Analyst Insight: Could a smaller domestic wheat crop impact bread prices?

Thursday, 1 August 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £191.75/t yesterday, gaining £2.70/t from Tuesday’s close. The May-25 contract rose £1.25/t over the same period, to close at £201.80/t.

- Global wheat markets were supported by a technical bounce in addition to uncertainty regarding the extent of how rains in France are impacting on the harvest. Also, the Ukrainian grain traders union (UGA) forecast wheat production at 19.8 Mt for 2024, 2.2 Mt less than last year.

- Paris rapeseed futures (Nov-24) closed at €477.50/t yesterday, up €5.50/t from Tuesday’s close. The May-25 contract also gained €5.50/t over the same period, to close at €481.00/t.

- Support in the wider vegetable oils market came from gains in crude oil prices. Nearby Brent crude futures closed at $80.72/bbl yesterday, rising 3% from Tuesday's close in response to tensions in the Middle East. This support filtered into rapeseed markets.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Could a smaller domestic wheat crop impact bread prices?

AHDB’s 2024 Planting and Variety Survey (PVS) results forecast UK wheat area at 1.56 Mha, the second smallest area since 1981 (after 2020). While the proportion of the crop made up of UK flour groups 1 and 2 remained broadly unchanged from last year, the considerably smaller area tightens the supply of the domestic breadmaking wheat crop.

AHDB crop development reports in spring reported that the wet growing conditions impacted root development, input applications (e.g. fertiliser) and seed germination for the UK wheat crop, spurring concerns regarding quality and yield. For the final AHDB crop development report before 2024 harvest, 56% of winter wheat was rated good or excellent, markedly lower than the three-year average (2021 – 2023) for July of 73%.

In July, the USDA forecasted UK wheat production at 10.85 Mt, substantially lower than historical production where the five-year average (2019 – 2023) is 13.86 Mt. However, it is important to note that UK wheat production forecasts vary markedly across the industry due to the weather experienced and consequent variability in crops across the country. Nonetheless, the widespread expectation of a smaller domestic wheat crop triggered some concern regarding if prices of products where wheat is a key ingredient, such as bread, would increase.

How much does the price of wheat impact the price of bread?

Past AHDB analysis has shown that the price of wheat has accounted for 11-15% of the price of bread (standard 800g loaf of white bread). Therefore, 85% or more of the price could be attributed to all other aspects along the supply chain such as bakery production processes, other ingredients, packaging, marketing, and transportation.

Since then, in view of the volatility that the wheat price has experienced, the cost of wheat had begun accounting for a larger share of bread prices. In 2021/22, the considerable rise in ex-farm milling wheat price led to the price of wheat accounting for 18% of the price of bread, however this has since reduced to 16% in 2022/23 and 14% in 2023/24 as the price of bread increased due to wider inflationary pressures (e.g. cost of energy).

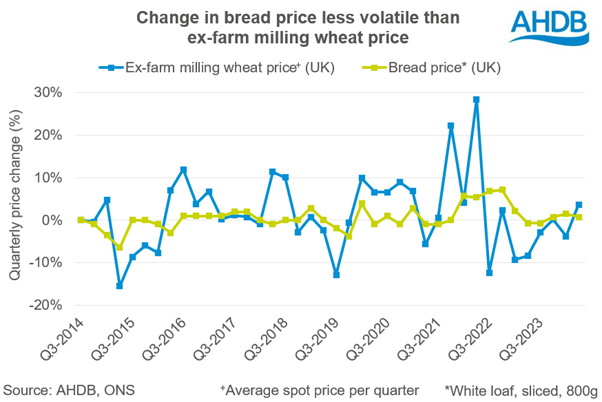

While ex-farm milling wheat prices have experienced periods of marked volatility, the change in the price of bread is more subdued.

Milling wheat premiums remain historically high

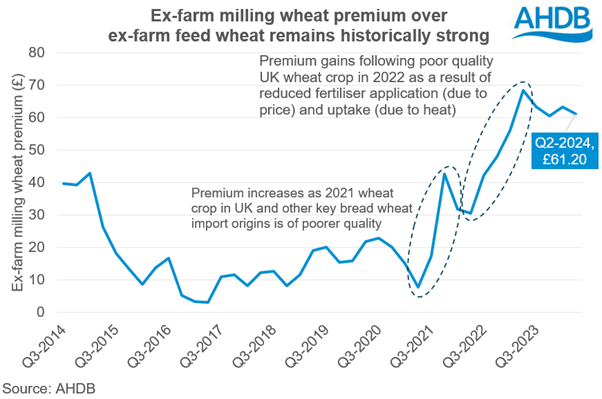

Domestic milling wheat premiums continue to be notably above historical averages. For the 2023/24 marketing year (July – June), the premium averaged at £62.07, considerably above the 5-year average (2018/19 – 2022/23) of £26.62. Moreover, this is also the highest average milling wheat premium for a marketing year since at least 2000/01.

The elevated premium has recently been supported by a smaller domestic supply of breadmaking wheat in addition to firm domestic milling demand.

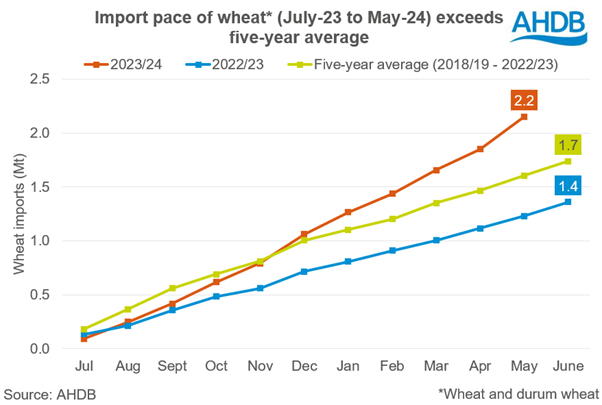

To satisfy milling wheat demand, wheat imports (incl. durum) have increased considerably. Since 2000/01, for July to May, the 2023/24 marketing year had the third greatest wheat import pace of 2.15 Mt (following 2020/21 and 2012/13). It is anticipated that this considerably strong import pace will continue into the 2024/25 marketing year in response to even tighter milling wheat supplies domestically.

Outlook for milling wheat premium and impact on bread price

Therefore, as the dependence on wheat imports increases, milling wheat premiums are likely be more reactive to global wheat supplies in key bread wheat producers, such as Canada and Germany. However, despite the milling wheat premiums increased exposure to global wheat markets, the price of bread on the shelf will continue to be influenced considerably more by aspects further along the supply chain after the farm gate.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.