2021/22 UK rapeseed imports – what could be coming home? Grain Market Daily

Wednesday, 30 June 2021

Market Commentary

- UK feed wheat futures (Nov-21) slightly fell £0.05/t yesterday to close at £168.70/t. Conversely the May-22 contract gained £0.25/t to £174.45/t. The spread between the two contracts at £5.75/t is the widest since January 2021.

- Russian agricultural firm IKAR raised its forecast for the Russian wheat crop to 83.6Mt from an earlier forecast of 82.0Mt. Export forecasts are also seen at 39Mt for the wheat crop.

- India cut its base import tax on crude palm oil to 10% from 15%, with the cut lasting from today until September 30. The tax cut should incentivise further imports by the world’s largest palm oil purchaser supporting palm oil prices. This in turn should support the vegetable oil complex.

- Today (30 June) is the final date for submissions for both the Defra English on-farm stocks survey and the AHDB Merchants, Ports and Co-Ops survey. Both surveys provide great value to the agricultural data environment and so all submissions are greatly appreciated!

2021/22 UK rapeseed imports – what could be coming home?

After attending a crop trials open day yesterday, I was pleased to hear from fellow attendees that the domestic rapeseed crops they’d seen were faring a little better than last season. Cabbage stem flea beetle reports suggest, whilst still present, damage has been lesser somewhat. This isn’t to say we are expected a bumper crop, far from it, with the planted area lower than last season. But how could the import programme pan out with EU and the UK both in production deficits versus demand?

41% of the GB winter OSR crop was in ‘Good’ to ‘Excellent’ condition back in March. This was much better than the 2020 crop rating of 26% back in March 2020. Reportedly, frosts in early April may have affected the early maturing crops, though we await the next crop condition report in a couple weeks for the final picture.

A range of 1.015Mt – 1.045Mt is a rough estimate for a production figure based on a 2%-5% rise to the estimated five year average yield of 3.25t/ha. This is based on a harvested area of 307.3Kha (using the USDA FAS forecast of a 1.88% cut then applied to the EBS area estimate of 312Kha). Stratégie Grains expect UK demand at 1.7Mt, requiring c.640Kt to be imported this season.

A range of 1.015Mt – 1.045Mt is a rough estimate for a production figure based on a 2%-5% rise to the estimated five year average yield of 3.25t/ha. This is based on a harvested area of 307.3Kha, using the USDA FAS forecast of a 1.88% cut to the EBS area estimate of 312Kha. Stratégie Grains expect UK demand at 1.7Mt, requiring c.640Kt to be imported this season.

Stratégie Grains raised its forecast to 17.0Mt for the EU-27 rapeseed crop in its monthly report, owing to a better Romanian crop. Imports were unchanged and are expected at 6.4Mt. The surplus is expected at 0.1Mt suggesting a very tight balance to European rapeseed markets next season.

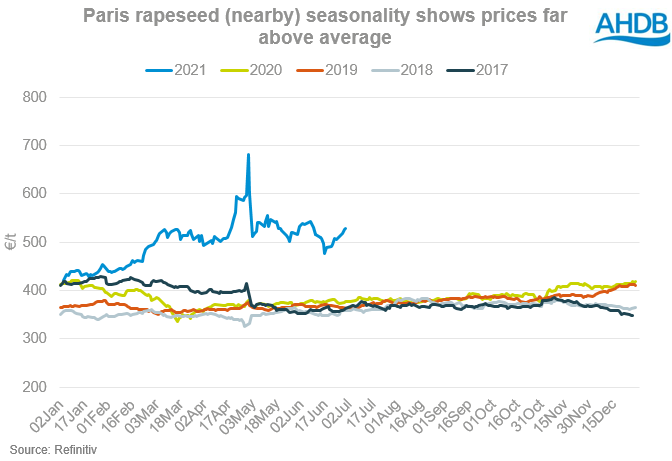

Weather conditions in the next few weeks will contribute considerably to sentiment for rapeseed prices, especially with harvest imminent for European countries. Forecast rains for the Black Sea over the next couple weeks if realised, will aid Ukrainian and Romanian rapeseed yields, adding a degree of pressure to prices. Support for prices will, in part, come from Canadian crop conditions. The current record-breaking heatwave in Western Canada is a key watch point, with fears of a detrimental water deficit for the canola crop.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.