- Home

- Middle East and North Africa (MENA): How much do they consume?

Middle East and North Africa (MENA): How much do they consume?

With expanding populations and changing food consumption patterns, the MENA region is a large net importer of food.

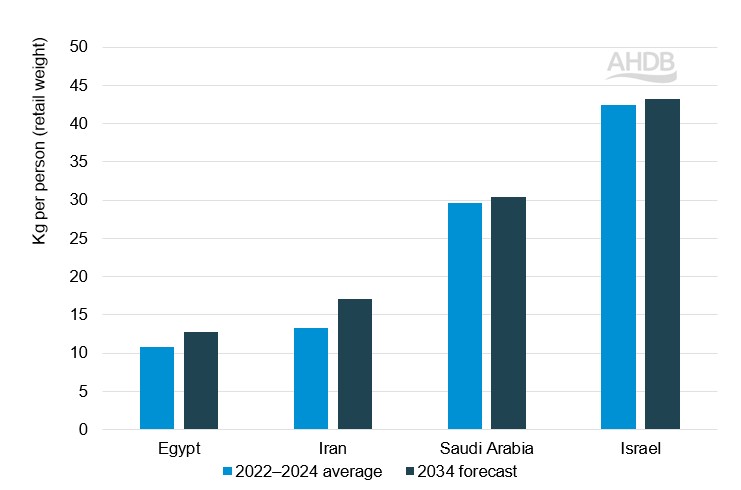

In the MENA region, poultry is the most consumed meat (Figure 1), followed by beef and sheep meat.

Figure 1. Poultry meat consumption per capita in selected MENA countries (for which data is available)

Source: OECD-FAO Agricultural Outlook 2025–2034

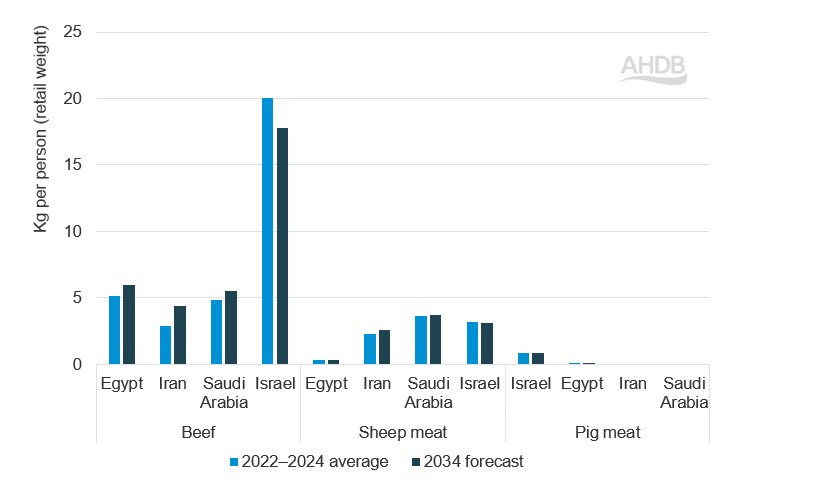

Red meat consumption varies across the region (Figure 2), with the highest per capita consumption in the more affluent countries in the Gulf Region, such as Saudi Arabia and the United Arab Emirates (UAE). Beef is the most widely consumed red meat, followed by sheep meat. Pig meat is not widely consumed across the region.

Figure 2. Red meat consumption per capita in selected MENA countries (for which data is available)

Source: OECD-FAO Agricultural Outlook 2025–2034

Beef and veal

MENA is a net importer of beef, which is a popular source of protein in the region behind chicken and fish. Brazil and India are the main suppliers of imported beef in MENA, accounting for 48% and 36% of total imports, respectively (based on the 2022–2024 average).

Beef import demand across the MENA region varies depending on domestic production and consumption habits.

In the Gulf region – countries like the UAE, Kuwait, Oman, Qatar and Bahrain – almost all beef consumed is imported.

In Saudi Arabia, Jordan, Egypt, Israel and Iran, over half of beef consumed is imported. The rest comes from live imports and local production (primarily from the domestic dairy industry).

Out of the countries shown in Figure 2, beef consumption per capita (by retail weight) is expected to increase in Egypt, Iran and Saudi Arabia by 18%, 52% and 15%, respectively, over the next decade.

