- Home

- Trade and production: Japan

Trade and production: Japan

Japan is located on the Ring of Fire in the North Pacific, making it prone to frequent earthquakes. It comprises four large islands and more than 6,800 smaller islands and islets. Japan’s population is around 125 million and is expected to decline to 122 million by 2027 (IMF).

Japan has the world's third-largest economy and one of the highest levels of per capita GDP in Asia. Year-on-year GDP growth in Japan is forecast to be 1.8% between 2022 and 2023, and then in 2024, GDP growth is forecast to fall to 0.9%. Domestic demand has been sluggish as the country has emerged from COVID-19. The depreciation of the yen has also impacted trade.

Farmland area has declined over the past decade, falling from 4.59 million hectares in 2010 to 4.35 million hectares in 2021. Japan’s livestock sector had the highest production by sector in 2020, but the country is a net importer of beef, pork and sheep meat, as well as dairy products.

Beef

Most beef raised in Japan is from four native breeds of Wagyu cattle:

- Kuroge (Japanese Black)

- Akage (Japanese Brown)

- Nihon Tankaku (Japanese Shorthorn)

- Mukaku (Japanese Polled)

Holstein, Angus and Jersey cattle are also bred and raised for beef in Japan.

Japan produces almost half as much beef as the UK and relies on imports to satisfy domestic demand.

Table 1. Beef annual production and trade* (2019–2021 average)

| Japan | UK | |

|---|---|---|

|

Production (Kt) |

475.5 |

912.6 |

|

Total exports (Kt) |

5.7 |

118.1 |

|

Total imports (Kt) |

600.2 |

238.0 |

*Not including offal

Source: FAO, Defra, Japan Ministry of Finance and Customs via Trade Data Monitor LLC

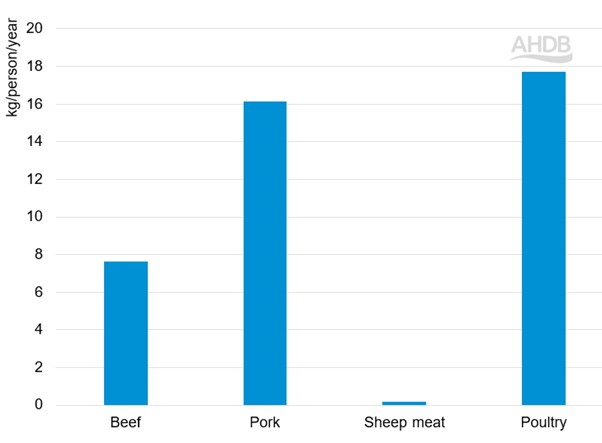

Beef consumption averaged 7.6 kg per person per year between 2019 and 2021, which is less than for poultry and pork. The OECD forecasts Japanese beef consumption to remain at this level for the rest of this decade.

The main beef suppliers to Japan are the USA and Australia, accounting for 40% and 44% of imports, respectively.

Japan’s WTO tariffs for beef imports are prohibitive: the average rate is 38.5% of the price of the product.

However, under the UK–Japan Comprehensive Economic Partnership Agreement (CEPA), the UK can export beef at a preferential rate of 24.2%. This tariff will gradually reduce until it reaches 9% in 2033.

Pork

Japan produces more pork than the UK. Despite this, it also imports pork to meet the nation’s demand. Japan is the second-largest pork importer in the world after China. Between 2019 and 2021, the value of Japan’s pork imports was £3.4bn per year.

Table 2. Pork annual production and trade (2019–2021 average)

| Japan | UK | |

|---|---|---|

|

Production (Kt) |

1,300.9 |

991.8 |

|

Total exports (Kt) |

1.3 |

231 |

|

Total imports (Kt) |

918.1 |

369 |

Source: FAO, Defra, Japan Ministry of Finance and Customs via Trade Data Monitor LLC

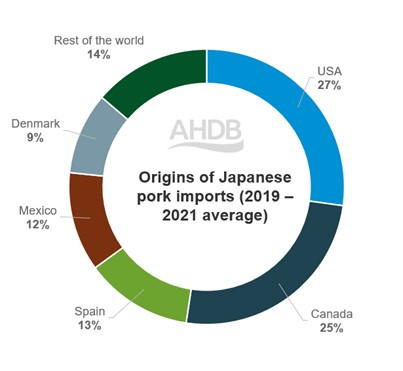

The USA and Canada are the main suppliers of pork to Japan, accounting for over half of total imports (Figure 1).

