- Home

- What can the UK learn from successful agricultural exporters around the globe?

What can the UK learn from successful agricultural exporters around the globe?

This section examines what other countries are doing to support their own producers when they access overseas markets. We look at not only the agri-exporting powerhouses like the USA but also examine similar-sized nations to the UK to determine what is realistically achievable for our producers.

UK producers benefit in several ways from developing export markets.

Exports:

- Drive revenue by balancing the value of the whole carcase

- Create competition for domestic markets, thereby underpinning prices

- Balance demand and supply cycles at home and abroad

- Can exploit premium markets for UK produce while providing an outlet for products not in demand domestically

As the UK continues to negotiate and agree on trade deals and accession to trade blocs around the world, producers often focus on their potential negative impact. This is not surprising since the first two major Free Trade Agreements (FTAs) to be agreed upon after the EU Exit were with major agricultural exporters, New Zealand and Australia, whose farming industry has benefited while ours has not. However, other potential trading partners present more opportunities.

Are we ready to export?

How do we ensure that UK producers can export to new markets? The signing of an FTA does not automatically create demand. Before the UK can benefit from overseas markets, we must establish the potential demand, gain market access to target markets and create supply chains that can deliver a consistent product in a timely manner. While an FTA may lower tariffs and non-tariff barriers to trade, it doesn’t pump-prime the flow of goods.

This is something that successful exporters understand very well. The UK can learn important lessons from those major agricultural exporters, as well as from similar-sized countries who have focused on growing their exports. Below are case studies that the UK can learn from.

Case study: United States of America (USA)

The USA is the world’s largest agricultural exporter. In 2021, US agricultural exports were a record $177bn and 18% higher compared with 2020.

China, Mexico, Canada, Japan and the EU are the top destinations for US agricultural exports.

The Foreign Agricultural Service (FAS) links US agriculture to the world to enhance export opportunities.

FAS has almost 100 offices around the world in approximately 180 countries, which are run by agricultural attachés and local experts who are tasked with promoting US agriculture around the world. FAS help address any trade issues and identify and develop opportunities for US agriculture.

FAS has four main services and programmes:

- Trade Policy: increasing and maintaining foreign market access for US agricultural products by removing trade barriers and implementing US rights under existing trade agreements

- Market Development and Export Assistance: FAS has more than 70 cooperator group partners, which represent a cross-section of the US food and agricultural industry and manages a variety of programmes to help US exporters develop and maintain markets for hundreds of products. FAS also offers export guarantee programs and other types of assistance to US exporters

- Data and Analysis: FAS analysts provide evidence-based intelligence, including, foreign market conditions, production forecasts and policy changes which may affect US exports and imports. They also assess export opportunities

- Food Security: Providing assistance to developing countries in improving their agricultural systems and helping them to increase their capacity for trade

The Market Access Program (MAP) and Foreign Market Development Program (FMD) are the US Department of Agriculture’s (USDA) primary export promotion programmes. They are public-private partnerships between the FAS and non-profit US agricultural trade associations, farmer cooperatives, non-profit state-regional trade groups and small businesses to conduct overseas marketing and promotional activities. The FAS administers these programmes within the USDA.

MAP promotes US agricultural and food product exports by focusing on consumer promotion, market research, trade shows and trade servicing.

FMD intends to provide trade servicing and trade capacity building through efforts to open, expand, and maintain long-term markets for US agricultural products.

Over 70% of total USDA Export Market Development Programs have been funded by industry contributions since 2013. The growth in contributions demonstrates that industry partners recognise the success of the MAP and FMD programs in opening, expanding, and maintaining export markets.

An economic impact study funded by the US grains market was undertaken in February 2022. Read the study

With discounted benefit:cost ratios (BCR) ranging from 17.4:1 for export revenue and 3.3:1 for net farm income, the study demonstrates how successful the programmes are at generating a high return on investment and that they are an effective use of public funds.

Case study: Australia

Australia is a major exporter of agricultural goods, which were valued at AUS$49.6bn in 2020/21. Australia exports red meat and livestock to more than 100 countries, representing over 60% of the industry's production. China continues to be the largest importer of Australian agricultural products, while Japan, the USA and the Republic of Korea are also important markets.

Improving international trade to grow farm businesses is one of the key priorities of current domestic policy. This was set out in the 2015 Agricultural Competitiveness White Paper, and the Australian Government is committed to securing new and better access to overseas markets.

Meat and Livestock Australia (MLA) is a levy-funded body, and the Australian Government match funds spend on research and development. In addition, Australian livestock exporters and processors co-invest levies into MLA programmes through their service companies – Australian Meat Processor Corporation and Australian Livestock Export Corporation (LiveCorp). Individual exporters can also co-invest in marketing activities, and eligible programmes are also match-funded by the Australian Government.

MLA invested AUS$101.8m in marketing, market access and insights in 2019/20 with the aim to increase demand for Australian red meat and livestock in both the domestic and export market.

