Lower trade volumes tighten supplies of dairy products

Wednesday, 7 October 2020

By Patty Clayton

Dairy product pricing has been remarkably firm in recent months, supported by elevated retail demand and some recovery in foodservice demand. This stability is expected to limit movements in farmgate milk prices on market-based dairy contracts through the final months of 2020.

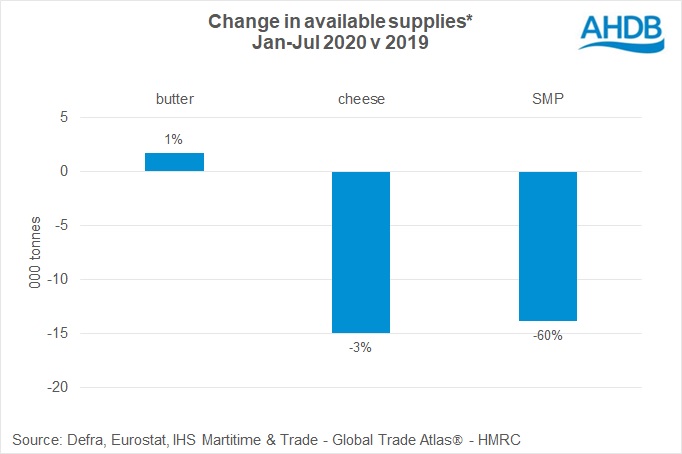

Developments in product availability relative to demand can help provide a longer term view for price trends in the markets. In the period January to July, available supplies[1] of cheese and milk powders have both tightened in comparison to their position a year ago, although for different reasons. For butter, there has been only a minor change in volumes available to the market.

The absence of any significant stock build would normally suggest upward pressure on pricing. However, the shortfall in demand as a result of reduced hospitality activity will have offset this, limiting competition for supplies and any pressure on prices.

Supplies of butter had already risen in 2019, with year on year increases in production through most of the year. In Jan-Jul 2020, production levels have been broadly similar to 2019 but imports have fallen. This was particularly the case for bulk butter, typically destined for the food manufacturing sector, with comparable volumes down by almost 30%. Conversely, imports of block butter have been higher this year, likely due to strong retail demand. Available supplies rose overall, however, as lower export demand reduced shipments.

The reduction in available cheese supplies is mostly reflective of developments in the Cheddar market. The switch in consumption from out-of-home to retail favoured domestically produced Cheddar as retailers tend to source Red Tractor certified product. The food manufacturing sector is often more price-sensitive, with imports competing with domestic product. In response to these shifts in demand, production of Cheddar has been higher, but there was an 11% drop in import volumes in the Jan-Jul period.

Estimated supplies of skim milk powder have also dropped in comparison to its position a year ago. Demand for SMP is much more concentrated in the food manufacturing market, which has experienced the largest drop in activity. In response, production volumes have fallen year on year. Further reducing available supplies has been the lower import volumes, which are 33% below the comparable period last year.

[1] Available supplies= production + imports – exports. The figures do not take account of stocks.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.