What are the prospects for European new crop oilseed rape? Grain Market Daily

Wednesday, 6 January 2021

Market Commentary

-

UK feed wheat futures continue to rally. The nearby contract closed at £201.50/t; this is its highest price since April 2013. The May-21 (old crop) contract closed at £204.00/t and the Nov-21 (new crop) contract closed at £166.05/t, up £1.40/t and £1.20/ respectively.

-

Chicago maize continues its rally to hit $5/bushel for the first time in 6 years. This has been driven by dryness concerns in South America and the 2 month Argentine maize export ban.

-

Malaysian palm oil stocks have been forecast lower again due to strong Chinese demand. The La Niña weather event has caused heavy rains in key palm oil producing regions which is likely to keep global supplies tight.

What are the prospects for European new crop oilseed rape?

Harvest 2020 was not a good year for oilseed rape in the UK and across Europe. Unfavourable weather, the increasing bans of plant protection products and the flea beetle all contributed to a crop that struggled across the continent.

The plant is now becoming a risky and expensive option for many farmers to grow and for this reason, many growers are choosing to move away from growing OSR.

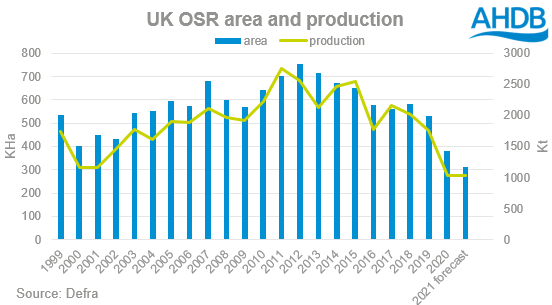

Domestically, according to AHDB’s Early Bird Survey, we are facing the third consecutive year of decline in OSR area. Area planted for harvest 2021 is forecast to be a further 18% lower than the harvest 2020.

At 312Kha this would be the lowest OSR area since 1986. Even if a 5-year average yield of 3.3t/ha was achieved, this would only give a production of 1.049Mt, only slightly above last year’s production figure of 1.038Mt.

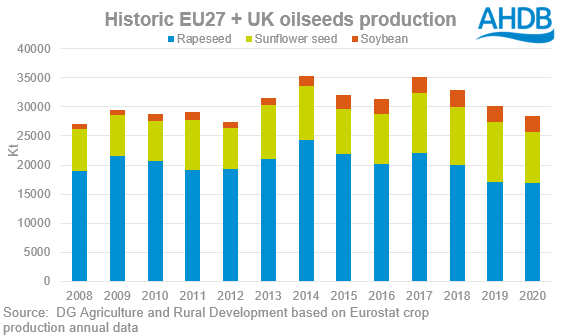

Last month, consultancy firm Stratégie Grains reported that production from the EU27 and the UK combined could reach 18.2Mt, 1Mt higher than poor harvest of 2020. Decreased planted area from the UK is expected to be outweighed by increased plantings across the EU, notably Germany and Eastern Europe, increasing total area planted just 0.05Mha to 5.53Mha.

Therefore, increased yields would be necessary to significantly boost production. Looking back over EU28 OSR production for the last 11 years, production has only been below 20Mt on two occasions. Yet, even with record yields achieved in 2014/15 total produced would not manage to hit 20Mt.

UkrAgroConsult has also reported a large cut to Ukrainian OSR area, forecasting it at 1.08Mha, 20% lower than harvest 2020. Weather has not posed a threat to production yet. However, current warm weather may lead the plant to start growing again, posing a risk if air temperature suddenly drops below zero, with no snow cover to protect the crop from winter kill.

Despite this drop in rapeseed area, Ukraine has increased the sunflower seed area by 1.5% to 6.75Mha and soyabeans by 10% to 1.7Mha. These increases largely outweigh the decline in rapeseed area. Total oilseed area is now pegged at 9.53Mha, compared with 9.55Mha last year. Total rapeseed production is provisionally forecast at 2.4Mt, 11% lower than in 2020.

So, with Ukraine and the UK forecasting declines in production, and EU forecasts only slightly up on harvest 2020, we could well be facing another season of tight supply. Should this be realised, once again Europe will have to reply on global supplies, potentially needing to maintain a price premium to world levels to attract supply.

With Canada and Australia the turn to origins, much interest will be placed on their production projections going forward. However, with their canola plantings not commencing until the spring at the earliest, we do not know how much canola will come out of these two countries.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.