Greater-than-expected revisions to US maize and soyabean crops: Grain market daily

Tuesday, 13 August 2024

Market commentary

- UK feed wheat futures (Nov-24) fell £2.30/t yesterday, closing at £190.35/t. The May-25 contract ended the session at £201.90/t, down £2.75/t over the same period.

- Domestic wheat futures followed global prices down yesterday. Wheat prices were generally pressured by cheaper supplies from the Black Sea and repositioning ahead of yesterday evening’s USDA WASDE report.

- Paris rapeseed futures (Nov-24) were down €4.50/t from Friday’s close, ending the session at €460.00/t. The May-25 contract fell €2.50/t over the same period to close at €461.50/t.

- Paris rapeseed futures followed the wider oilseeds complex down yesterday as weakness in the soyabeans market continued to have an impact. After European markets had closed, Soyabean futures have fell further to their lowest level since September 2020 as the USDA WASDE report showed a record production estimate for the crop. Get more details below.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Greater-than-expected revisions to US maize and soyabean crops

The USDA released its latest World Agricultural Supply and Demand Estimates (WASDE) report yesterday. A record soyabean crop is projected in the US on higher area and yield. The US maize crop was also revised up, though ending stocks of major exporters looked tighter than last month’s figure. Global wheat ending stocks were also revised down.

Soyabeans

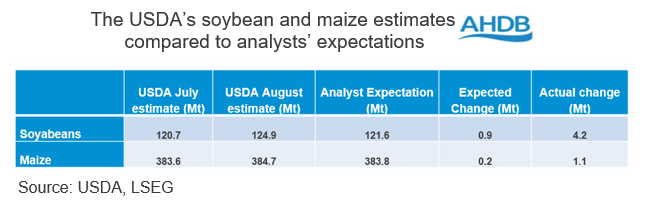

2024/25 US soyabean production is now expected to reach 124.9 Mt, up from 120.7 Mt last month. This also far exceeded the average analysts’ expectation of 121.6 Mt. Production in other top exporting countries remained unchanged from July.

Global production among top exporters (incl. Argentina, Brazil, Paraguay and the US) is now estimated to be up 9.1% on the year, and 15.9% higher than the five-year average.

As a result of the revision to the US crop, ending stocks of major exporters are now projected to rise to 78.3 Mt, up 26.8% from 2023/24. If realised, these would be the heaviest ending stocks for major exporters since 2018/19.

Maize

The USDA raised its US maize production estimate yesterday by 1.18 Mt to reach 384.7 Mt. This is again above the average analyst expectation of 383.9 Mt. Despite this increase, increased US exports leaves ending stocks in the US tighter, now at 52.7 Mt, down from 53.3 Mt in July and below the average analyst expectation of 53.24 Mt. Though this remains the largest US ending stock figure in six years.

Total production by major exporters (US, Argentina, Brazil and Ukraine) is raised by 0.7 Mt from July’s estimate to 589.9 Mt. While ending stocks are forecast at 58.0 Mt, down 0.5 Mt from July. Though it’s important to note, these are the heaviest since 2019/20.

Wheat

Wheat production this season in the US and European Union was cut in yesterday’s report. However, the increases projected for Australia and Ukraine outweighed the cuts, leaving production by major exporters (incl. Argentina, Australia, Canada, EU, Russia, Ukraine and the US) up slightly from last month’s report.

World ending stocks of wheat for the 2024/25 season is projected to reach 256.6 Mt, down 0.6 Mt from July’s estimate and relatively in line with (0.3 Mt below) the average of analysts’ expectations.

What does this mean for markets?

For soyabeans, a larger-than-expected US crop estimate intensifies the current bearish sentiment in the market. Following the release of the WASDE report yesterday, Chicago soyabean futures (Nov-24) were pressured, and ended the session down 1.6% from Friday’s close, with more pressure on prices so far today.

For Chicago wheat and maize futures, due to the changes in yesterday’s report being relatively in line with what was expected, and the focus more on European conditions and Black Sea supply, price impact was minimal. Though any future changes to the US maize crop will be a key watchpoint in markets over the coming months.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.