Figure 1. Origins of Japanese pork imports by volume (2019–2021 average)

Source: Japan Ministry of Finance and Customs via Trade Data Monitor LLC

Japanese pork consumption is more than double that of beef, at over 16.1 kg per person per year, but is lower than the amount of poultry meat consumed on a per capita basis (Figure 2). The OECD forecasts Japan’s pork consumption to increase by less than 0.5% to reach 17 kg per person per year by 2031.

Figure 2. Meat consumption per capita in Japan (2019–2021 average)

Source: OECD

Japan applies an average tariff of 2.2% of the price plus ¥361/kg or ¥482/kg, depending on the cut. This equates to around £2.50/kg. Under the CEPA agreement, the UK will be able to export higher-value pork to Japan tariff-free by 2027.

Sheep meat

Sheep meat production is limited in Japan.

Sheep meat imports were just over 20 Kt per year between 2019 and 2021, with 64% originating from Australia and 34% from New Zealand.

Table 3. Sheep meat annual production and trade (2019–2021 average)

| Japan | UK | |

|---|---|---|

|

Production (Kt) |

0.21 |

290.3 |

|

Total exports (Kt) |

0.0 |

84 |

|

Total imports (Kt) |

20.6 |

55 |

Source: FAO, Defra, Japan Ministry of Finance and Customs via Trade Data Monitor LLC

Sheep meat consumption in Japan is much lower than for other red meats; however, there are regional differences. Many consumers are interested in the quality and leanness of the meat, which is considered a healthy option. The OECD expects little change (less than a 0.2% increase) in Japan’s sheep meat consumption between 2023 and 2031.

Sheep meat imports are not subject to import tariffs in Japan.

Dairy

Cheese

Japan is the largest cheese importer in the Asia Pacific region. By 2031 the OECD expects imports to increase by 27%. Around 46% of Japan’s cheese imports are from Australia and New Zealand, although the USA and EU are also key suppliers.

Table 4. Cheese annual production and trade (2019–2021 average)

| Japan | UK | |

|---|---|---|

|

Production (Kt) |

46* |

488 |

|

Total exports (Kt) |

1 |

185 |

|

Total imports (Kt) |

294 |

482 |

*2019/20 average (data is not available for 2021)

Source: FAO, Defra, Japan Ministry of Finance and Customs via Trade Data Monitor LLC

Japan’s cheese consumption averaged 3.6 kg per person per year between 2019 and 2021; this is expected to increase to 4.5 kg per person per year by 2031 (OECD).

Japan’s import tariffs on cheese are around 32% of the price. However, UK cheddar cheese will be exempt from tariffs from 2033 because of the UK–Japan CEPA.

Butter

Table 5. Butter annual production and trade (2019–2021 average)

| Japan | UK | |

|---|---|---|

|

Production (Kt) |

67* |

202 |

|

Total exports (Kt) |

0.01 |

61 |

|

Total imports (Kt) |

17.9 |

72 |

*2019/20 average as data not available for 2021

Source: FAO, Defra, Japan Ministry of Finance and Customs via Trade Data Monitor LLC

Japan is a net importer of butter. However, the OECD forecasts that consumption will decline by 3 Kt by 2031, resulting in lower imports (around 10 Kt). New Zealand and France supplied the majority of Japan’s imported butter (60% and 20%, respectively) in 2019–2021.

Japan’s import tariffs on butter are fairly prohibitive and similar to those applied to cheese, at around 30% of the price plus ¥985 or ¥1,159 per kilogram.