- Home

- Knowledge library

- Farm business performance and producer confidence

Farm business performance and producer confidence

This analysis examines the delicate nature of beef and lamb profitability in the context of other farm income.

The English grazing livestock sector is in a delicate economic state. The average business is having to subsidise production from other sources of income – including direct payments. This analysis examines the long-term challenges facing farm business income (FBI) and producer confidence.

Key points

- Given the persistently negative medium-term confidence, it will take time and supportive economics to rebuild. Farm businesses will want to see that the current firmer beef and lamb prices are a paradigm shift rather than a phase in the commodity cycle.

- Direct payments and non-farming income have played a key role in underpinning production. The Sustainable Farming Incentive (SFI) could arguably – and depending on options deployed – be more integrated with production (e.g. establishment of a herbal ley provides forage for livestock), and so could be justifiably part of the livestock enterprise. However, from a net-return perspective, SFI is not comparable to direct payments.

Therefore, because of the phasing out of direct payments, the raw economics of production and improvement are likely to be increasingly important to the overall profitability of a predominantly beef and lamb business.

Erosion of breeding capacity

Since 2005 the size of the English beef breeding herd has fallen by 18% and the English sheep flock by 5%.

The 2005 start point here is important because this represents the point in time that subsidies were effectively decoupled from production and paid on an area basis rather than per head of livestock. This basically has meant that the suckler breed herd and sheep flock had to be economically viable in their own right.

Although subsidies were formally decoupled from production 19 years ago, the viability of the average herd and flock at farm level has been relying on direct payments. In other words, it could be dangerous to assume that direct payment income isn’t being used to prop up the viability of beef and sheep production in some businesses.

Is beef and sheep production an economic passenger, relying on other sources of farm income?

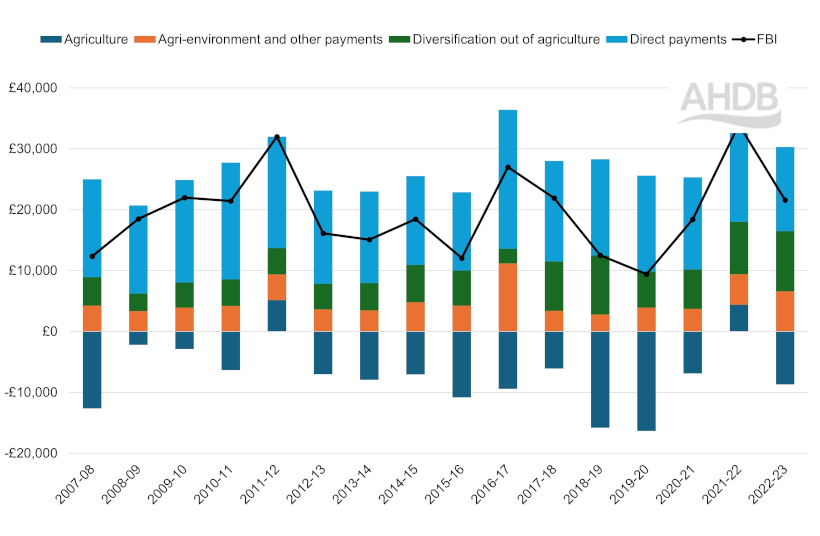

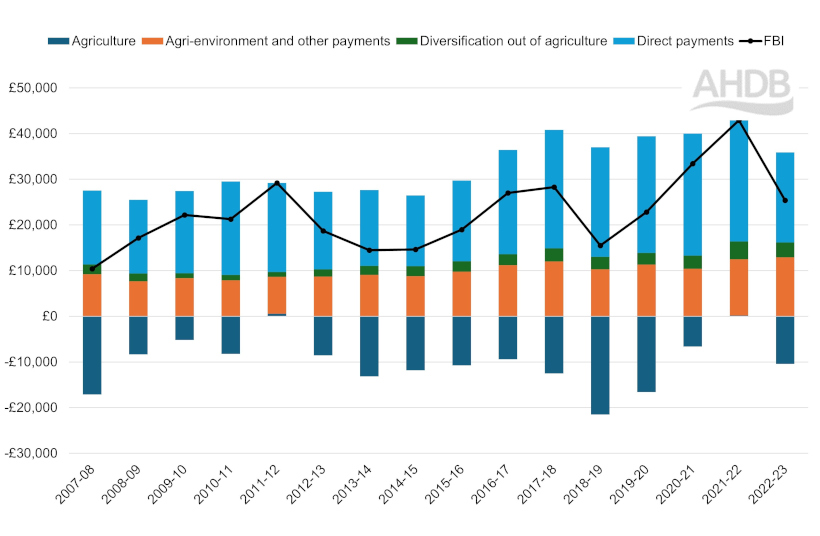

Figures 1 and 2 look at sources of farm business income on beef and sheep farms in lowland and less favoured areas. FBI needs to provide a return for the farmer for any unpaid labour and capital invested.

Figure 1. Components of annual farm business income (FBI) in England for cattle and sheep farms (Lowland)

Figure 2. Components of annual farm business income (FBI) in England for cattle and sheep farms (Less favoured areas)

The striking observation from both the Lowland and LFA scenarios is that out of the last 17 years, agricultural production has only twice made a positive contribution to FBI. For the other 15 years, other sources of income (including direct payments) have offset losses incurred from production.

Diversified income has been playing an increasing role in supporting FBI. In 2022/23, diversified income (excluding direct payments and environmental schemes) provided almost £10,000 of FBI for an average lowland farm – this has doubled in ten years.

Lack of confidence?

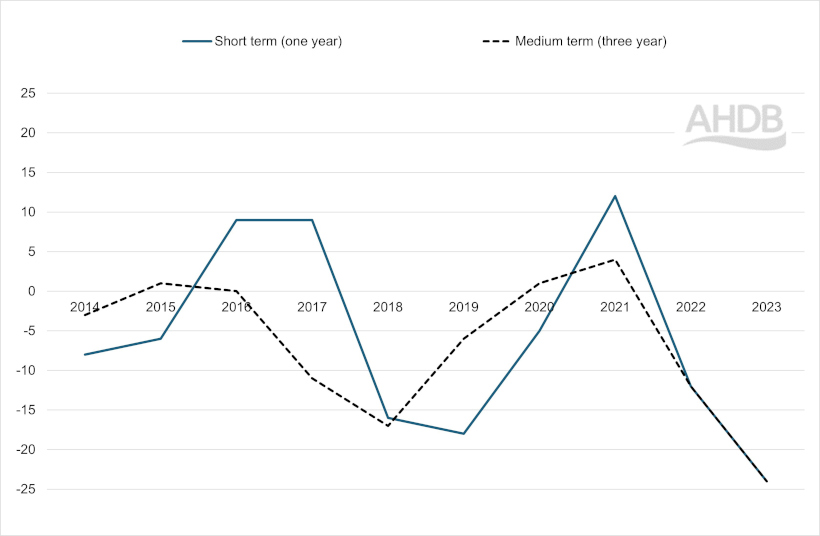

Figure 3 looks at data from the NFU confidence survey for the Beef & Lamb sector over the last ten years.

Figure 3. NFU confidence survey: Short- and medium-term confidence in the Beef & Lamb sector (on a scale of -100 to +100)

Despite some positive spikes, both short- and medium-term confidence have largely been negative. The lack of positive medium-term confidence is particularly concerning.

With the ups and downs of markets and weather challenges, we can expect short-term confidence to be volatile. But lack of medium-term confidence is significant and does resonate with the income data and the ongoing contraction in breeding capacity.