New crop discount diminishing as focus turns to harvest 2022: Grain Market Daily

Wednesday, 13 April 2022

Market Commentary

- Yesterday, both old and new crop UK feed wheat futures closed at new contract highs. The May-22 contract settled at £322.00/t, up £9.55/t from Mondays close. Nov-22 futures gained £9.65/t on the day at £293.00/t.

- Dec-22 Chicago wheat futures also closed at a contract high yesterday at $404.69/t, up $7.44/t from Mondays close. The May-22 settled at $405.52/t, up $8.27/t.

- On the back of plans to increase US biofuel demand, both May-22 and Dec-22 Chicago maize futures closed at new contract highs on Tuesday of $305.61/t and $287.79/t respectively.

New crop discount diminishing as focus turns to harvest 2022

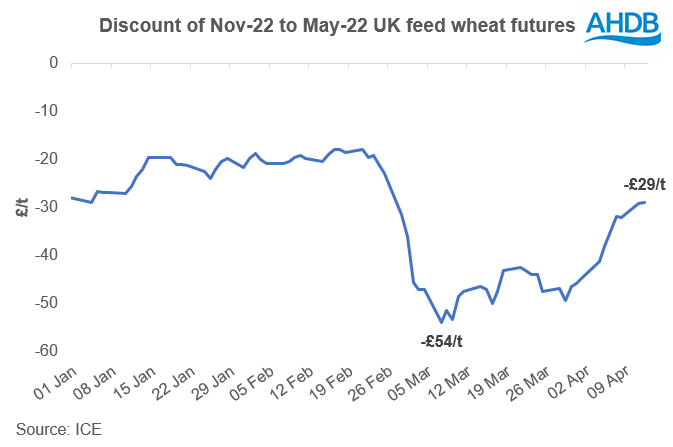

Both old (May-22) and new crop (Nov-22) UK feed wheat futures closed at new contract highs again yesterday at £322/t and £293/t respectively. The discount between new and old crop prices now stands at £29/t. Only just over a month ago (7 March) the gap between the two contracts stood at a substantial £54/t.

So why has the discount shrunk? The impact of the war between Russia and Ukraine has been the key driver of markets of late, with the conflict leading to the ever tightening of global supplies this season. As we edge closer to next season, the focus has started to switch to harvest 2022. As we covered in Market Report on Monday, the USDA have cut the Ukrainian grain harvest by 20% on the year due to a reduction in area planted. On top of this, dryness in the US and parts of Europe may have an impact on global wheat output for next season.

Domestically, the wheat area is expected to be higher in 2022. At the end of March, 81% of the crop that was is in the ground was in good/excellent condition according to the AHDB Arable Crop Report. However, it is worth noting that we are still a fair way off harvest so any adverse weather, as well as a substantial increase in input costs, may well have an impact on total output.

As we progress through the year, the focus on next season’s crop will continue to ramp up. As such, we may well see the gap between old and new crop tighten further if concerns around global supply greaten. Weather conditions in key exporting nations will have a bigger bearing on volatility, on top of new information, with markets awaiting the Canadian planted area data (released 26 April). With UK markets following global price movements, these changes will be felt domestically.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.