Analyst Insight: A look at farm income in 2020 and beyond

Thursday, 27 February 2020

Market Commentary

- May-20 UK feed wheat futures moved up £0.45/t yesterday to close at £151.00/t and new crop Nov-20 UK feed wheat futures gained £0.50/t closing at £160.50/t.

- Driving the gains in UK feed wheat futures yesterday was a temporary rise in global crude markets, as US inventory data was below market expectations. However, by the time oil markets closed, overall crude oil closed lower and UK feed wheat futures are likely to remain under pressure as coronavirus fears continue to grip global commodities.

A look at farm income in 2020 and beyond

As we creep ever closer to harvest 2020, we are entering some relatively unprecedented territory. Whilst for some, small crops and challenging weather will lead to memories of 2012, 2009 and beyond, there are challenges greater than the weather on the horizon.

As we transition away from the EU, we are faced with the loss of direct payments which will, for many, result in significant challenges for the bottom line. Cash flow is something that will need monitoring closely.

To try and draw some insight into the challenges ahead I have pulled together a hypothetical balance sheet for an arable business in East Anglia, using data from the Defra Farm Business Survey, in conjunction with forward forecasts and a qualitative view on what could be an issue over the short, medium and long term.

By and large over the coming years, it is assumed that costs associated with farming will increase, this puts a significant challenge on farm businesses and farm business cash flows.

We know that income, particularly from farm support, is set for some significant decline. But alongside this we can anticipate a likely rise in cropping costs over the next 12 months and beyond, with reduced seed availability and the increased spend required for crop protection.

From a fixed cost perspective, it is plausible that there will be a reduction in bank charges relating to a cut in interest rates, but this will also result in a fall in net interest rates.

Information like this can be used to set targets and strategy for selling crops. Knowing your possible outlay going forward can help to set targets for crop sales and head off cash flow challenges.

There are tools available to perform a farm business analysis yourself, and time spent doing this is never wasted. The AHDB website has a dedicated business tools section available. Furthermore, there is a section of the website dedicated to conducting cash flow and balance sheet analysis

Additionally, Farmbench is a hugely valuable resource, allowing you to delve into your business to identify cost savings. Using benchmarking can help you identify what you and your peers are doing and grow your business.

Find out who to contact for support using Farmbench

Download a copy of the balance sheet here

For some, you will already be heavily committed to your spend for harvest 2020, others may be less so with fertiliser and some seed still to be purchased. Gross margins for the coming crop are still very much in the air, yields are still to be determined, and in a lot of cases crops are yet to be planted.

One thing we do know is that the market is already nearing import parity, if it isn’t already there. This sets the price tone for next season. Barring a global challenge, we can expect wheat prices to feel pressure from large Black Sea crops, and larger maize crops. Oilseed rape is in a similar boat, with a small crop anticipated prices will sit at import parity.

Barley prices will feel similar pressures, with expectations of a large domestic crop and pressure from imported maize.

Even with smaller crops in 2020/21 we could see margins on par with those in larger production years. This is primarily driven by the increased costs associated with this season's challenges, and the lower import parity.

Alongside the challenges for this harvest, we can also start to highlight some of the potential ramifications for margins in the 2021/22 season.

With such a small area of crops in the ground, seed prices could well be elevated again in 2021/22.

Costs associated with crop protection are anticipated to keep rising. Not least because the loss of actives results in more needing to be done to control pests and grass weeds.

Fertiliser costs are uncertain, there is no clear pattern of increases year on year. Much will depend on the path of currency. As such I have assumed they will move forward at the five year average.

Incomes for the 2021 can be estimated based on using average or worst-case yields, depending on your appetite for risk. As far as prices are concerned you can set your baseline for the 2021 crop by looking at where the Nov-21 prices currently sit.

With any forecast it is important to review and adjust it, setting a baseline can help to look at forward projections but for continued business success this needs to be reviewed and updated regularly.

The last part of the work looking at cost projections concerns the fixed costs associated with both agri income and non-agri income.

For machinery and labour costs, I have assumed the five-year average is carried forward. The true path of this will depend heavily on individual machinery replacement plans, and there is information on the AHDB website and YouTube channel targeted at understanding machinery costs.

For financial and farm services costs, I have assumed that bank charges and net interest payments will change in relation to changes in interest rates. I believe that we will likely see current interest rate levels maintained in the short term (3-6 months). Beyond this I would anticipate a cut to rates targeted at boosting the economy and inflation back towards targets. This means that bank charges would likely decline, as would net interest payments in the medium to long term.

