- Home

- News

- UK wheat export pace increases, but is it enough to avoid a large carry-out? Grain market daily

UK wheat export pace increases, but is it enough to avoid a large carry-out? Grain market daily

Thursday, 19 January 2023

Market commentary

- UK feed wheat futures (May-23) closed at £230.50/t yesterday, up £0.50/t from Tuesday’s close. New crop futures (Nov-23) were up £0.95/t over the same period, closing at £223.45/t yesterday.

- Potential demand for European wheat from Tuesday’s Algerian tender for c.600Kt wheat and uncertainty surrounding Russia’s exports supported prices. Meanwhile, US wheat markets followed maize markets lower on profit-taking and rains in Argentina easing dryness concerns.

- Paris rapeseed futures (May-23) closed yesterday at €543.50/t, down €16.50/t from Tuesday’s close. European rapeseed markets fell following a proposal from the German environment minister to retract the usage of crop-based biofuel in the country. Pressure was also felt from downward movements in soyabean markets on the back of improved weather in Argentina.

UK wheat export pace increases, but is it enough to avoid a large carry-out?

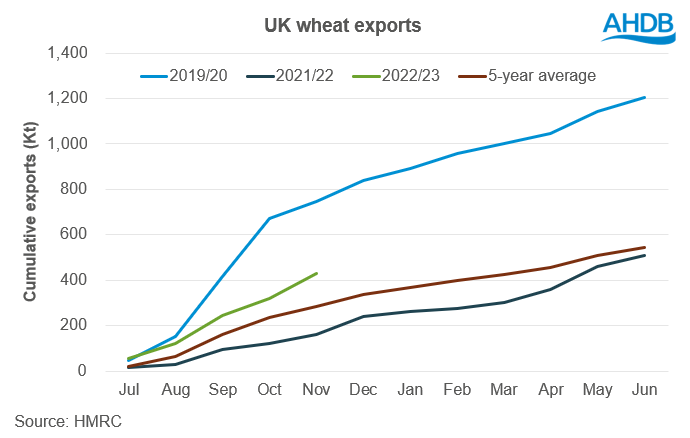

Following a bumper 2022 harvest, on top of relatively subdued demand, the UK is expected to have a substantial exportable surplus of wheat this season. In November’s cereal supply and demand estimates, the surplus available for either export or free stock of wheat was forecast at 2.25Mt in 2022/23, over two and half times 2021/22 levels and the largest surplus since 2015/16. With trade data now available for the season up to November, are UK wheat exports progressing at a pace fast enough to avoid large ending stocks?

In November, the UK exported 112.9Kt of wheat (including durum wheat), 40.7Kt more than was exported in October, and the largest volume for the month of November since 2016/17. This takes UK wheat exports in the season to date (Jul-Nov) up to 432.2Kt. While this is the largest amount exported for this point in the season since 2019/20, it remains relatively low when compared with other seasons that had a c.2Mt exportable surplus. In 2019/20, the UK had an exportable surplus of wheat of 2.09Mt and by November of that season, wheat exports had reached 745.3Kt.

So why the low export volume if we have such a large surplus? There are a number of factors that have contributed to this. Firstly, with such market volatility over the past year, driven by the war in Ukraine, this is likely to have led to some growers to hold on to stock. Looking at the AHDB Corn Returns volume data, the total volume of feed wheat sold for spot and forward delivery from the start of July to date (12 January) is 4% lower than the same period last season. Another major factor that is influencing UK exports, is our competitiveness on the international market. It’s been well reported lately that cheap Black Sea supplies are dominating the export market.

To prevent the UK carrying out a large amount of free stock of wheat this season, the export pace is going to have to ramp up. Whether this will happen or not is yet to be known. For it to be able to happen though, the UK will have to price more competitively on the export market.

Next Thursday (26 January) AHDB will be publishing the January UK cereal supply and demand estimates, which will include the first estimates for exports and end-season stocks of wheat and barley for the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.