Sheep meat

MENA is a net importer of sheep meat, which is an important source of protein in the region, especially in the Middle East, where pork is not an acceptable alternative.

Sheep meat is also important to MENA consumers from a cultural and religious aspect and is often a key component of feasts for various festivals. Out of the selected countries shown in Figure 2, sheep meat consumption is expected to increase by 13% in Iran and 3% in Saudi Arabia by 2034.

Premium lamb consumption and import demand are forecast to continue to grow, particularly in the Gulf region, driven by increasing disposable incomes, urbanisation, Westernisation, young populations and large groups of wealthy expats.

The main supplier of sheep meat to MENA is Australia, although there is an opportunity for British lamb in the region, particularly for high-value cuts.

Pork

Pork consumption per capita is negligible.

Islamic dietary laws prohibit the eating of pork; as such, many MENA countries restrict the importation and consumption of pork. However, in countries with relatively large non-Muslim minorities – such as Egypt, UAE and Lebanon – pork is available in hotels, restaurants and non-Muslim supermarkets.

The main sources of imported pork in MENA are Türkiye and Saudi Arabia. A small quantity is imported from the UK. UK exports of sausages, processed hams, shoulders and pieces and bacon to the UAE totalled 104 tonnes in 2024 (the highest amount since 2010).

A rise in expat populations and tourism in the region is increasing demand for pig meat, especially fresh and chilled pork products. With minimal domestic production of pork, demand is likely to be filled by imported product.

Dairy

Dairy provides a staple part of diets in MENA, with the region being a net importer of dairy products.

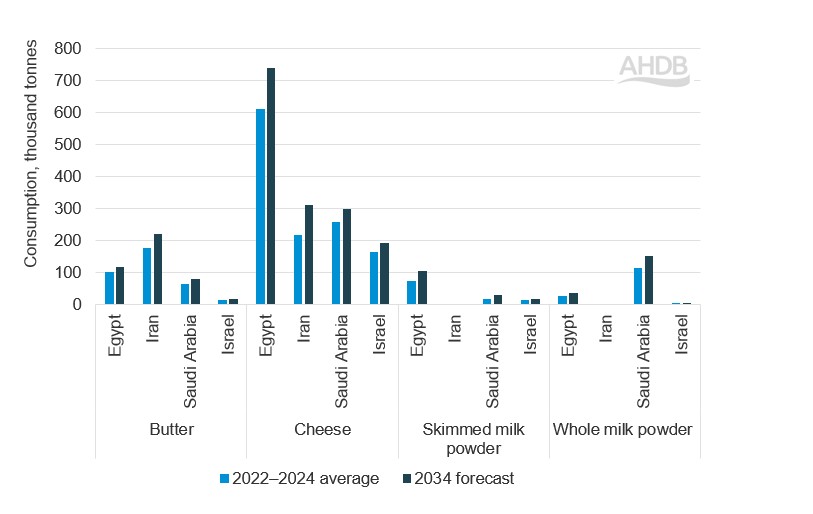

Dairy consumption is expected to grow, due to rising disposable incomes, increasing population, and rising health consciousness among consumers. Figure 3 shows that dairy consumption is expected to increase for the majority of products in the selected countries shown by 2034.

Cheese is the most widely consumed dairy product (Figure 3), particularly in Egypt, where consumption is forecast to grow by 21% over the next decade. Soft cheese consumption is leading growth in Egyptian cheese demand, due to its affordability, local production and nutritional appeal. This rising demand for cheese in Egypt, in particular, is due to a number of factors, including urbanisation, higher disposable incomes and changing consumer preferences.

Consumption of local and traditional cheeses is seeing a resurgence, and nutrition campaigns within the country are raising awareness of the health benefits of cheese.

