Lockdown measures impact human and industrial cereal usage: grain market daily

Thursday, 4 February 2021

Market commentary

- UK wheat futures (May-21) closed yesterday at £202.50/t, down £1.60/t on Tuesday’s close. Old crop futures (May-21) are currently trading at £201.50/t.

- New crop (Nov-21) futures also closed down £0.50/t yesterday at £166.00/t. New crop futures (Nov-21) are currently trading at £164.00/t.

- Egypt’s strategic reserves of wheat are sufficient to cover the countries needs until July 31, according to the country’s supply ministry. The announcement follows the latest purchase of 480Kt of wheat on Tuesday. Egypt’s local wheat harvest is set to begin mid-April.

- There have been talks that Russia may launch its own floating tax on exports from April to July for wheat, barley and maize. Currently the imposed tax of €25.00/t is set to start on February 15 and rise to €50.00/t from March.

Lockdown measures impacting human and industrial cereal usage

The latest cereal usage figures release today for December 2020 provide an insight into the use of cereals by industry, for more information please visit UK human and industrial cereal usage and GB animal feed production.

Human and industrial cereal usage

In December 2020, the usage by the UK milling industry was 18.6% lower on the year at 454.0Kt. This figure is 21.5% down on the 5-year-average. Despite being significantly down season to date the increase in July and August means total usage is only down 4.4% year to date.

Home grown wheat usage was down 37.8% to 303.2Kt in December on the year. This was significantly down on the five-year-average of 498Kt. Season to date home grown wheat milled is currently down 18.6%, which isn’t too surprising given our low production in 2020, which requires significant imports to fill a deficit.

The December figure for imported wheat milled is up 115% on the same time last year at 150.8Kt. The total usage to date is 743.9Kt; in half the season, imported wheat milled is only just behind the entire figure last year which was 749.9Kt.

The major loss of food service is being felt, as total bread making flour for December is at 233.0Kt down 13% on the same point last year. Usually figures increase at Christmas time with the 5-year-average being 269.3Kt. However, lockdown measures stopped food service reaping the increased seasonal demand.

December marks this first month this year that household flour usage is down on the month (-1.0%). Despite this, household flour usage is still 16.3% above the year to date at 47.7Kt.

With pubs and outlets only partly open at the start of December, we are still seeing barley usage down 16% on last year at 137.1Kt. Barley usage this season has consistently been down as we are comparing to figures last year that were pre-coronavirus until March. Year to date we are down 13.2%, with total usage so far at 821.3Kt.

GB animal feed

Latest GB animal feed usage statistics show that wheat used in animal feed (including poultry feed) was 17.8% down in December 2020 compared to the year previous. With wheat prices rising sharply through the month, and significantly cheaper alternatives, wheat usage dropped to 367.6kt. For the season-to-date (July-Dec) period, total wheat usage was 12.5% lower at 2.11Mt.

Now this is not really a surprise considering the smaller domestic crop and significant premium of feed wheat over feed barley.

Feed barley usage in animal feed in December was up 55.7% on the previous year at 178.4kt. This trend shows no sign of abating with strong demand for barley pulling prices higher in recent weeks.

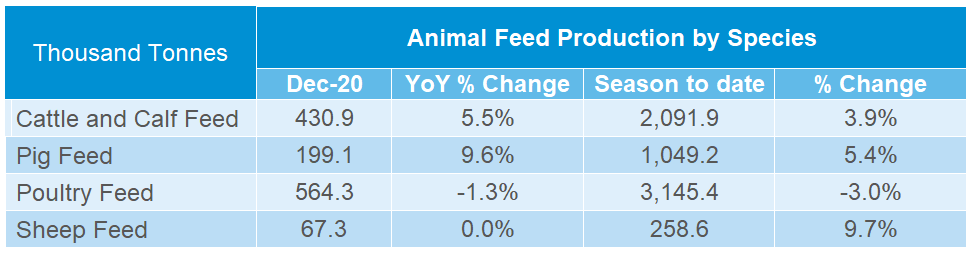

Looking at specific rations, we can see that season to date cattle feed is up 3.9% at 2.09Mt, pig feed up 5.4% at 1.05Mt and sheep feed up 9.7% at 258.6kt.

One question we have is over poultry data. In the latest figures, poultry feed for December is reported down 1.3% year on year at 564kt, with season-to-date feed totalling 3.15Mt, down 3.0%.

Defra data on chick and poult placings for December 2020 show a 7.5% increase for commercial broilers, yet we see only a 1% increase in broiler feed for December 2020 at 331kt. We would not expect to see a comparable percentage increase in chick placings and feed, but we are aware of the questions this poses about accuracy of data. We are working with our data team to investigate further in order to ensure the most accurate data possible.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.