Positive start to EU yield forecasts for 2025: Grain market daily

Tuesday, 25 March 2025

Market commentary

- UK feed wheat futures (May-25) closed at a new contract low of £170.85/t yesterday, falling £2.05/t from Friday’s close. The Nov-25 contract lost £1.65/t over the same period, to close at £190.25/t.

- Domestic feed wheat followed declines in Chicago and Paris, influenced by the ongoing talks over the war in Ukraine, trade barriers, and improved weather in key wheat-growing regions. IKAR also raised Russia’s 2025 wheat forecast to 82.5 Mt, up from 81.0 Mt. Russia harvested 82.4 Mt of wheat in 2024.

- Paris rapeseed futures (May-25) closed at €499.50/t yesterday, gaining €5.50/t from Friday’s close. The Nov-25 contract gained €1.75/t over the same period, to close at €476.75/t. The European markets gained support from support from Chicago soybean oil and Brent crude oil futures.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Positive start to EU yield forecasts for 2025

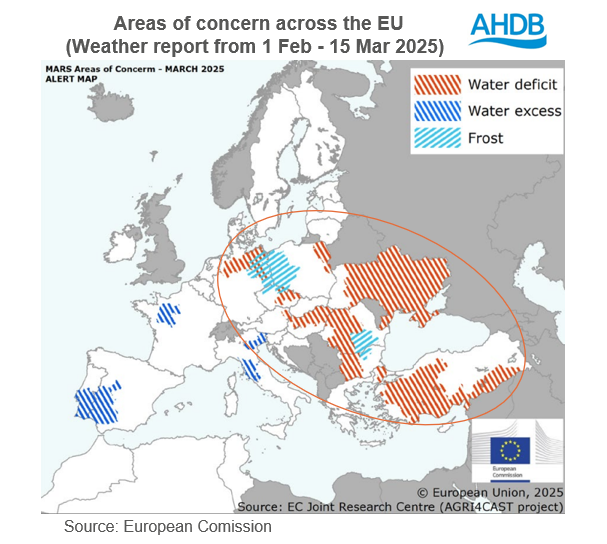

The latest EU MARS report shows winter crops are in good condition across most of the EU and neighbouring countries, with favourable conditions for sowing spring cereals. However, regions in Romania and Bulgaria, plus more widely in eastern Ukraine, Morocco, and western Algeria are facing severe crop damage. Yield forecasts are based on historical trends and look promising, although the season is still early.

.png)

Key areas of concern

Parts of central and south-eastern Europe are experiencing a lack of rainfall, which is affecting winter crop growth and could delay spring sowing. Dry conditions are fairly widespread in Romania and Bulgaria, while Hungary is seeing slower winter crop development due to the rain shortage.

In eastern Poland and Czechia, dry conditions could become an issue when winter crops start growing again and spring barley sowing starts.

The report also points out that Germany had its driest 1 February to 15 March on record. Because of this, rapeseed and winter cereals now need more water to reach their full potential.

On the flip side, southern and western Europe have seen too much rain, leading to waterlogging. Ongoing heavy rains in parts of Spain, Portugal and Italy are likely to disrupt fieldwork. In Northern France, the above-average rainfall earlier this year took its toll on the root systems, and even though conditions were drier in early March, the situation has not been fully remedied yet.

The long-range forecast predicts warmer-than-average conditions from April to June. While this could help crops in wet areas like France and Spain, it may increase moisture losses in the south east.

What does this mean?

The EU plays a crucial role in global cereal supply, and with the positive outlook for crop production in the MARS report, we could see a boost in global supply in 2025/26. The IGC is already forecasting an increase of 17.2 Mt in EU total grain production to 275 Mt in 2025. This could put downward pressure on both global and domestic cereal prices.

However, it is still early in the season, and the impact of these weather developments on crop production need to be closely monitored. If conditions remain challenging, crops in Central and South-Eastern Europe could face reduced yields in the coming months.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.