

In the latest harvest report 98% of winter barley was harvested with average yields ranging from 6.3 – 6.6t/ha, down from the 5-year-average of 7.1t/ha.

The latest PVS forecasts 296Kha of winter barley to be harvested for 2020. Therefore if we proportionally apply the yields against the May crop condition report and then apply that to the expected area harvested, we can expected to achieve a winter barley crop of around 1.9Mt, with 48% of the crop expected a ‘fair’ yield of 6.45t/ha.

Oilseed rape

The latest harvest report suggests that 89% of oilseed rape harvest is complete, with reports that average yields are currently ranging from 2.6 – 3.0t/ha, down from the 5-year-average of 3.5t/ha.

The latest PVS forecasts that 387Kha of OSR will be harvested for 2020, if we were to add the 5-year-average area of Wales (5Kha) from the Defra June survey, this area will stand at 392Kha.

If the yields are then proportionally applied against the May crop condition report and then against the PVS areas, we can expect to achieve an oilseed rape crop of around 1.08Mt, with 39% of the crop expected a ‘fair’ yield of 2.8t/ha.

Although the area on the PVS may be down from what was forecast as between the survey being conducted to harvest time additional crops would have been written off from poor establishment or excessive pest damage.

Wheat

The figure for wheat at the moment is very tentative as there is uncertainty over spring yields, which will need to be factored in as harvest progresses.

43% of wheat was reported to have been harvested by 11 Aug, with average yields currently ranging from 7.3 – 7.8t/ha. As we are not even halfway through the harvest yet, I would expect this figure to come down as harvest progresses and spring wheat is cut. Places such as the South West (25%), East Midlands (34%) and West Midlands (24%) have a significant amount of spring wheat sown.

The latest PVS forecasts that there is 1,363kha of wheat to be harvested within GB for 2020. Therefore, if yields are proportionally applied against the May crop condition report, there is currently expectations that GB wheat production could be around 10.3Mt.

However, there is a degree of fluidity within this figure as we are only 43% of the way through the wheat harvest, spring wheat yields are yet to be seen on a large scale and heavy rainfall in recent days may have damaged crops.

Conclusion

This is a piece of work that will need revisiting as we progress through harvest, especially around wheat and other commodities that we have been unable to get a yield for at the moment.

We are seeing yields down on both last year and the 5-year-average. However, this is not too surprising seeing as the May crop condition report did not provide significant optimism for bumper yields for all crops.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.