Russian wheat in focus: Grain market daily

Thursday, 4 July 2024

Russian wheat in focus

- UK feed wheat futures (Nov-24) fell £2.00/t yesterday, ending the session at £197.50/t. The May-25 contract closed at £205.35/t, also down £2.00/t over the session.

- Domestic wheat futures followed global grain markets down yesterday on the back of an improved outlook for the Russian wheat crop. Read more analysis on this below.

- Paris rapeseed futures (Nov-24) closed yesterday at €508.25/t, up €7.25/t from Tuesday’s close. The May-25 contract also gained €7.25/t, to close at €509.25/t.

- Paris rapeseed futures tracked the wider oilseeds complex yesterday. US soyabeans were supported by forecasts of hot and dry weather towards the end of July in key soyabean growing regions of the US. Adverse weather at this time of the year could impact soyabean pod setting, something to keep an eye on.

Russian wheat in focus

As outlined in yesterday’s Grain market daily, a key driver in global wheat markets continues to be the uncertainty over the size of the Russian wheat crop, and what this means for global supplies. According to USDA data, for the 2023/24 season, Russian wheat exports were estimated to account for 25% of total global wheat exports. As such, any change in level of exports expected as we enter this new season can have great influence on price direction.

Earlier last month, dry conditions in Southern parts of the country, as well as frost conditions in more central regions caused doubt over the development of the crop. As a result, Russian consultancy firm Sovecon had revised its wheat production figure to as low as 80.7 Mt. However, more recently, weather in the key wheat growing regions has improved and the actual impact of the poor weather has been assessed, causing estimates to begin to edge back up.

Yesterday, Sovecon revised its production estimate to 84.1 Mt, up 3.4 Mt on its previous figure. However, at the end of last week, Sovecon cut its 2024/25 Russian wheat export forecast to 46.1 Mt from the previous estimate of 47.8 Mt. The USDA currently pegs Russian wheat production at 83.0 Mt, and exports at 48.0 Mt.

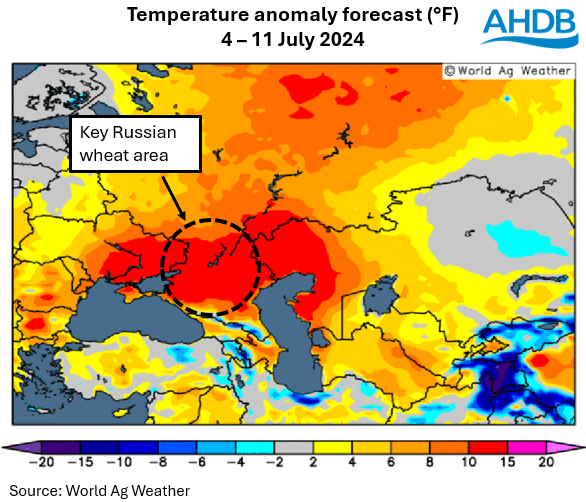

Looking ahead, despite seeing a slight improvement in the outlook as of late, more hot weather and minimal rain is forecast over the next seven days in Southern parts of Russia.

However, with much of the Russian winter wheat crop now filling/maturing or being harvested, the impact of adverse weather is becoming increasingly limited. As such, we might not see much market reaction as a result of these conditions.

Furthermore, with harvest progressing across the country, export prices are continuing to weaken. At the end of last week, the price of new crop 12.5% protein Russian wheat (FOB) for delivery in late July was $226/t, down $5/t on the previous week (IKAR).

Over the coming weeks, updates on yield, and any subsequent adjustments to production and export figures from consultancy firms in the country will be key. Revisions for Russia made in the USDA’s next World Agricultural Supply and Demand Estimates, due to be released next week, will also be a watchpoint for grain markets in the short-term.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.