Figure 3. Dairy consumption in selected MENA countries (for which data is available)

Source: OECD-FAO Agricultural Outlook 2025–2034

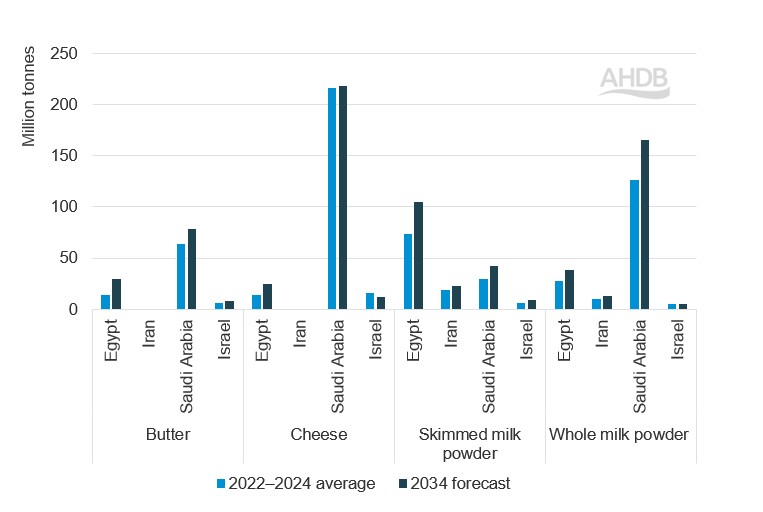

Demand is high for dairy products in MENA, with consumption expected to outstrip domestic production levels, increasing the region’s reliance on imports by 2034.

Figure 4. MENA dairy product imports in selected MENA countries (for which data is available)

Source: OECD-FAO Agricultural Outlook 2025–2034

In the MENA region, Saudi Arabia is among the top dairy importers. According to OECD/FAO forecasts, Egypt is expected to show the largest percentage of growth in dairy imports between now and 2034 compared with the other countries shown in Figure 4.

UK cheese exports to Saudi Arabia averaged 4,700 tonnes between 2022 and 2024. Over the same period, UK cheese exports to the UAE reached a similar level (4,500 tonnes) due to a boost in exports to the country in 2024.

UK cheese exports to Egypt averaged 1,600 tonnes between 2022 and 2024.

Trade data for January to September 2025 shows most UK cheese exports to MENA were destined for Saudi Arabia and UAE (3,900 tonnes each), tracking 11% higher year-on-year. There are new opportunities for high-value dairy cheeses for retail in these markets.

Factors driving MENA’s import demand for red meat and dairy

The MENA region faces a difficult production environment due to limited arable land and water constraints and is one of the largest net food-importing regions.

Population growth and rising incomes will push food imports higher in coming years. Self-sufficiency rates remain low for many staples, although some meat/animal-products are closer to self-sufficiency when looked at in total.

In the GCC, strong consumer demand and reliance on imports is pronounced. Rising incomes and growing middle-class populations are expected to raise demand for animal proteins including poultry, red meat and dairy.

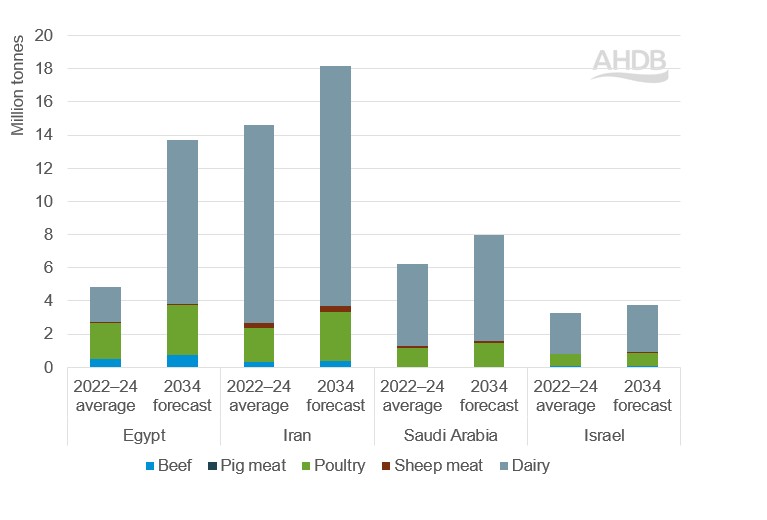

Investment in agriculture within the region is clear, with output projected to increase most strongly in the poultry and dairy sectors to 2034 (Figure 5), according to the OECD/FAO. Despite this, import demand will remain high as consumption will outstrip domestic production.

Dairy production primarily focuses on fresh milk rather than processed products – such as cheese, butter and powders – so again, imports will be required to satisfy demand.

