Natural gas prices continue to fall: Grain market daily

Tuesday, 14 February 2023

Market commentary

- May-23 UK feed wheat futures closed at £236.50/t yesterday, up £1.50 from Friday’s close. The Nov-23 contract gained £2.50/t over the same period to close at £239.00/t. UK prices followed movements in global markets yesterday, as the war in Ukraine continues to add concern around supply.

- Paris rapeseed futures (May-23) settled at €555.25/t yesterday, up €4.75/t from Friday’s close, supported by movements in the wider oilseed complex.

Natural gas prices continue to fall

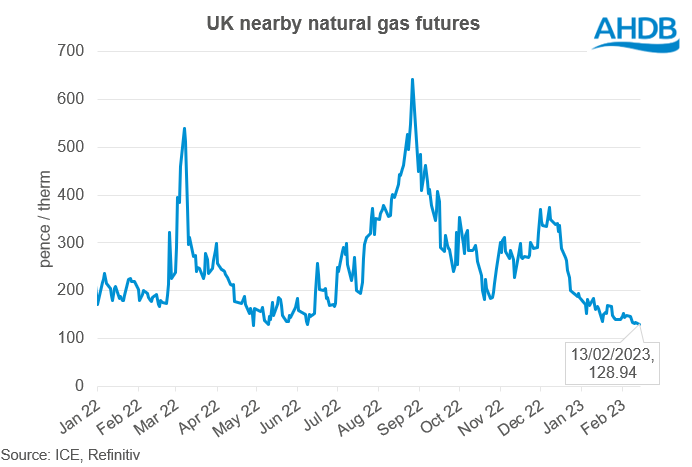

UK natural gas prices have continued to decline over the past month. Nearby UK natural gas futures closed at 128.94p/therm yesterday, down 33.6p/therm from the same point in January and 64.08p/therm lower than the same point in 2022. Natural gas prices have been coming down in Europe over the past few months, as dwindled stocks of Russian gas have been replenished by liquid natural gas (LNG), which has alleviated the immediate supply issues. On top of that, the UK and EU have had a relatively mild winter so far, taking some of the pressure off demand too.

With natural gas prices coming down over recent months, so have fertiliser prices. For the first time in six months AHDB were able to publish a UK produced AN price in its latest release, with UK produced AN (34.5% N) for spot delivery in January averaging £700/t. This is £141/t lower than the last reported monthly price in July 2022, but remains £55/t higher than January 2022. The average price for imported AN in January came in at £682/t, down £19/t from December, but £34/t higher than the same period in 2022.

While Europe have managed to secure ample supplies of gas for this year, it doesn’t necessarily mean that the supply issues have been completely solved. With Russian supplies of natural gas diminished, Europe’s reliance on other sources and LNG have become greater. As Europe’s demand for LNG has increased, it means that its market has become more linked with others such as Asia.

Typically, Asia buys LNG to manage fluctuations in gas demand. Now that Europe has become more reliant on LNG, it means that demand from Asia will likely have a larger influence on price fluctuations than it would have done previously. As with all commodities at the moment Chinese demand is a big watch point for LNG markets too. With the covid restrictions in China lifting, this could lead to greater gas and therefore LNG demand, which could impact Europe’s ability to obtain supplies going forward. Obviously, this is very much a ‘could’ and there are other factors which could influence this. However, with Europe using more LNG since supply from Russia was cut, changes in demand from Asia will likely have a greater impact on prices and availability going forward.

In terms of what this means for fertiliser prices going forward, it is likely that prices will continue to come down, in line with natural gas prices. However, with volatility still present in gas markets its unlikely that we will see fertiliser prices coming back down to the low levels we saw pre-war in the mid-term at least.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.