Analyst insight: Harvest 2023 gross margins

Wednesday, 1 March 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £225.50/t, down £0.50/t from Monday’s close. The Nov-23 contract closed at £228.00/t, down £1.50/t over the same period.

- Domestic market followed both the Paris and Chicago wheat markets down yesterday. The main pressure is due to rains in parts of the US winter wheat belt and optimism over the continuation of the Black Sea export corridor continuing.

- Paris rapeseed futures (May-23) closed yesterday at €528.25/t, down €14.50/t on Mondays close. This is shadowing the pressure on Chicago soyabeans as commodity funds liquidated positions before the end of the month.

Harvest 2023 gross margins

Fluctuating input costs and volatile grain and oilseed markets continue to add uncertainty to farm business profitability.

New crop UK feed wheat futures (Nov-23) averaged £233.34/t in February, up 14.6% on the year from last year’s new crop futures, when the Nov-22 contract averaged £203.59/t in February. From reaching their peak in May, global wheat prices have eased somewhat, though remain historically high as the war in Ukraine provides a floor of support to markets.

While declining as of late, input costs this season remain high. From July 2022 to January 2023 imported ammonium nitrate (AN) (34.5% N) averaged £784.00/t, up 34.4% from last seasons (2021/22) average of £583.00/t.

Today, I take a look at how this changing picture could impact gross margins for harvest 2023. The aim of these figures is not to directly indicate how much profit can be made by each crop, as costs will differ from farm to farm. It is more to give an indicative view into the difference in profitability on the year, and a comparison of how profitability in different crops could react to the changing market conditions.

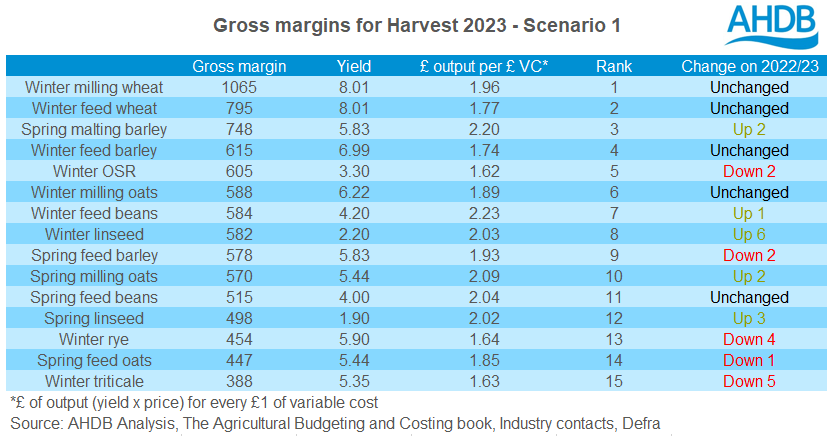

Scenario 1 - a ‘normal’ fertiliser application rate

In a year with such high input costs, for many businesses profitability will depend greatly on when fertiliser was purchased, and whether they are planning on applying less than the recommended rate in a ‘normal’ year. For this analysis, an average price from May and June 2022 was taken, with many farmers purchasing most of their fertiliser at this point in the season. The first scenario assumes a normal (100% of recommended) application rate and takes an average of the May and June UK produced AN (34.5% N), Muriate of Potash (MOP) and Triple Super Phosphate (TSP) prices.

Despite higher fertiliser prices, strong global wheat futures and high UK milling premiums see milling wheat and feed wheat as the top two performers once again, though margins look reduced from earlier harvest 2023 projections. It’s also important to remember that the difference in the price paid for fertiliser will make a big difference for gross margins.

For most of the basis calculations (to calculate ex-farm prices from futures prices), a five-year average was used. However, for milling wheat and malting barley premiums, due to them being considerably higher this season, this analysis uses an average for the 2022/23 season-to-date.

From the start of July to 16 February, milling wheat premiums have averaged £42.18/t, more than double the five-year average. Overall lower protein from the 2022 wheat crop has led to strong premiums so far this season. As such, milling wheat gross margins currently look attractive for harvest 2023, though unsurprisingly are down on the year. It is also too soon to know how milling wheat will fair next harvest, and so premiums could come down if we see increased supply of full specification milling wheat.

After feed wheat, the results of this analysis suggest spring malting barley could have the third largest margins next harvest. Despite the cost-of-living crisis, demand from brewers, maltsters and distillers has remained strong this season, and has seen the malting barley premium over futures average £5.67/t in the season-to-date (up to 9 February), compared to the five-year average discount of -£2.59/t. With the total barley area expected to be down 2% on the year, according to the results of the AHDB early bird survey of plantings and planting intentions, and strong demand expected to continue, it’s likely premiums will remain strong as we head into next season. With stronger premiums and despite higher input costs, margins are currently looking favourable in comparison to other grains, should the crop meet specification.

Oilseed rape is expected to be slightly less profitable when compared to other crops than harvest 22 and is pegged fifth in the table, as prices have come down considerably from their peak in May last season. Looking ahead, the sentiment is more bearish for global rapeseed prices and a forecast yearly domestic area increase of 52Kha could also weigh on UK ex-farm prices.

However, linseed is understood to be trading separately to oilseed rape. As a result, linseed looks to be moving up the ranks in profitability next harvest, benefitting from the lower cost of production when compared with other crops.

