Wheat remains tight for the 2021/22 season: Grain market daily

Thursday, 28 October 2021

Market commentary

- May-22 UK feed wheat futures were up £1.35/t yesterday, to close at £221.50/t, another contract high.

- The Nov-21 contract also saw gains yesterday to close at £213.05/t, up £2.80/t from the day before. However, there were only 153 open contracts for Nov-21 at yesterday’s close, compared to May-22, which had 7,185 open contracts.

- After cancelling an earlier tender, Pakistan has issued a new tender for 90Kt of wheat. This is the same volume as the cancelled tender.

- US ethanol demand seems strong. The latest weekly ethanol production stats record 1.106M barrels per day. The weekly total was the second largest on record. Strong demand helped curb losses in US maize futures driven by falling crude oil prices.

Wheat remains tight for the 2021/22 season

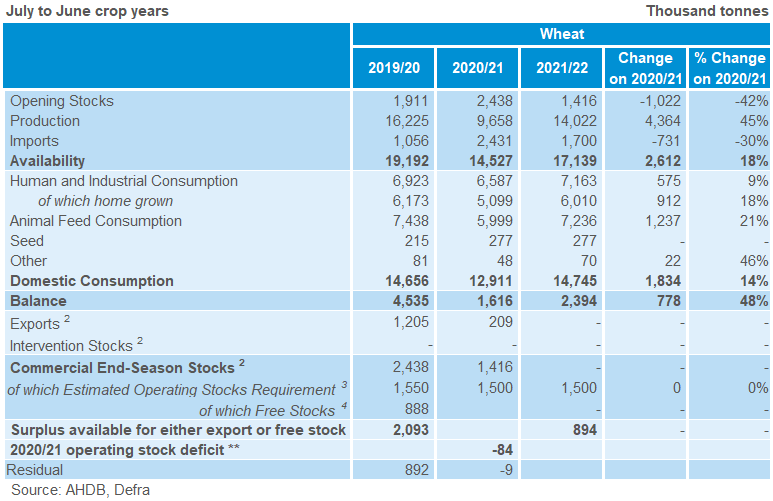

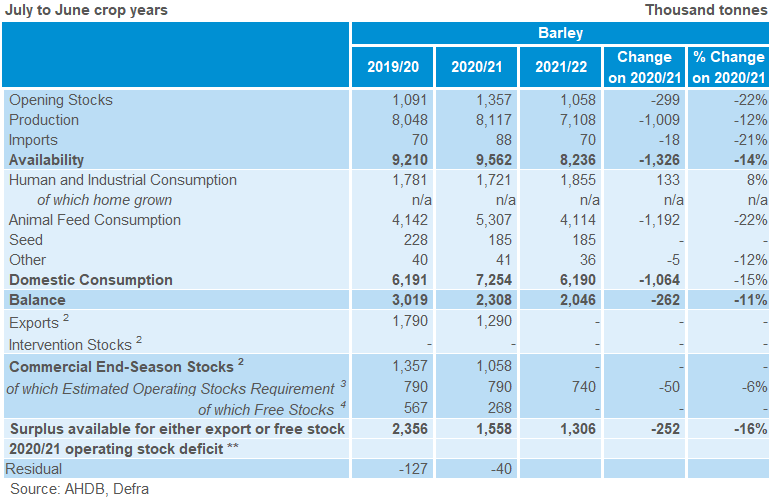

The 2021/22 AHDB early balance sheets are now out. They give a first insight into wheat and barley supply and demand for the season ahead.

With wheat opening stocks at the lowest level this century, the outlook continues to be tight throughout 2021/22. Total availability of wheat is anticipated up 18% from 2020/21, due to a rebound in wheat production. Defra are provisionally pegging wheat production at 14.0Mt.

We foresee, due to increased production counteracting reduced opening stocks, imports will be back on the year. However, at 1.7Mt, we predict imports to be above average. The driver behind this is haulage struggles. So, although there is greater availability of home-grown wheat compared to 2020/21, imports may not be cut back proportionally.

We expect, following an announcement in February, the Vivergo Fuels bioethanol plant to come back online this season. However, it is unclear when this might be with statements suggesting “early 2022”.

As a result of two bioethanol plants coming back online, we anticipate increased usage. This feeds into the Human & Industrial (H&I) consumption figure. Total usage by flour millers is currently forecast as relatively flat on the year though.

As Helen talked about on Tuesday, the prices of feed grain have shifted. Feed barley is now pricing closely behind feed wheat. As a result, we expect barley usage to drop back from last year when the discount to feed wheat was much greater, and this to be replaced by wheat in feed rations.

Predictions for less barley usage in animal feed led to a drop in total domestic consumption estimates. Despite a drop in consumption, the barley picture is relatively tight for the commodity. Availability is also curbed this season, due to the lowest opening stocks since 2013/14 and a drop in production.

The balance of supply and demand for barley is estimated at 2.0Mt, which is down 11% from last year. The balance was also 2.0Mt in 2018/19 but, prior to this, a tighter balance was last seen in 2012/13.

Due to the tight picture, barley is likely to continue to hold it’s discount to wheat. It could even squeeze the discount slightly further, which would keep a lid on demand.

The first official UK supply and demand estimates will be published on 25 November. These will provide estimates for all cereals. The wheat and barley estimates will also be updated to reflect the latest data and trade expectations.

Notes

- Forecast using best information available as at 28 October 2021

- Split of exports, intervention and total commercial end-season stocks only published for historical seasons

- This is a calculated estimate of the minimum tonnage that users of grain require to get through to a point at which new crop can be utilised

Estimated Operating Stocks Requirement calculated as shown here - Free Stocks are those available after exports and operating stocks have been fulfilled; these will be estimated later in the season when stocks survey data is available

** Due to the highly unusual nature of the 2020/21 seasons hugely reduced wheat production figure, an extra line is included in the balance sheet to show the operating stock deficit

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.