A poor forecast for UK oilseed rape: Grain Market Daily

Wednesday, 4 December 2019

Market Commentary

- UK wheat futures (May-20) closed yesterday at £150.25/t, down £0.50/t. Nov-20 closed at £156.25/t, down also £0.50/t. Recent dry weather may have slackened new crop anxieties, the carry from May-20 to Nov-20 remains at £6.00/t is close to offering an incentive to carry wheat into the new season.

- Sterling closed trading yesterday at £1=€1.17371. The last time it closed that high was the end of March – Find out below how this may affect domestic oilseed rape prices.

- The Ukrainian 2019 harvest has now been completed. Harvesting a record 74.7Mt of grain. Up from 70Mt in 2018.

A poor forecast for UK oilseed rape?

Please note, this article has been amended with updated information on the size of Ukrainian rapeseed plantings for 2020/21 which were incorrectly published at 1.28Mha.

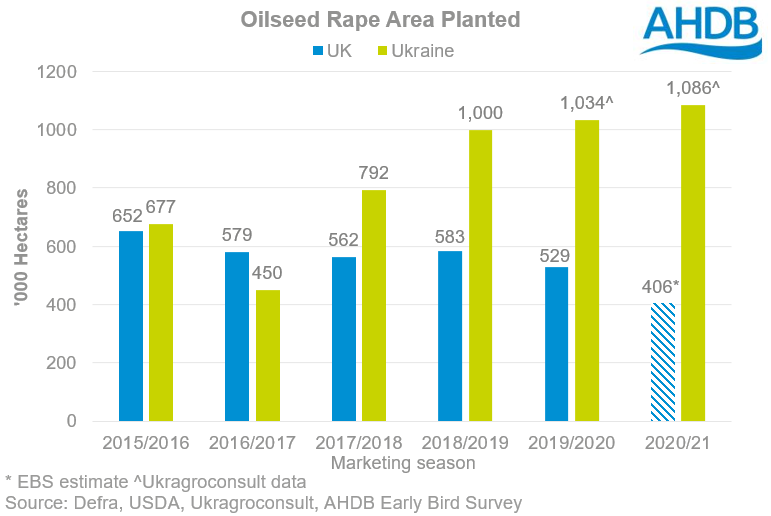

If provisional production rates released by DEFRA are correct, we are set to have only produced 1.75Mt of oilseed rape (OSR) for this marketing year, the lowest since 2004. Last weeks Early Bird Survey (EBS) forecast that planting of OSR for 2020 would be 406Kha, reducing at a significant rate of 23% year-on-year.

Last week’s UK delivered survey contained our first prices for oilseed rape for harvest 2020. These ranged from £314.50/t to £318.50/t depending on delivery point with Erith priced at £318.50/t. This is a considerable discount to pre-harvest prices with May-20 Erith priced at £338.00/t.

Although the UK’s current and future production of OSR appears to be in a deficit. There are other factors that can have greater influence on markets.

Pricing against Paris MATIF and stronger pound

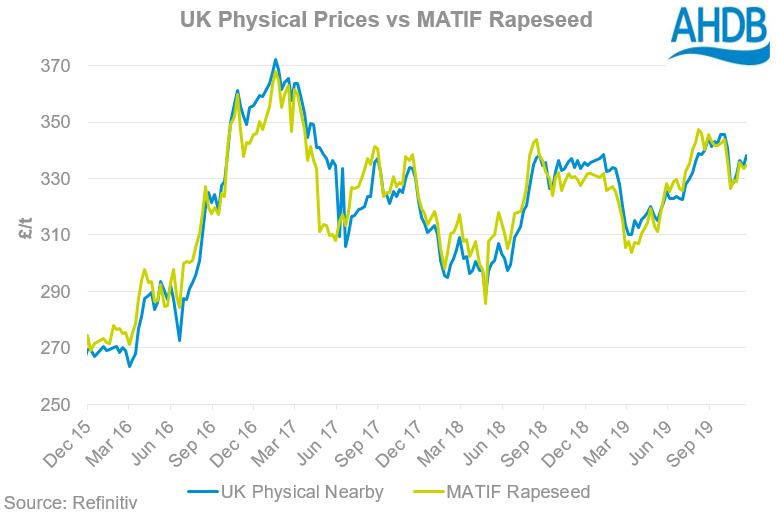

The UK’s physical rapeseed price has always correlated with Paris rape seed prices. Regardless of supply and demand, the UK’s OSR price is set by the continental market.

Moreover, the pound has been strengthening significantly recently in comparison to the euro. This has meant that prices remain suppressed to compete with European markets.

Why the harvest discount?

Although the UK has seen a reduction in area. Global grain giant Ukraine have increased their planted area by 52Kha, in spite of the removal of the VAT exemption on exports.

Further to that, OSR is a price elastic commodity. Meaning that over inflated prices will cause consumers to switch products, therefore an equilibrium of pricing is paramount to ensure demand.

There are suitable alternatives such as soyabeans that have similarities to rapeseed. Where the oil and meal can be used utilised by the respective industries without compromise.

Currently, the market does not seem to be reacting to the UK’s rapeseed supply. Due to current Ukrainian supplies our rapeseed demands are fulfilled and views for 2020 harvest are for more Ukrainian production. Therefore, the reduced quote for harvest may be reasonably valued as of today.

Based on average yields and the EBS planting forecast. We could potentially see the OSR production drop by 20-33%. If this to be the case, the market will react in spring when any reduction is able to be fully understood.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.