2022/23 maize and soyabean production estimates rise: Grain market daily

Friday, 24 June 2022

Market Commentary

- UK feed wheat futures (Nov-22) fell by £10.70/t yesterday closing at £282.00/t, as a likely result of EU harvest pressure coming in. The May-23 contract fell by the same amount, closing at £287.80/t.

- Continental prices followed suit, with the Dec-22 Paris milling wheat contract seeing a €10.75/t drop from the previous session, closing at €352.25/t.

- Next season’s soyabean production was revised up by the IGC yesterday. The Chicago soyabean Nov-22 contract closed at $520.05/t, down $22.42/t from Wednesday’s close.

2022/23 maize and soyabean production estimates rise

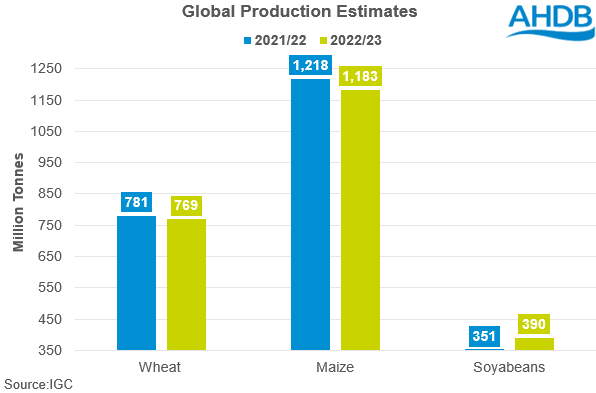

This month’s IGC (International Grains Council) grain market report was released yesterday. Overall, forecasted world total grains production for this marketing year saw a 300.0Kt cut from the previous month's figure. While down from earlier estimations, this remains a record high at 2,290.0Mt, a 3.0% increase from last season. On the contrary, output projections for the coming season (2022/23) were revised up, with global total grains supply 4.0Mt higher than predicted in the May report.

Wheat

Global wheat production estimates saw little change from last month’s report. However global consumption was revised down for both this season and next, by 500.0Kt and 1.4Mt respectively, as high prices weaken demand.

Interestingly, wheat production figures for Russia and Ukraine were unchanged and remain higher than those in the latest WASDE report. The USDA revised Russia’s 2022/23 production estimate up 1.0Mt to 81.0Mt. The IGC report has kept next seasons figure at 84.7Mt, sitting in between the USDA figure and the SovEcon figure of 89.2Mt.

Maize

Maize on the other hand saw considerable changes for next seasons production estimates mainly due to revisions for Ukraine. Projections in Ukraine were revised up by 6.5Mt to 25.1Mt for the 2022/23 season, due to a higher-than-expected acreage and putting prices under some pressure. This estimate matches the USDA figure in this month’s WASDE report.

An increase in demand in the EU saw consumption estimates on the continent increase by 2.0Mt for the 2022/23 season, making up a large proportion of the global demand increase.

Soyabeans

This season’s world soyabean production is estimated to have seen a 18.0Mt drop from 2020/21, at 351.0Mt. As a result, opening stocks going into the new season look to be considerably lower than normal estimated at 43.0Mt, down 21.2% year on year. If released it’s likely that prices will remain supported for now.

Total global production of soyabeans for the next marketing year was revised up by 3.0Mt from last months projection, now at 390.0Mt. This is an 11.2% increase on the estimate for this season, however sits below the WASDE figure of 395.0Mt.

Looking forward

To summarise, wheat estimates were relatively unchanged from last month’s report with uncertainty surrounding Russia and Ukraine’s production prospects. Ukraine’s maize production was revised up for next season with a higher acreage than previously expected, however the estimate still looks low compared to previous years. Soyabeans were also revised up with next seasons figures looking higher than the current.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.