Market Report – 22 February 2021

Monday, 22 February 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Canadian canola futures (May-21) closed at CA$735.50/t on Friday, gaining CA$34.50 across the week. The nearby contract set its highest ever piece on Friday at CA$773.50/t, ahead of the large peak in 2008. The support in canola was bolstered by Chicago soya oil (May-21), which gained 3.3% across the week.

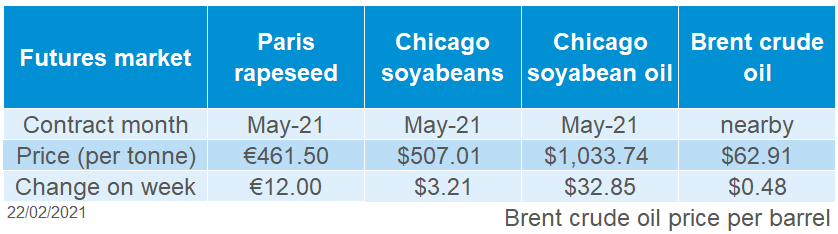

Paris rapeseed futures (May-21) also gained support, closing on Friday at €461.50/t, gaining €12.00/t across the week.

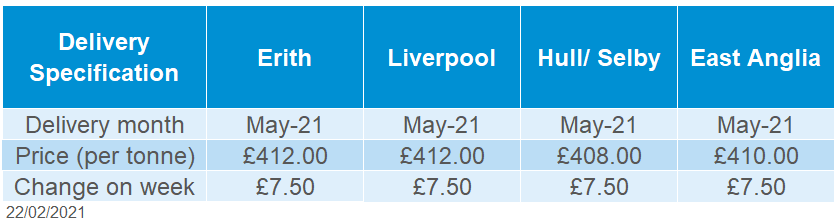

UK old-crop delivered prices on Friday (May, into Erith) were quoted at £410.00/t, up from £7.50/t last week. Gains in domestic markets weren’t as large as global markets, with sterling strengthening against the euro, closing on Friday at £1 = €1.1562.

The UK vaccination program is continuing to support sterling, which gained1.23% against the US dollar last week, to close at £1 =$1.4014 on Friday.

Wheat

Global new crop worries are supporting prices. It’s too early to know the full impact, but more information on the outlook will emerge in the coming weeks as crops come out of dormancy.

Global grain markets

Maize

Short-term, we are waiting on South American area and yield results to confirm the crop size. A larger US maize area could boost global supplies next season, but this is expected to be mostly absorbed by higher demand.

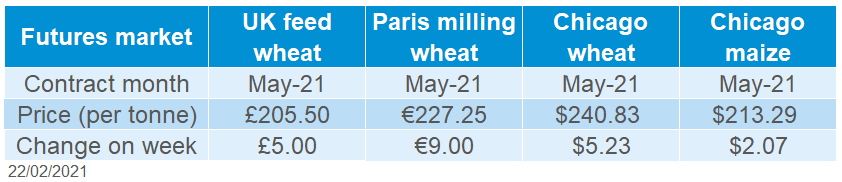

Global grain futures

Barley

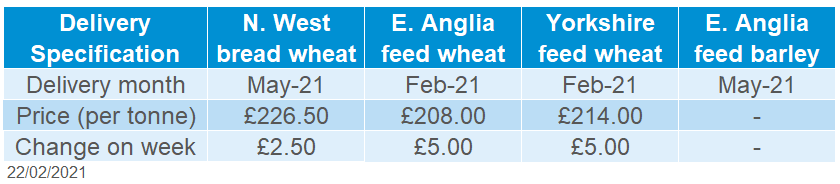

Barley prices continue to follow the direction of wheat in the UK. The large gap between wheat and barley prices pushed up demand for barley but that seems to have reached a ceiling.

UK focus

Delivered cereals

Global wheat futures rose last week, because of worries about the impact of cold weather on winter wheat crops in the US and a lower crop forecast for Russia. US net export sales for 2021/22 in the week ending 11 February were also higher than expected (Refinitiv).

SovEcon cut 1.5Mt from its 2021 Russian wheat crop forecast, due to the impact of the Russian export tax on farmers’ decisions and unfavourable weather. At 76.2Mt, the latest forecast is 9.7Mt smaller than the 2020 crop.

Maize futures fell on Thursday after the USDA estimated the 2021 area at 37.2Mha at its annual Outlook Forum, 0.5Mha more than the 2020 area. This could mean a bigger 2021 crop.

But, maize futures ended the week higher. The USDA only forecast a small year-on-year rise (+1.3Mt) to US stocks by end of 2021/22, because of more domestic demand and high exports. The US also sold more for export in 2021/22 in the week ending 11 February than the trade expected (Refinitiv).

Uncertainty persists over maize yields in South America, especially Argentina. January rain was 30% above average, boosting soil moisture and crop conditions. However, this month, rainfall is expected to be half the normal level (Refinitiv). Crop condition ratings by Buenos Aries Grain Exchange slipped last week, but are still better than at the start of January.

Oilseeds

May-21 UK feed wheat futures rose by a similar amount to US markets last week (Fri-Fri). This was despite sterling rising. On Friday, sterling hits its highest level against the euro since end-Feb 2020 (£1 = €1.1562) and since April 2018 against the US dollar (£1 =$1.4014).

Delivered prices for feed wheat and feed barley rose by similar amounts to UK futures (Thu-Thu). But there were smaller price rises for Group 1 bread wheat. The market is working through stocks built ahead of the EU exit deadline. In addition, demand is curtailed for some market sectors by the coronavirus restrictions.

AHDB will release the next estimates of UK grain supply and demand on Wednesday.

This week, Defra launch surveys to understand on-farm stocks of grain in England and Wales. Completing this survey is imperative to ensuring accurate data this season. Accurate data helps everyone to make better business and policy decisions. Click here to see how we’re working with Defra to improve the accuracy of market data.

Rapeseed

Support in soyabeans prices continues to assist moves in rapeseed markets. Tightening continental supplies offer support, with imports required to fulfil demand.

Global oilseed markets

Soyabeans

On-going tight US stocks for the 2021/22 marketing year offer support in soyabean markets. However, this is tempered by South American harvest progression.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

US soybean futures (May-21) gained $3.21/t last week (Friday-Friday), closing on Friday at $507.01/t.

The support stemmed from the USDA outlook forum last week. The USDA forecast US stocks of soyabeans to increase from 3.27Mt in 2020/21 to 3.95Mt in 2021/22. This is despite a much bigger US area.

Due to the current attractive price of soyabeans, US growers are expected to sow a record 36.4Mha of soyabeans for the 2021/22 marketing year (USDA). But, strong demand is also expected.

The gains in soybean markets were partially offset by the slowing of US export demand, as the South American harvest continues. Net US export sales (this season and next) in the week ending 11 February stood at 624Kt, in-line with market expectations.

Reports last Monday put the harvest of soybeans in Brazil at 10.1% complete, as at 12 Feb, up from 3.6% the week before. Brazilian agency Conab will update these figures later today. Any gains in soyabean markets would likely be tempered by a faster South American harvest.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.