What will happen to Australian barley exports? Grain Market Daily

Wednesday, 9 December 2020

Market Commentary

- London wheat futures continued to firm yesterday. Both the old (May-21) and new crop (Nov-21) contracts closed up £0.70/t, at £189.25/t and £158.00/t respectively.

- Support was found from a weakening of sterling which hit a low of £1=€1.0968 during trading yesterday. However, it only closed marginally down, at £1=€1.1033. Sterling has rallied somewhat this morning. Today’s gains encapsulate the losses from the previous two days.

- Chicago soyabeans (Jan-21) have found some support today, having hit the lowest point since 12 November yesterday. Positive news about weather and crop conditions in South America has capped gains.

- This morning, ProAgro cut its Ukraine grain export forecast for 2020/21 by 1.1Mt to 47.1Mt due to lower production. This would be 8.5Mt lower than last year’s exports of 55.6Mt.

What will happen to Australian barley exports?

After 3 years of droughts, Australia has experienced vastly improved conditions the whole way through this season. As a result the country is currently harvesting a bumper crop. Wheat production is forecast to increase by 106% from last year, to 31.2Mt, and barley production is set to increase by 33% to 12.0Mt. if realised, both of these would be the 2nd largest on record.

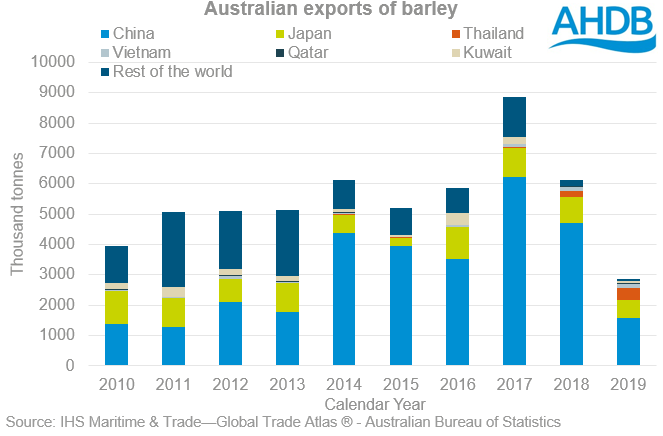

As a net exporter, much of this wheat and barley will end up on the global market. Usually China is Australia’s largest export destination for barley. Over the last 10 years, an average of 55% of Australia’s barley has gone to China. In 2015 and 2018, this figure reached 76% and 77% respectively. However, from May 2020, due to ongoing trade disputes, China implemented an 80.5% tariff on Australian barley. This poses a serious question as to where this massive crop will go, and what does this mean for the UK?

Aside from China, there is one other reasonably sizeable importer of Australian barley, Japan. That said, tonnages have been reducing over the last couple of years, although this has been due to Australia having a reduced exportable surplus in these years. There have been increasing tonnages moving into Thailand and Vietnam which is destination for Australian barley that we may see expand over the coming seasons. However, with increased availability Australian barley is also going to have to compete on the world market to gain export business that it would not normally attract.

Looking at trade data for October, Saudi Arabia was the largest importer of Australia’s barley at 66Kt, having not imported any tonnage in previous years. October is typically a quieter month for Australian exports. Furthermore, it is expected that Australian origns will make up a large proportion of feed barley in the Saudi Arabian Grains Organisation tender, issued in November. While origins are optional, traders expect much of the 730Kt of barley for Jan-Feb delivery to be sourced from either Australia or the Black Sea.

With more Australian barley potentially coming onto the global market, UK barley will face increased competition into homes such as North Africa, especially if UK barley is subject to tariffs into the EU post 31 December 2020. With increased competition from other origins, UK barley will be under pressure to price into export markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.