Agonomics podcast takes a look at input costs: Grain market daily

Thursday, 12 September 2024

Market Commentary

- UK feed wheat futures (Nov-24) closed at £184.80/t yesterday, rising £2.40/t from Tuesday’s close. The May-25 contract gained £1.25/t over the same period, to close at £198.00/t.

- Global wheat markets were supported yesterday as the Ukrainian Agrarian Council reported smaller wheat stocks (18.7 Mt) relative to previous seasons (>20 Mt) as well as recent uncertainty regarding the size of the Russian wheat crop. This follows news that some grains in Kursk won’t be harvested due to Ukrainian’s incursion (Reuters).

- Paris rapeseed futures (Nov-24) closed at €465.75/t yesterday, gaining €2.50/t from Tuesday’s close. The May-25 contract rose €2.00/t over the same period, to close at €468.25/t.

- Strengthening in oil markets yesterday, in response to Hurricane Francine disrupting US oil supply, supported the vegetable oils complex. In addition Chicago soyabean futures (Nov-24) gained as traders revised their positions in advance of today’s USDA World Agricultural Supply and Demand Estimates (WASDE).

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Agonomics podcast takes a look at input costs

In the latest Agonomics podcast AHDB gives an overview of how key input markets are shaping up, including straw, gas and fertiliser.

Straw prices have fallen from their highs earlier in the year following new supplies coming onto the market, although a long tail to the harvest in the North is creating uncertainty. As at 01 September, baled wheat straw has fallen by 29% from 07 July to £65/t, while baled barley straw has fallen by 23% over the same period to £75/t.

Recent gas price volatility is causing some concern, but will it translate into higher fertiliser prices? With a challenging growing year and stressed cash flows, the fertiliser market will need to nurture demand from farmers. Natural gas prices have been rising due to escalated geo-political tensions in the Middle East as well as potential disruption to natural gas supply from Russia due to the ongoing conflict. The latest fertiliser prices showed that UK ammonium nitrate (34.5% N) was pricing at £338/t in July, trading within a range of £6/t since at least March 2024. Prices for August 2024 are due to be released this week.

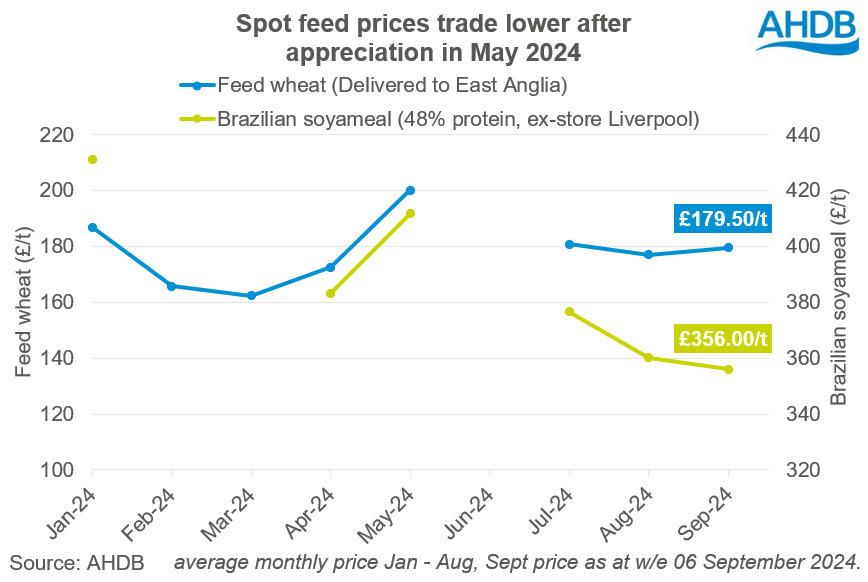

While compounding challenges for growers, consolidation in grain and oilseed markets is supporting prospects for livestock sectors. Feed wheat delivered into East Anglia for September was quoted at £179.50/t last Friday. Spot delivery prices moved below £180/t as harvest pressure from the Northern Hemisphere ensued. Meanwhile, soyameal prices have been trading lower since the beginning of the year following ample supply from Brazil and expectations of a record US soybean crop nearing harvest. Brazilian soyameal (48% protein, ex-store Liverpool) was quoted at £356/t for September delivery last week.

Listen using the following link or wherever you get your podcasts. Input cost review - Agonomics with David & Jack (captivate.fm).

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.