Figure 5. Livestock production trends in the MENA region

Source: OECD-FAO Agricultural Outlook 2025–2034

Cereals

Many MENA countries lack suitable arable land, with insufficient rainfall limiting production, rendering them heavily reliant on cereal imports.

Wheat

Iran and Egypt are the leading wheat-producing countries in the MENA region, with wheat output at 14 Mt and 9 Mt, respectively (2022–2024 average).

As domestic consumption outweighs production in all MENA countries, even the leading wheat producers are net importers of wheat.

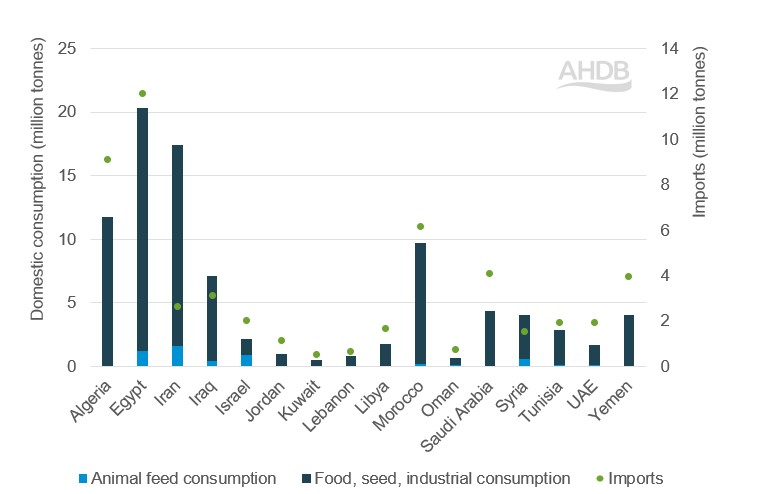

Wheat is primarily for human consumption, shown in the “Food, seed, industrial consumption” category in Figure 6.

Figure 6. Wheat consumption and imports for selected MENA countries (2022/23–2024/25 average)

Source: USDA

Egypt is a significant wheat importer. In contrast, Iran is able to satisfy much of its domestic demand through its own production. Algeria’s and Morocco’s wheat imports are the second and third highest in the region, respectively.

The OECD forecasts that Egypt’s consumption of wheat will increase by 3.6 million tonnes (Mt) by 2034 compared with the 2022–2024 average. The MENA region in general is expected to continue having a high per capita consumption of wheat compared with the global average.

Barley

Iran produces the most barley in the MENA region (over 3 Mt per year, based on the 2022–2024 average). Over the same period, Morocco, Algeria and Iraq each produced an average of under 1 Mt per year.

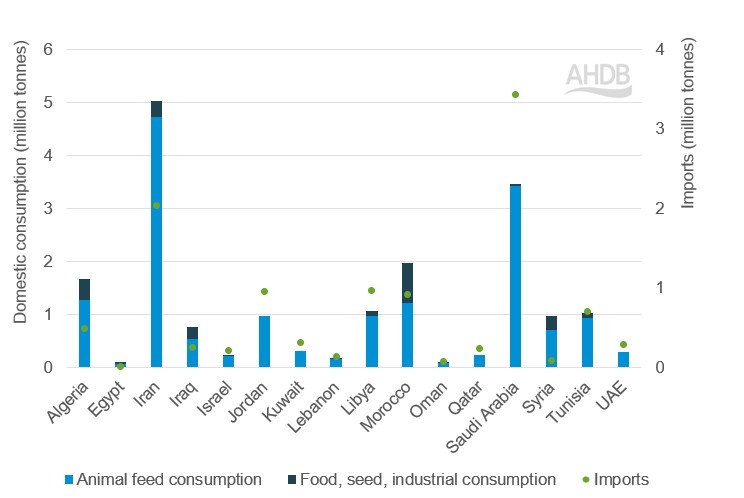

MENA countries are also net importers of barley, with Saudi Arabia importing the highest amounts (Figure 7).

Figure 7. Barley consumption and imports for selected MENA countries (2022/23–2024/25 average)

Source: USDA

Within MENA, animal feed demand dominates barley consumption, especially in Saudi Arabia (Figure 7).

Continue reading about the MENA market

Market access and barriers to trade