Analyst Insight: Bearish outlook for wheat but could losses be limited?

Thursday, 1 August 2019

Market Commentary

Markets were dragged lower by favourable growing conditions for US corn inspiring investment fund selling. Weather remains cool and non-threatening allowing for excellent conditions for yield development across the US Corn Belt. Dec-19 Chicago corn futures lost 2% yesterday to close at $161.40/t.

Nov-19 London wheat futures closed down £1.50 yesterday at £147.25/t. Despite seeing gains in the day the market failed to capture these at the close as the lower corn market and sterling seeing a ‘dead cat bounce’ from recent lows dragged wheat prices down.

Bearish outlook for wheat but could losses be limited?

Over the past two months there has been a lot of “noise”, volatility and uncertainty in grain markets. A lot of the grain market noise has been driven by uncertainty over the US maize picture. This noise which we have covered at length in grain market daily has arguably masked the longer term picture for global wheat.

The global wheat market continues to look well supplied, although there are still areas that could cap future losses.

Global outlook

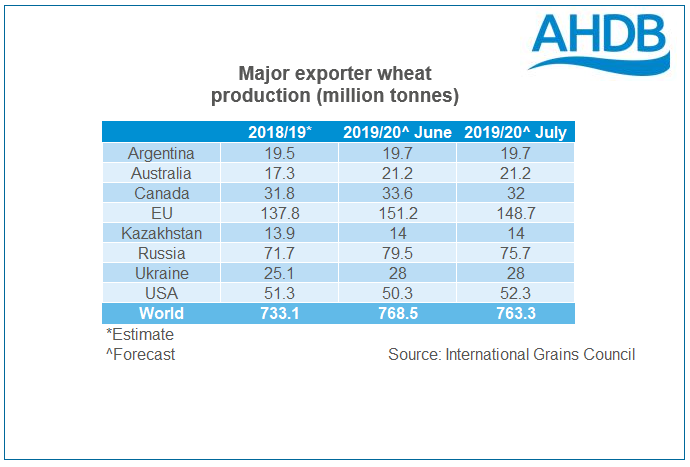

Global wheat production this season is forecast to hit record levels. The most recent forecast from the International Grains Council (IGC) pegs global wheat production for 2019/20 at a record 763Mt, up 4.1% year-on-year.

Demand is expected to increase by around 2%, as such closing stocks are expected to grow year-on-year, even with low carry-in stocks.

This simplistic look at supply and demand would suggest a largely bearish outlook for global wheat markets. However, there are a number of key drivers which could limit losses in wheat prices.

Competition for demand

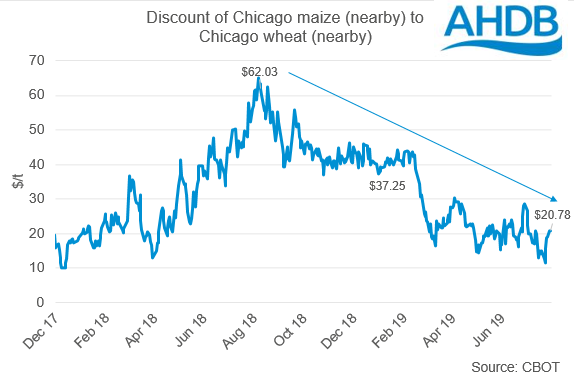

I’ve already mentioned that maize has added “noise” to the wheat market. This noise has saw prices supported in late-Spring. With the uncertain production outlook for maize, the discount of Chicago maize futures (nearby) to Chicago wheat futures (nearby) had dropped to its lowest level since December 2017.

Should the maize uncertainty result in a continued reduced discount to wheat, wheat prices could well see some support from increased feed and industrial demand.

Supply question marks?

As well as the potential for a demand led lift in prices, there is also one or two question marks over available supply. Although the IGC forecast for production is a record level. The latest forecast was a cut by 5.2Mt relative to the organisations June forecast.

The cut was driven by challenges for EU (heat), Russian (dry now wet) and Canadian crops (growing dryness concerns). With Russian and EU harvests underway we are unlikely to see too many major changes to winter wheat yield prospects. Yet Spring wheat yield potential in Russia remains a question.

However, Canada is forecast to remain dry, and while temperatures are still relatively low, a lack of rainfall could continue moisture concerns.

Exchange rates

The Russian ruble and Russian economy as whole could offer support to global wheat prices too. The ruble has strengthened 10% against the dollar since the beginning of 2019. However, Russian economic growth is seen slowing, this could lead to further interest rate cuts and a subsequent devaluation of the ruble.

With Russian wheat increasingly the global export benchmark, any weakening of the ruble has the potential to support domestic Russian prices whilst making Russian exports more competive in US Dollar terms.

What does this mean for UK wheat prices?

The outlook for wheat remains bearish, albeit with potential short-term lifts from the points mentioned above.

For the UK we are still expecting a large wheat crop (15-15.3Mt). As such, UK prices will need to price competitively into EU and third-country export markets. Weak sterling will somewhat insulate us from the global bearish outlook for the short-term.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.