South American weather can support your new crop rapeseed: Grain market daily

Tuesday, 11 January 2022

Market commentary

- UK wheat futures (May-22) closed yesterday at £219.00/t, gaining £0.50/t on Friday’s close. Nov-22 UK wheat futures closed at £191.80/t, gaining £0.25/t on Friday’s close.

- Domestic values were supported yesterday from both Chicago and Paris wheat futures markets. The global market moved up slightly on the back of “bargain buying” and short covering in the Chicago wheat market.

- Chicago soyabean futures (May-22) closed yesterday down 1.76%. This is due to forecast rains in Southern states of Brazil and Argentinian states of Santiago de Estero, Cordoba and Santa Fe. These regions are key to soy and maize production.

South American weather can support your new crop rapeseed

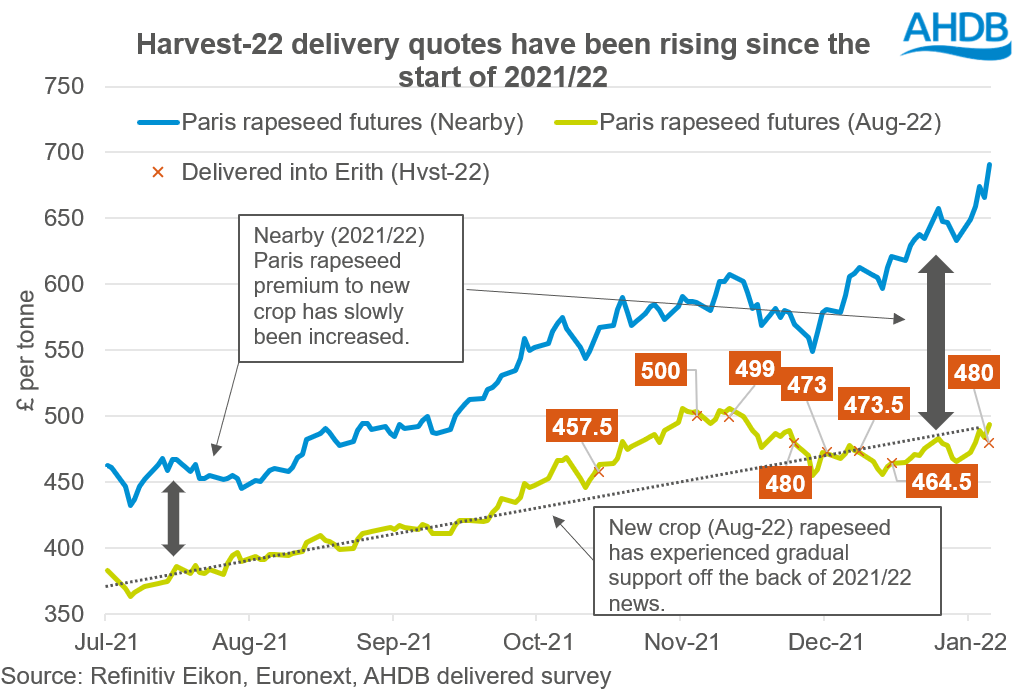

As it’s been mentioned before, for the rest of this marketing year the global rapeseed market is extremely tight. Nearby Paris rapeseed futures closed yesterday at around £675/t.

For the majority of this year, the market has been inversed meaning forward futures prices are lower than the spot market price. Also, rapeseed prices have generally been rising due to a global tightness.

Soyabeans still supporting rape

There has been a lack of supply and relatively inelastic demand for rapeseed this marketing year. This has meant the pricing relationship between rapeseed and soyabeans has not correlated as closely as in previous years. However, with soyabeans making up a large proportion of global supply and demand of oilseeds, it is still very much a sentiment driver of rapeseed prices.

Recent weather events in South America, which were outlined in yesterday’s market report, have been somewhat underpinning recent oilseed prices. Further to that, weather and labour issues in Malaysia have assisted the oil/oilseed complex too.

Nearby Chicago soyabean, Chicago soy oil and Paris rapeseed futures prices have gained 3.2%, 4.4% & 6.9% respectively since before the Christmas break (23 Dec – 10 Jan).

Support for harvest-22 rapeseed

Based on yesterday’s close, new crop Paris rapeseed futures (Aug-22) closed at a c.£182/t discount to old crop futures (Feb-22). At this time of year, the 5-year average discount from February futures to August futures is c.£18/t. With this huge discount it would be expected that global rapeseed stocks-to-use may be set to recover for the 2022/23 marketing year.

However, despite this large discount, current South American weather news is supporting new crop domestic rapeseed values.

Last week’s new crop delivered rapeseed (into Erith, Hvst-22) was quoted at £480.00/t, gaining £15.50/t since our last pricing report (17 Dec).

Conclusion – prices may not be high forever

Although old crop soyabean market news may be driving new crop rapeseed values at the moment, this may not last forever.

Looking forward, initial estimates show that rapeseed area is set for a 2022/23 recovery. The latest Stratégie Grains oilseed report pegged EU-27 area for harvest 2022 at 5.61Mha, up 7% year-on-year. UkrAgroConsult estimate Ukraine’s area to increase by 4% at 1.2Mha.

Key data from Statistics Canada will be released at the end of April 2022. This will reveal anticipated Canola area for 2022/23.

In the meantime, soyabeans are very much a sentiment driver and weather in South America over the next few weeks will be critical for global oilseed sentiment.

High nearby rapeseed prices may not last forever. Rapeseed’s huge premium to soya could close if global stocks look like they will be replenished in 2022/23.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.