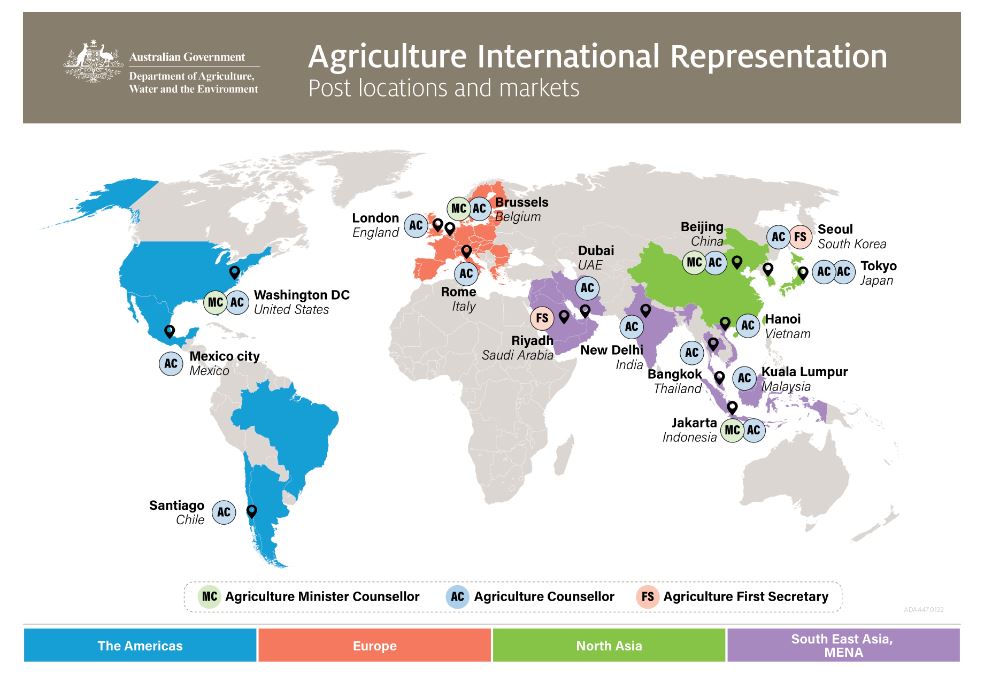

Australia has a network of 22 counsellors across the globe to support its exporters. Their work involves improving and maintaining Australian access to global export markets.

Figure 1. Australia’s agricultural counsellor office locations

Source: Australian Government

This network of counsellors was reviewed in 2020 to assess the effectiveness and efficiency of the network. Read the review

The Australian Government aims to reach $100bn in production by 2030 under its Ag2030 programme.

Support for Australian exporters within the Ag2030 programme includes funds to:

- Reduce congestion for agricultural exporters

- Improve agricultural traceability systems

- Support industry in expanding and diversifying export markets

- Modernise and improve Australia’s trade system

- Appoint Australia’s first Special Representative for Australian Agriculture

Full details and allocated funds are available on the Australian Government's Delivering Ag2030 publication (April 2022).

Useful links

Snapshot of Australian Agriculture 2022

Transforming Australia’s agricultural export services

Case study: Ireland

Ireland is a much smaller agricultural producer – in size and value – than the USA and Australia. However, exports play an important role and were worth €15.4bn to the Irish economy in 2021. The agricultural sector accounted for 9.5% of Irish exports and 7.1% of employment in 2021. Around 90% of Irish beef, sheep meat and dairy produce is exported.

Ireland exports to more than 180 markets worldwide. The UK is Ireland’s largest trading partner, with a 38% share of total agri-food exports by value (€5.8bn) in 2021, closely followed by the EU with 31% (€4.8bn) and the rest of the world accounting for 31% (€4.8bn). After the UK, the USA is the second largest destination, followed by the Netherlands, both importing over €1.2bn of Irish agri-food in 2021.

Dairy is the largest agri-food export, at €5.1bn, followed by beef (€2.4bn) and other meats (€1.6 bn).

Source: Department of Agriculture, Food and the Marine Annual Review and Outlook published for 2022

Irish agricultural exports are supported by the Irish food board Bord Bia. Bord Bia was established in 1994 and brought together the Irish Meat and Livestock Board and the food promotion activities of the Irish Trade Board. It has since integrated horticulture and seafood into its activities.

Bord Bia has offices in Europe, the Middle East and Africa (EMEA), Asia and the USA. It helps Irish businesses maximise their export potential. It delivers national and international marketing campaigns underpinned by sustainability and reputational credentials.

Bord Bia focuses on trade shows, market showcases, inward and outward trade visits and engaging with potential and existing customers.

Case study: The Netherlands

The food and agricultural sector in the Netherlands is innovative and export-oriented and accounts for around 10% of their economy. Agricultural exports totalled €65bn in 2021 (source: Dutch Government), making it the second largest agri-food exporter by value after the USA. A quarter of these exports went to Germany (worth €26.3bn), followed by Belgium (12%), France (8%) and the UK (8%).

The Netherlands is also Europe’s biggest meat exporter, with total meat exports valued at €9.1bn in 2021.

Twenty years ago, the food and agricultural sector set a target of producing twice as much food using half the amount of resources. Investment in research and development, and the uptake of innovative technology, have improved productivity so much that there is a surplus of agricultural products available to export.

Since 1995, agricultural production has risen by 20% in volume, without a corresponding increase in inputs such as energy and fertiliser; this has been driven by a threefold increase in research and development investment.

Advances in vertical farming, seed technology and robotics, as well as other innovations, have helped the Netherlands become a model for other nations. It has also become a major exporter of agricultural and food technology, including environmental innovations that reduce water usage and carbon and methane emissions.

The Netherlands is continuing to invest in its agricultural sector, with the focus shifting towards optimising the use of resources. The Dutch Government has published its plan of action to support circular agriculture and is working with entrepreneurs to develop a more sustainable agricultural and horticultural sector.