- Home

- Cheese: modelling the impact of the UK’s accession to CPTPP

Cheese: modelling the impact of the UK’s accession to CPTPP

The impact of the UK’s accession to CPTPP was examined for cheese, looking at the changes expected after the deal comes into force. This aspect of the modelling work assumes all other factors, except succession, remain the same.

Key points for cheese were:

- The model suggests that increases in CPTPP cheese exports to the UK will be negligible

- The model suggests that UK cheese exports to CPTPP will increase by about 3,839 t (an increase of 87% in percentage terms on the baseline used within the model)

- The model predicts that changes to production and price will be relatively small (less than 1%)

For this analysis, the trade model chosen accommodates five nodes: the UK, EU, USA, New Zealand/Australia, and the rest of CPTPP.

The EU is the world’s largest cheese exporter and is a key trading partner for the UK. The USA also exports a large amount of cheese, mainly to Mexico, Japan, Australia and Chile. New Zealand and Australia also export a lot of cheese, mainly to Japan and China.

Within the CPTPP group Canada and Mexico export the most cheese, mainly to the USA. A key consideration when interpreting the results is that the model cannot determine which of the nine countries within the rest of CPTPP node will be importing or exporting the cheese.

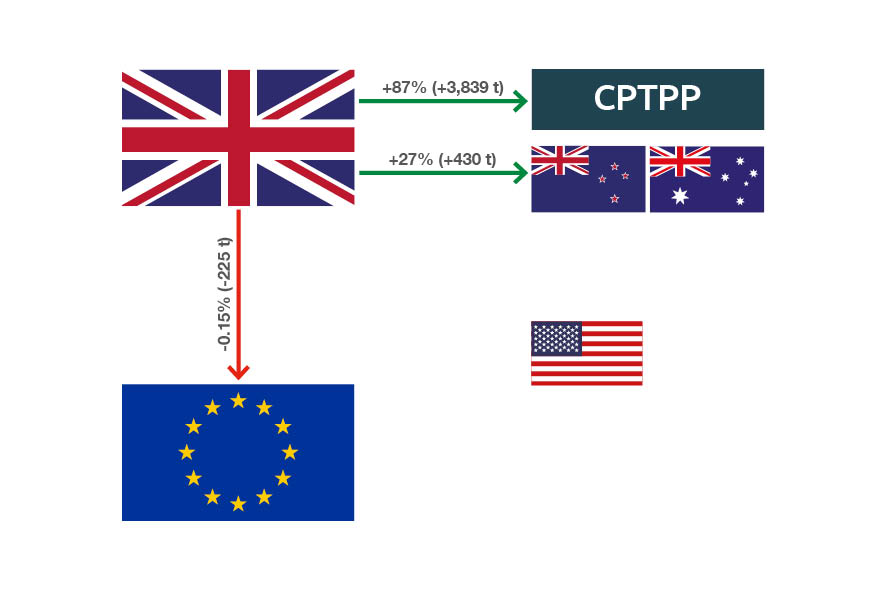

The model predicts an 87% increase in UK cheese exports to CPTPP in the first year of a fully liberalised trade scenario, a rise of about 3,839 t a year (see Figure 1). To put this into context, the UK currently exports about 183,000 t of cheese per year globally. The model also predicts a slight reduction in UK cheese exports to the EU by 225 t and a reduction in the amount of UK cheese sold into the UK market. Overall these changes represent a slight increase in the amount of cheese sold by the UK farming sector by 1,800 t.

Figure 1. Predicted impact of joining CPTPP on UK’s cheese exports

Note: No connecting arrows indicate no change in trade levels.

In a recent AHDB analysis of UK export opportunities around the world, AHDB identified Singapore and Japan as having the best prospects, with Canada, Mexico, Chile and Vietnam also providing good potential butter markets.

There isn’t a great deal of change in the domestic marketplace. As discussed above, UK domestic production will increase by 1,864 t, a rise of less than 1%. There is a very small increase in retail prices, also less than 1%. Table 1 details the impact on domestic production, prices, and the total amount of cheese available in both countries.

Table 1. Modelled changes in the UK and the rest of CPTPP of domestic production, prices and total amount of cheese sold

| UK | The rest of CPTPP | |

| Domestic production | +0.41% (+1,864 t) | -0.11% (-1,090 t) |

| Price paid to producers | No change | No change |

| Total cheese sold in the domestic market (incl imports) | -0.66% (-5,105 t) | +0.08% (+1,148 t) |

| Retail price | +0.04% | -0.01 |

Limitations of modelling results

There are a number of caveats to these results.

Like other economic models, the trade network model is not a prediction or forecast and assumes all factors other than UK accession to CPTPP remain equal. This is unrealistic in a global economy but is an essential assumption for modelling due to the complexity of predicting future changes. What the network model can do, though, is examine specific ‘what if’ scenarios, and this is something that AHDB will continue to analyse.

Like other economic models, the trade network model treats all products in a category as homogenous. In reality, we know that there are varying levels of demand for different types of cheese in each market.

The model does not take into account Sanitary and Phytosanitary (SPS) limitations such as Export Health Certificates (EHCs) and other trade barriers.

Read more about trade implications of Non-Tariff Measures (NTMs).