2020: A mixed year for global pork prices. What next?

Thursday, 8 April 2021

By Bethan Wilkins

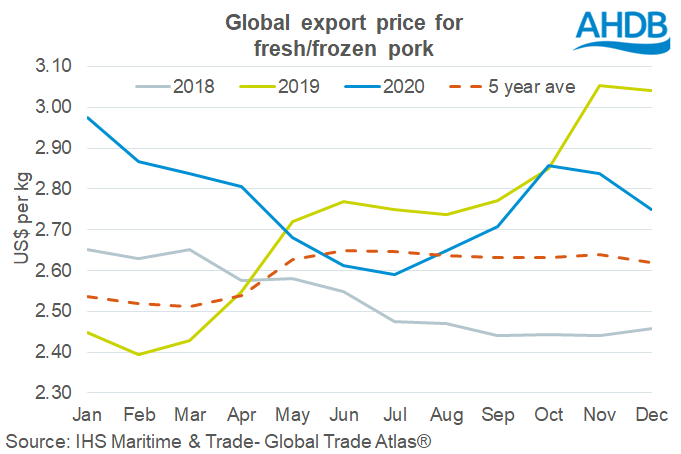

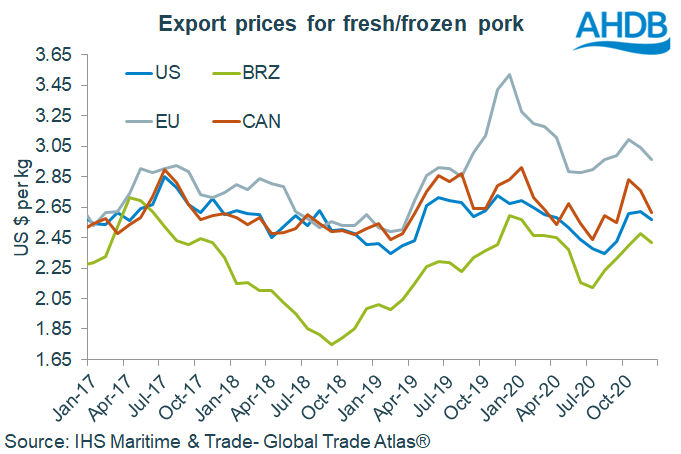

Global pork prices were volatile throughout 2020, following from some exceptionally high levels achieved at the end of 2019. Based on prices from the four major exporters (the EU, US, Canada and Brazil), the average export price was $2.82/kg in the final quarter of the year. This was not far off levels seen at the start of 2020 and $0.17 higher than the previous quarter, but still lower than levels at the end of 2019. Values were highest in October and November, dropping off in the final month of the year.

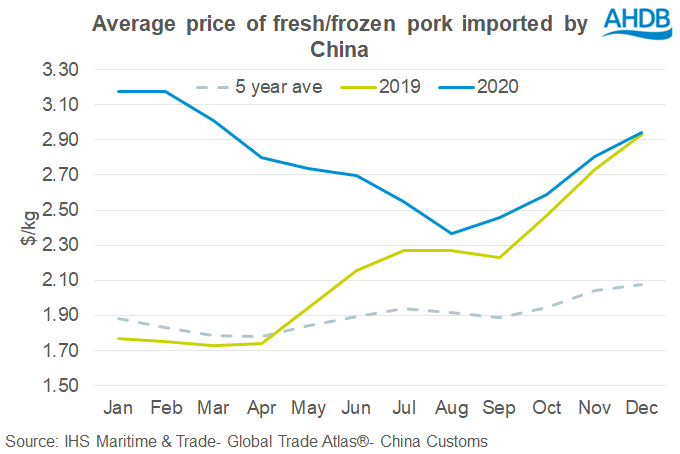

Several factors combined to support the general recovery in the value of pork traded internationally in the second half of last year. Demand from China was still strong at the end of 2020, evidenced by rising import prices, which will have supported overall export values. Limitations on suppliers to this market may have influenced this trend, with Germany unable to supply China from mid-September due to ASF. Some other plants around the world have also not been shipping to China due to COVID-19 related challenges.

Although export values showed some recovery late last year, at farmgate level, EU prices did not start to rise until late February. A backlog of pigs on European farms developed last winter, which subdued prices until this could be cleared. With some processors left without access the Chinese market, this also limited price prospects. Nonetheless, more recently, farmgate pig prices have increased again in Europe. The latest market reports indicate that demand is largely in balance with supply; although exports to China are supporting the market for those able to access this outlet, the domestic market lacks momentum, not helped by disappointing weather recently.

US farmgate prices were generally low in 2020, again influenced by difficulties at processing level. Poor profitability encouraged some producers to contract their herd size and we are now seeing strong growth in US pig prices on the back of this tightening supply and growing optimism over export demand. The value of the US dollar against the Euro also fell last year, helping boost the relative competitiveness of US product on the global stage and supporting demand.

The value of Brazilian pork has been significantly affected by currency fluctuations, with the real weakening against the dollar due to COVID-19 challenging the Brazilian economy. This has helped boost exports, particularly to China. It also means the value of exports in reals increased strongly last year, even though prices were relatively stable in US dollar terms. This likely influenced the sharp rise in farmgate pig prices seen in the second half of 2020.

So, with pig prices strong in the Americas, can we expect EU prices to continue to strengthen too? This may not be straightforward. EU export prices are already higher than the other global competitors. As ever, it will likely come down to the strength of Chinese import demand this year and how much product this can draw from the EU market, especially with ongoing access difficulties.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.