Rent and depreciation of land and buildings can be modelled using a natural logarithm. Both are anticipated to continue rising in the coming years. Two caveats to this would be if land values decline with the loss of BPS or if there is a change in taxation law in relation to land, which would surely devalue it if punitive, reducing rents.

We already know that agriculture led income is likely to be limited next season. Even with a small crop, we will be limited by the import parity for wheat and oilseed rape, while barley prices will likely be capped by the value of maize. The ramifications of reduced prices will be felt beyond this season.

It is important, therefore, to consider non-crop incomes and look at where these are likely to go over the next few years.

BPS Income

Starting with arguably the most important income stream outside of cropping, we know that BPS will be tapered from 2021 onwards. For the first season we know what this will look like, however beyond that the future is somewhat uncertain.

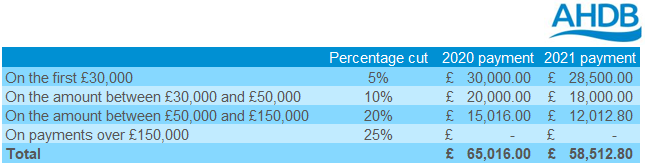

In the first year of the cuts to farm support we will see reductions based on the previous payment received in 2020.

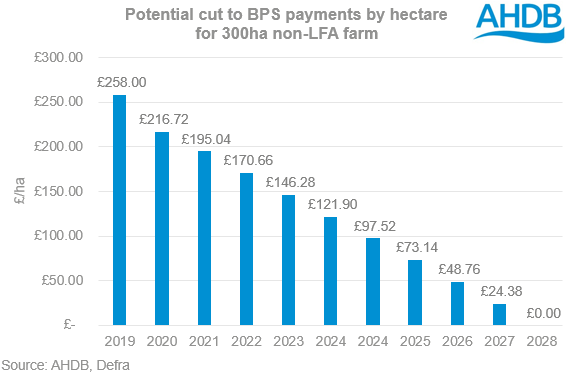

Using the example from the table above, a 300ha farm receiving £65,016 in BPS in 2020 (@£217/ha), if cuts are made evenly payments to 2028 would be as in the graph below.

Beyond 2021 the future of payments is less clear, for that reason it is assumed that payments will reduce by an even amount to reach zero in 2028.

Agri environment schemes

As with BPS, we know that as we transition towards the new Environmental Land Management Scheme (ELMS), we will see the loss of the Countryside Stewardship Schemes.

According to the Defra Farm Business Survey the amount being spent annually on agri environment schemes is reducing, the payment received in kind is also declining. Modelling this over the next five years, I would anticipate a continued decline in the amount spent and received. The caveat to this is the introduction of the ELMS scheme. When the scheme is introduced, provided it is relatively straightforward to get involved in you can anticipate an increase in the amount received by the average farm business.

The government has committed to providing the same amount in farm support through the lifetime of the government. However, inflationary pressures over that time mean that “real” amount will be less.

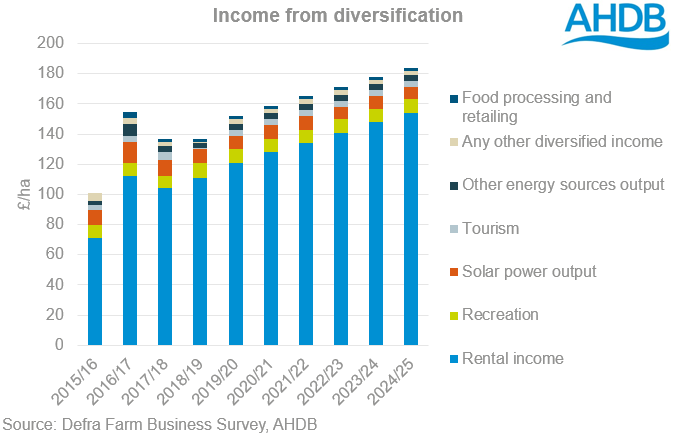

Diversification is not an option for every farm business in the UK, be that for financial or geographical reasons. However, there is an observable trend in the income received from diversification and I would anticipate that this will increase as we transition away from BPS.

In order to reflect a more plausible option for the majority of UK business the focus of the increased income from diversification has been drawn from rental income, rather than recreation, tourism or food.

Driving around the UK, particularly the West Midlands, solar farming also seems to be an increasingly popular form of diversification. However, I would expect the returns from this to decline over the next five years, as feed in tariffs also fall.

The spend on diversified income will rise in line with outlay.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.