Highest UK wheat stocks since 2015/16: Grain Market Daily

Friday, 20 September 2019

Market Commentary

- UK feed wheat futures rose to £136.00/t yesterday, up £0.65/t. Globally wheat futures continued to drift with Paris (+0.1%) and Chicago (-0.3%) recording minimal changes.

- Optimism surrounding a potential Brexit deal helped buoy sterling again with sterling worth £1= €1.1341 at yesterday’s close, the highest since 21 May. UK prices will continue to be currency led and could come under pressure should the UK comes closer to reaching a deal.

- Trade talks between the US and China have resumed, which combined with the largest net sales of US soyabeans since late march has offered support to Chicago soyabean futures.

Highest UK wheat stocks since 2015/16

- Wheat ending stocks at 1,911Kt, up 11% from the previous season.

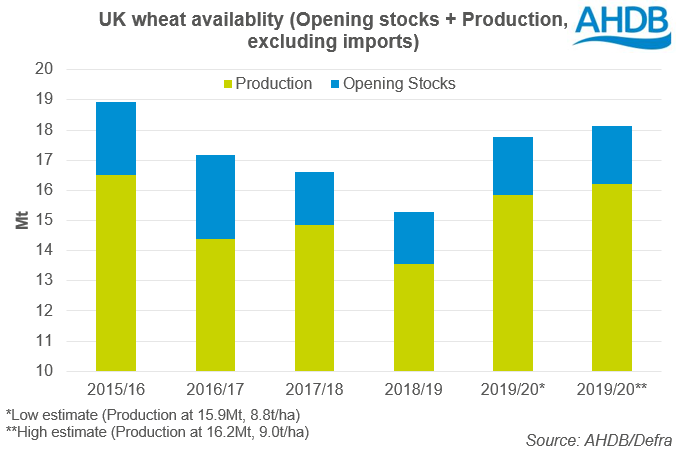

- Estimated 2019/20 UK wheat production and opening stocks the highest since 2015/16 at between 17.8Mt-18.1Mt.

- Likely to see reduced animal feed demand for wheat and uncertainty remains around bioethanol usage.

UK 2018/19 ending stocks of wheat are up 11% from last season at 1,911Kt, the highest since 2015/16, according to the AHDB/Defra end-season balance sheet. Combined with current wheat production estimates of 15.9-16.2Mt*, this would result in UK wheat availability at the start of the season reaching between 17.8-18.1Mt in 2019/20.

*(ADAS harvest report yield figures 8.8-9.0t/ha, Planting and Variety survey wheat area 1.802Mha)

The end-season domestic consumption figures are notably lower year-on-year, at 14.7Mt (-933Kt from 2017/18). The reduced consumption is driven by lower animal feed demand (-111Kt) and a large drop in human and industrial (H&I) consumption (-816Kt). The fall in H&I consumption was due, in part, to the reduced demand for wheat for bioethanol, following the closure of Vivergo and the use of maize at the Ensus bioethanol plant.

Moving into the new season there are indications that demand for wheat could remain subdued again this season further increasing the UK’s exportable surplus.

Higher grass growth over the summer and plentiful silage stocks mean that we could see wheat demand for animal feed stay low. Furthermore, there is a question over how much bioethanol demand will be seen this season.

With uncertain demand the ability to export will be key this year, with potential tariff barriers in the event of a no-deal Brexit we could see UK prices ease further in order to compete. In the short term Brexit news will continue to drive currency fluctuations and lead domestic wheat prices over the coming weeks.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.