Milling wheat premiums remain strong: Grain market daily

Tuesday, 5 July 2022

Market commentary

- Yesterday, US markets were closed due to the national 4 July holiday. With strong demand for European wheat on the global market in the absence of US markets yesterday, Paris milling wheat futures gained support. As a result, UK markets were boosted too.

- UK feed wheat futures (Nov-22) settled at £267.00/t yesterday, up £1.00/t from Fridays close. Paris milling wheat futures (Dec-22) recorded a larger gain of €7.50/t, to close at €335.75/t on Monday.

- Nov-22 Paris rapeseed futures closed at €667.00/t yesterday, down €6.00/t from Fridays close.

Milling wheat premiums remain strong

Over recent weeks, we have seen UK wheat prices coming down from the record highs recorded when the war began in Ukraine. Without underplaying the severity of the situation in Ukraine, for global grain markets, this has now been ‘factored in’ and is acting as a floor for price movements. With harvest now underway in parts of the Northern Hemisphere, global grain markets have felt the pressure, with prices coming down. While strong global demand for European grain has cushioned the fall, domestic markets have followed the downward trajectory.

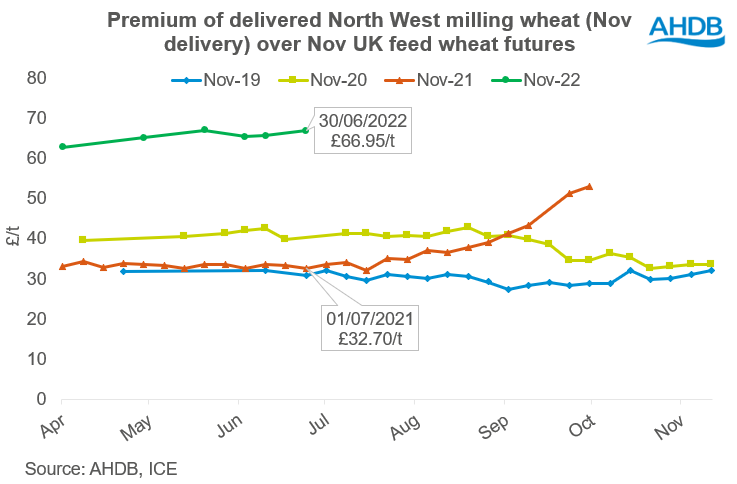

While prices are coming down, they remain well above levels recorded this time last year. What is interesting is that despite the downward turn in markets, the premium of milling wheat over feed wheat has remained high. As at 30 June, milling wheat for November delivery into the North West was at a £66.95/t premium to Nov-22 UK feed wheat futures. For comparison, this time last year the premium of delivered milling wheat into the North West (Nov-21 delivery) was £32.70/t over the Nov-21 futures contract (as at 1 July 2021).

While we can’t say for sure what the size of the 2022 wheat harvest will actually be, it is expected that it will be larger this year than last, driven by a larger planted area. So, you may be thinking, why the bigger milling wheat premiums? It is a given that the current level of volatility and uncertainty on the global market has its part to play. However, looking closer to home and it would appear that domestically the market may have its reservations over the quality and quantity of the 2022 milling wheat pool too. With high fertiliser prices there were questions earlier on in the year whether or not farmers would use their last application of fertiliser or not. On top of that, wet weather when the crop was flowering in some regions may have had an impact on quality.

A lot can happen over the next few weeks as we approach harvest and harvest begins. Any adverse weather at harvest may impact the quality of the crop. However, until it is actually cut, the full picture on quality and even quantity of domestic milling wheat this season cannot be assessed fully. One thing is for sure, the current premium of milling wheat is looking rather attractive for a grower.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.