2025 rapeseed futures prices down vs crop 2024: Grain market daily

Thursday, 31 October 2024

Market commentary

- UK feed wheat futures (Nov-24) closed yesterday at £180.00/t, down £0.90/t from Tuesday’s close. The May-25 contract ended the session at £194.05/t, down £0.65/t over the same period.

- Domestic wheat futures prices, Paris milling wheat and Paris maize futures prices fell on Wednesday’s close. Paris milling wheat was under pressure from doubts that Algeria would accept French wheat in its tender this week. Chicago maize futures were slightly down on harvesting pressure and slower demand. However, markets are waiting for today’s weekly US export sales report for further insight on demand.

- Nov-24 Paris rapeseed futures closed at €514.00/t yesterday, rising €4.75/t from Tuesday’s close. Today is the last trading day for the Nov-24 contract. The May-25 contract also rose €5.75/t over the same period, ending at €518.75/t.

- European rapeseed futures prices followed crude oil and soyabean futures markets higher yesterday despite decreasing Winnipeg canola futures. Chicago soyabeans Nov-24 futures rose on Wednesday after four consecutive trading days of decline.

2025 rapeseed futures prices down vs crop 2024

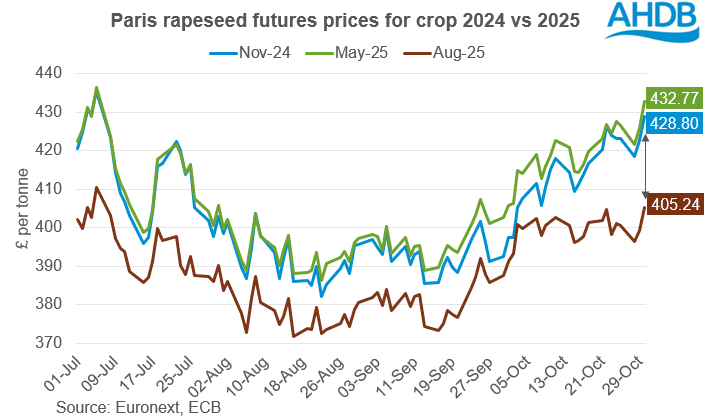

From the start of the month to 30 October, Paris rapeseed futures Nov-24 (crop 2024) gained £31.35/t. But over the same period Aug-25 (crop 2025) rose only £14.02/t. As a result, by Wednesday 30 October, 2025 crop rapeseed prices were £23.56/t lower than the 2024 crop, compared to £6.23/t lower on 1 October.

Why did the spread between Paris rapeseed futures for the 2025 crop vs 2024 crop widen during October? Information about lower production in EU, strong demand for rapeseed on the physical market, lower sunflower production, and reduced ending stock forecasts for the current marketing year supported prices for the 2024 rapeseed crop. Higher import shows the tightness in the EU market. In the season 2024/25 by 25 October, EU rapeseed imports totalled 1.75 Mt, against 1.67 Mt a year earlier. The main rapeseed exporters in current marketing year to EU are Ukraine 1.27 Mt and Australia 0.35 Mt. On the other hand, soyabean harvest pressure from the US, along with the expectations of ample global soyabean supply, limited rises in oilseed prices in general, including rapeseed.

Although the gap between the prices for the 2024 and 2025 crop widened, there are a number of factors supporting rapeseed futures prices for the 2025 crop. In France, sowing of rapeseed is completed. Rapeseed emergence and conditions of late-sown crops were diverse, and some fields will need to be resown, according to the October report from EU crop monitor, MARS. In Germany and Poland, the wet conditions brought increased pest pressure, MARS said. In Ukraine, some estimates show rapeseed production in 2025/26 at more or less the same level as in the current marketing year. But according to other sources, Ukraine’s rapeseed harvest in 2025 could fall due to a smaller sown area and poor weather.

As of 30 October, Winnipeg canola Nov-25 futures (2025 crop) were already £11.13/t below the May-24 contract (2024 crop). This is more two times lower than Paris futures difference. On the same date, 2025 crop prices (Nov-25) were higher than Chicago May-25 soyabean futures (2024). Both of these could limit further increasing in spread in Paris futures.

Looking ahead

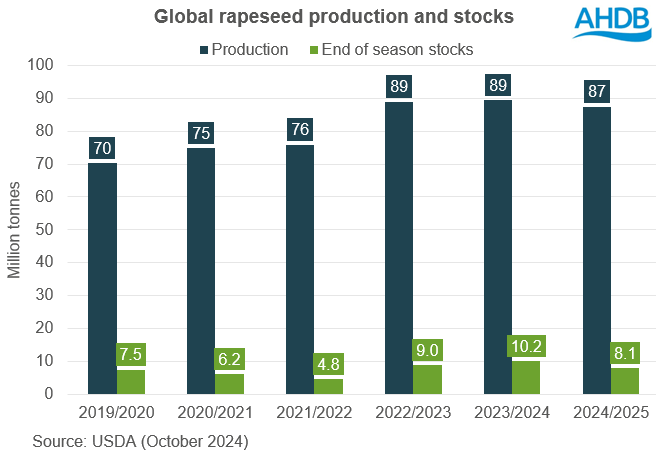

Weather risks remain for winter rapeseed in France, Germany, Poland and Ukraine, which could support crop 2025 prices. The lowest world rapeseed ending stocks in 2024/25 in the last two years could also support futures prices for crop 2025.

However, technically, Paris rapeseed futures prices for crop 2024 are above the strong level €500/t, but the price for crop 2025 (Aug-25) is below this level. For the crop 2025 prices, there is some support at €475/t, but to break above the €500/t level, we will need very significant factors of influence.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.