Palm oil, the floor to the vegetable oil complex: Grain market daily

Wednesday, 16 November 2022

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £263.80/t, down £5.95/t on Monday’s close. The Nov-23 contract fell the same amount, closing at £245.30/t yesterday.

- Domestic and European futures closed down yesterday following news of progress in talks between the UN and Russia to extend the Black Sea grain corridor. The export corridor deal is set to renew on Nov 19, unless there are objections. Russia have said the extension depends on the extent of Western sanctions impacting their grain and fertiliser exports (Refinitiv).

- Yesterday, US grain markets closed up despite the initial pressure. This was due to yesterday evenings reports that Russian missile strikes crossed into Poland’s territory. Chicago wheat futures (May-23) gained $3.31/t to close at $315.32/t.

- Paris rapeseed futures (May-23) closed down €11.00/t yesterday, closing at €614.75/t.

- Tomorrow, Chancellor of the Exchequer Jeremy Hunt will release the Autumn budget report, detailing plans for how the government will collect and spend money. With exchange rate markets currently volatile to news from the government, this will remain a watchpoint.

Palm oil, the floor to the vegetable oil complex

Palm oil has felt underlying support this year from demand recovery following the pandemic. Further support has come from the war in Ukraine which disrupted their exports and plantings of oilseeds. Over this period nearby palm oil futures were very close to closing at $1,950/t (01 March).

However, since this point palm oil prices have come back down since Indonesia lifted their palm oil export ban on 23 May, which lasted three weeks.

Going forward the outlook for palm oil is important as it sits at the bottom of the vegetable oil complex. Lower prices will reduce the price floor for oils, which in turn will influence rape oil and impact your farm gate rapeseed price.

The current situation

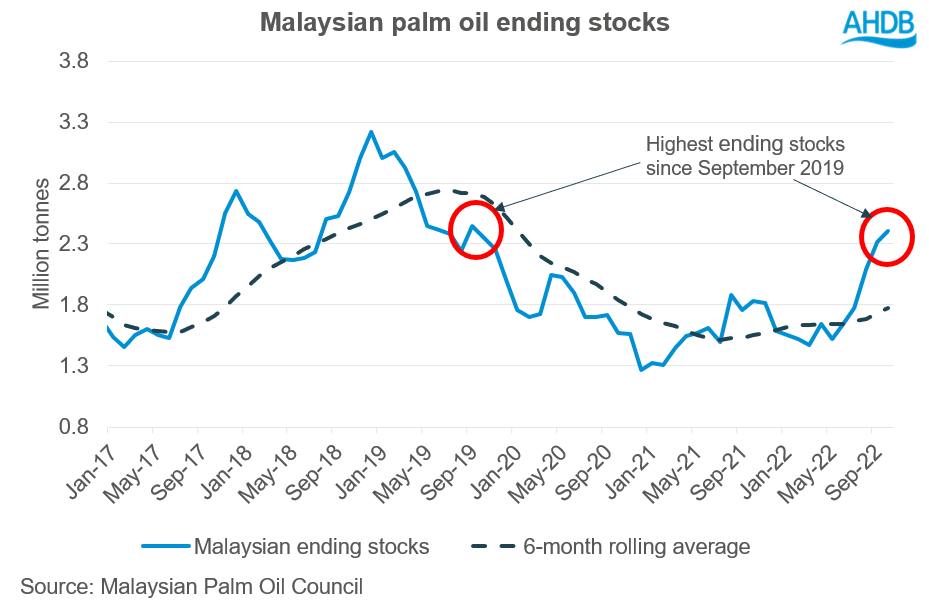

Global palm oil production is forecast 3.6% higher year-on-year at 80.1Mt for 2022/23 (OilWorld.biz). Further to this, recent data estimates that Malaysian palm oil stocks are at 2.4Mt, their highest point in three years (Malaysian Palm Oil Council). Much of this increase in Malaysian stocks is from strong production and lower exports to countries like China and India. High vegetable oil prices combined with COVID-19 measures have meant Chinese demand has not been as strong for palm oil.

What is to be expected for palm oil prices?

Going forward palm oil will continue to be influenced by other vegetable oils and energy markets.

However, recently the Malaysian Palm Oil Council (MPOC) forecast prices to be maintained or slightly supported until the end of 2022. This results from stronger demand expected due to increased Chinese palm oil imports for New Year’s Day and Lunar New Year celebrations.

Also, what is critical to note is Southeast Asia is heading into monsoon season which usually reduces palm oil production output going into Q1.

For 2023, things are a lot less predictable. However, the MPOC forecast there is potential that prices could feel some pressure as we head into Q1 and Q2, but price drops will be more limited in Q1 if production output is lower than expectations, but this is a key watchpoint.

On the other hand, parameters that could sustain higher prices are if Chinese COVID-19 restrictions are removed and they aggressively come back to the market to replenish their depleted vegetable oil stocks.

From now until the end of June there is a lot that can play out in the vegetable oil complex but if the palm oil floor drops lower this is something that could weigh on oilseed prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.