Analyst insight: Don’t let your profits dry out

Thursday, 5 May 2022

Market commentary

- Old crop UK feed wheat futures (May-22) closed yesterday at £329.50/t, down £0.50/t on Tuesday’s close. New crop futures (Nov-22) settled at £302.70/t, gaining £4.75/t over the same period.

- Global wheat markets were supported yesterday on rumoured reports that India would restrict exports, as drought poses a threat to their production. Markets are very sensitive to any new news at the moment due to Ukraine’s exportable surplus in question. Later that day it was reported by an official at the Indian food ministry that they would only consider curbs if there is a sudden unexpected surge in shipments, but still have capacity to fulfil export expectations.

- Paris rapeseed futures (Nov-22) closed yesterday at €821.75/t yesterday, gaining €17.25/t on Tuesday’s close.

- As at the end-February 3.85Mt of wheat was stored on farm in England and Wales, up 45% on the year, according to the latest Defra stocks survey. Total wheat stocks held by merchants, ports and co-ops at the end of February were 12% down on the year at 1.28Mt, according to latest AHDB data. On farm barley stocks were down 35% on the year at 767Kt, with the amount being held by merchant, ports and co-ops down 18% at 786Kt.

Don’t let your profits dry out

We are facing a high price but high-cost climate currently, which we discussed in our recent Spring Grain Market Outlook. The inputs into making your crop saleable (such as the cost of drying) should not be overlooked. Gas oil and kerosene prices have risen considerably since harvest last year.

In this analysis I am going to discuss the cost of drying grain:

- To start with, I am going to explore different scenarios for drying feed wheat to varying moisture levels using gas oil and kerosene, which will include the income reduction from drying the crop.

- In the second half I am then going to take two of these scenarios and compare them with energy and grain prices last year, to see the difference year-on-year, analysing if the increase in cost of grain compensates for the rise in input costs.

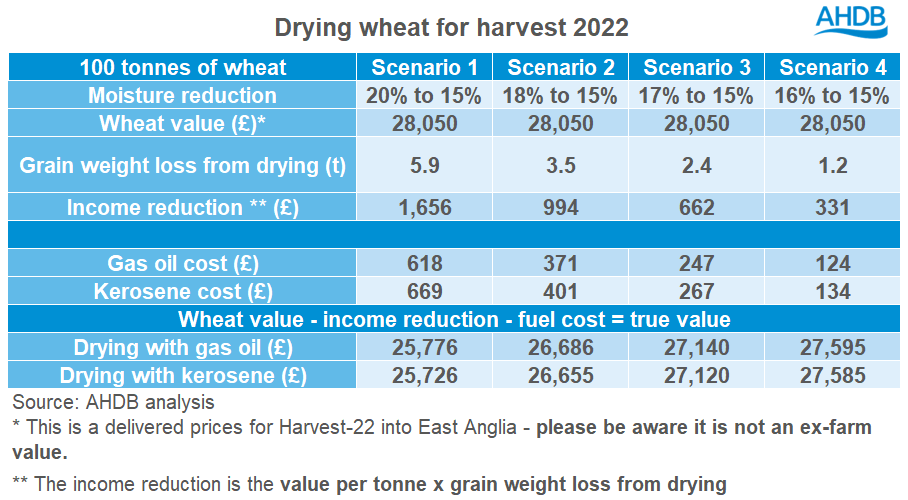

Please note for this analysis I have used delivered feed wheat into East Anglia for Harvest, using the last published price (21 April) of £280.50/t which was published in our delivered survey. For the year-on-year comparison I have used the equivalent price published on 05 August 2021 (£180.50/t).

Moisture percentage matters

We cannot predict harvest weather but for your wheat to meet specifications, the moisture level needs to be 15%.

The grain drying calculator developed by AHDB Farm Economics assumes that gas oil usage is 1.20L of fuel per tonne of grain dried by 1%. While kerosene is slightly less efficient at 1.32L.

The four scenarios above are calculating the cost of drying 100 tonnes of wheat to 15% moisture from differing moisture levels with gas oil and kerosene, also taking into account the income reduction. The income reduction is the price per tonne multiplied by the weight lost from drying.

It is no surprise that the less drying required, the cheaper it costs and therefore increasing the true value of your wheat.

Weather at harvest is something that we cannot control. However, input costs for drying does need to be considered in your cost of production calculations.

How does this compare to last harvest?

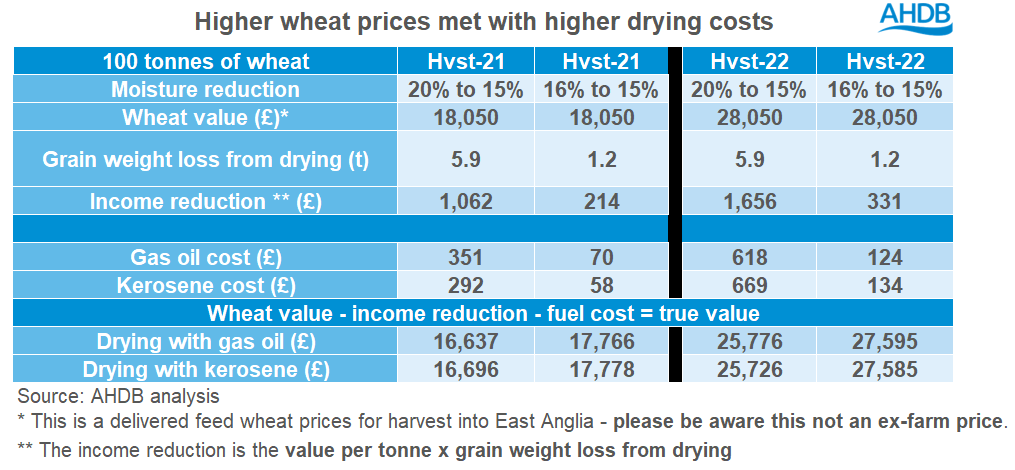

Gas oil and kerosene prices are up 76% and 129%, respectively, since harvest last year (1 Aug 21 – 3 May 22, BoilerJuice). However, wheat prices have not risen by the same degree. Delivered feed wheat into East Anglia as at 21 April 2022 is 55.4% higher per tonne than harvest last year.

I have compared the two extremes of drying scenarios (20% to 15% and 16% to 15%). Gas oil (+76%) and kerosene (+129%) costs have been revised up year-on-year accordingly.

Although in this snapshot grain prices are up 55.4% year-on-year, margins are squeezed due to the rise in energy costs. Using these scenarios, if you were to dry your grain using kerosene from 20% to 15% moisture, the true wheat value (after drying) would be up by 54.1% on the year. This change is over 1 percentage point less than the actual rise in quoted delivered prices.

Concluding thoughts

Fingers are crossed for a dry harvest, but drying costs are something that needs to be taken into account when marketing your grain. Although this analysis is just a snapshot in time, it shows that the rise in energy is something that may squeeze margins and impact profitability next season.

If faced with a choice of fuel this year, drying with gas oil this harvest will mitigate some losses as usually the drying equipment is more efficient and gas oil prices have risen by 76%, whereas kerosene is up 129%.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

.png?v=637826059780000000)