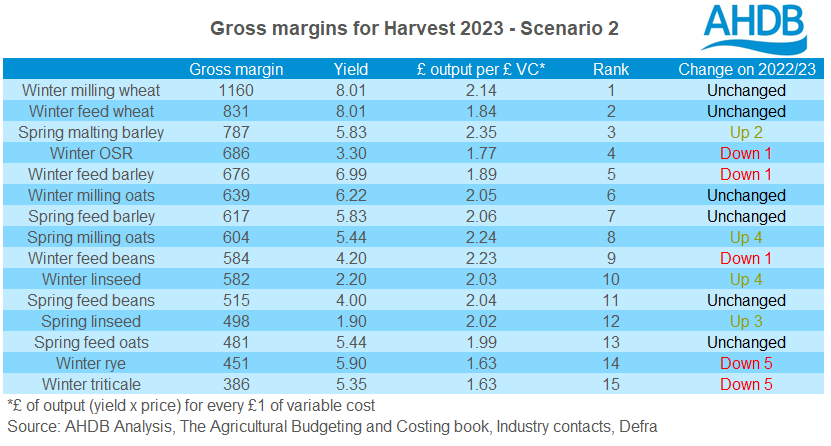

Scenario 2 – 10% reduced fertiliser application rate

With fertiliser prices being a key variable in profitability next season (harvest 2023) it’s important to look at different strategies and ways to cut down costs. Anecdotal reports suggest some farmers are choosing to apply slightly less fertiliser than they usually would. Therefore, scenario 2 assumes a 10% reduction in fertiliser application across UK produced AN (34.5% N), MOP and TSP.

As could be expected, there aren’t any major changes to the order of the crops, although winter OSR overtakes winter feed barley to become the fourth most profitable crop. Unsurprisingly, the gap between milling wheat and feed wheat has grown even larger with reduced fertiliser application. However, it’s important to consider that a reduction in fertiliser application could impact yields, as well as the quality of the crop. If a reduction in fertiliser application does impact yields and or quality, then this would affect the overall margin received on the crop.

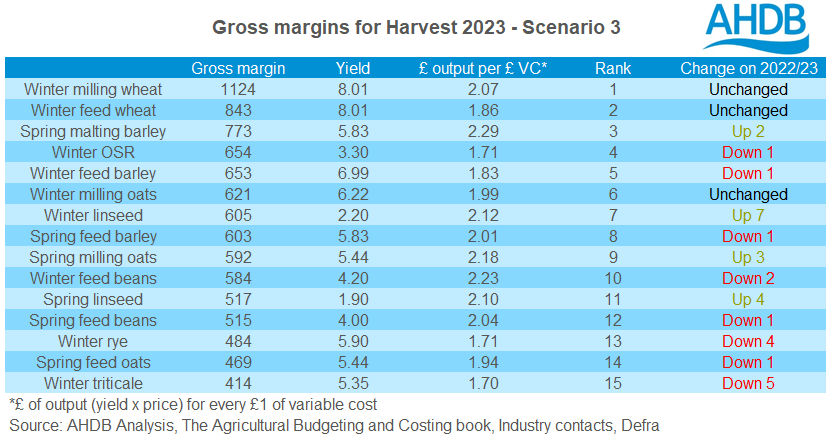

Scenario 3 – 20% AN carried over from harvest 2022

With AN prices rising considerably last year, anecdotal reports suggest that some growers reduced their AN application for harvest 2022 and carried over some AN, to be used for the 2023 crop. Therefore, scenario 3 assumes a normal application rate and uses a weighted average AN (34.5% N) price, assuming 20% was carried over from the previous year (bought in May/June 2021) and the remaining 80% was purchased as per the other two scenarios, in May/June 2022.

In terms of rankings, not much has changed from scenario 2 for the top five crops, and obviously with a lower fertiliser cost, margins are higher for all crops. The main changes in rankings, compared with scenario 1 is that winter linseed has moved its way up, with spring feed barley and spring milling oats, pushing winter feed beans down to 10th place.

Conclusion

To conclude, ultimately when you purchased your fertiliser and how much you paid for it will be a big factor in your gross margin picture for harvest 2023.

Currently, grain and oilseed prices look strong, but are generally much lower than last season and margins will be weighed on by ongoing high input costs. Cash flow will remain a concern to many given these high prices.

For help assessing your farm performance currently, Farmbench is a useful tool available from the AHDB. For more information, click here.

For a comparison to 2022 gross margins, please use this link.

Notes on calculations

- OSR price does not include oil bonuses.

- Winter rye and winter triticale are priced as feed grains.

- Premiums and discounts - winter milling premium and spring malting barley premium is based on this season to date 2022/23 data (up to 23 February), as this is the most representative for current trading. All other crops are based on previous five-year average data (2017/18-2021/22).

- Grain prices are calculated using Nov-23 UK feed wheat futures, recent 12-week average.

- Rapeseed prices are calculated using Paris rapeseed futures, recent four-week average (more representative of current market trends).

- Crop protection costs and sundries have been adjusted by 20.9% in line with Defra’s agricultural input inflation.

- Yield calculated using Defra five-year average (2018-2022) or ABC budgeting and costing book where applicable.

- Fertiliser costs:

- Scenario 1 & 2 – calculated using an average of May and June 2022 prices.

- AN UK produced (34.5%) = £737.00/t

- Muriate of Potash (MOP) = £706.00/t

- Triple Super Phosphate (TSP) = £902.00/t

- Scenario 3 – calculated using a weighted average of 20% of the average of May and June 2021 prices and 80% of the average of May and June 2022 prices for AN. MOP and TSP calculated using an average of May and June 2022 prices.

- AN UK produced (34.5%) = £647.60/t

- Muriate of Potash (MOP) = £706.00/t

- Triple Super Phosphate (TSP) = £902.00/t

- Scenario 1 & 2 – calculated using an average of May and June 2022 prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.