Market Report - 06 April 2021

Tuesday, 6 April 2021

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Rapeseed prices followed the trends set by soyabeans and old crop prices ended last week down, while new crop prices were up. New crop (Nov-21) rapeseed delivered to Erith was reported at £391.00/t on Thursday, £4.50/t more than on Friday 26 March. This was a similar gain to new crop Paris futures in percentage terms.

Something to watch going forward is the recent rise in sterling. On Thursday (01 April) £1 was worth €1.1745, compared to €1.1556 on 01 March (Refinitiv). This strength in sterling is expected to continue in the short term. This means that even if global prices rise, UK prices may not rise as much.

The 2021 EU-27 rapeseed crop is forecast at 16.8Mt by Stratégie Grains (Refinitiv). This is down from the 17.1Mt forecast last month. This would keep European OSR supplies tight next season and keep European and UK rapeseed prices high compared to those for other oilseeds.

Old crop Canadian canola futures rose sharply yesterday. This is likely linked to a jump in exports during the week ending 28 March and could also support European rapeseed prices.

Wheat

Large US acreage and bigger stocks are outweighed by tight maize prospects. Crop conditions will also be key to wheat price direction in the coming months.

Global grain markets

Maize

With a raft of bullish stories from the USDA, new crop prices moved higher. Crop planting/ development both sides of the equator will need watching for future direction.

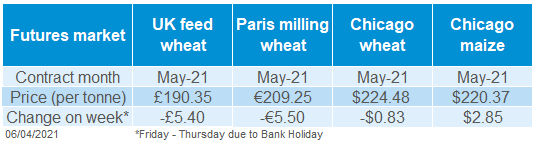

Global grain futures

Barley

Barley will take its steer from the wider grains complex, as it looks to remain attractive into diets. A large 2021 UK crop is likely to maintain a reasonable price discount to wheat, albeit unlikely to reach 2020/21 levels.

UK focus

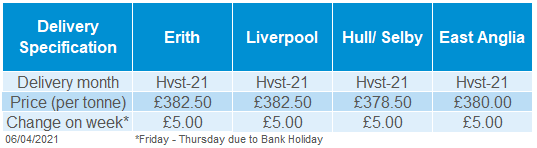

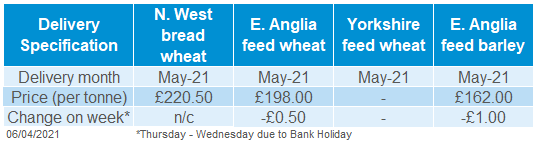

Delivered cereals

Global grain markets ended last week strong; the USDA plantings and stocks report was bullish for maize, which drove the whole complex higher. The 2021 US maize area was seen at 36.9Mha, 2.2% below trade expectations in a pre-report poll by Refinitiv. US stocks of maize as at 1 March were 195.6Mt, 1.7Mt tighter than trade expectations.

The bullish signals for maize were enough to outweigh the bearish wheat news. US farmers intend to plant 18.8Mha to wheat in 2021, 3.1% above trade expectations and 4.5% up year-on-year. Further, US stocks of all wheat were 2.8% above trade estimates at 35.8Mt.

As we move through April and into May, weather stories will likely be key drivers of market volatility. We need to watch stories for both the northern and southern Hemispheres. The price risk is heightened by the massive net long position held by managed money funds in Chicago corn futures. Net longs as a percentage of open interest now stand at 22.3%, the most bullish position for funds since February 2011.

In Brazil, Safrinha (second crop) maize planting is almost complete, but soil moisture is lacking after la Niña. Longer range weather forecasts suggest only average rainfall in the next month, which may hinder crop prospects. StoneX have trimmed their estimate of Safrinha maize by 3.65Mt, to 77.65Mt. Conab will release their latest forecast on 8 April.

North American weather will also be key as maize planting progresses and other crops develop. The first USDA crop report of the year was published yesterday and showed winter wheat conditions to be broadly in line with the five-year average.

Finally, Russian analytics firm Sovecon cut its estimate of 2020/21 Russian wheat exports by 200Kt, to 38.9Mt.

Oilseeds

It was a short week of trading for UK markets last week, with Friday a Bank Holiday. In the run up to Wednesday’s USDA reports new crop (Nov-21) feed wheat futures moved lower. The bullish USDA reports saw Nov-21 feed wheat futures move up £3.25/t, on Wednesday. We saw a further downward move on Thursday, with new crop wheat closing at £163.25/t, down £0.75/t Thursday-Thursday.

UK physical trade remained thin. This, combined with the volatility in futures caused by Wednesday’s reports, made pricing UK grain challenging last week. UK delivered values were largely flat or down, with some reductions to new crop delivered premiums.

Soyabeans

Good Brazilian harvest progress means more confidence in crop estimates. But, US farmers may not plant as much as originally expected. This is supporting new crop prices, though the higher prices may encourage more US acres.

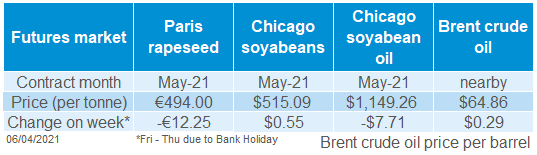

Global oilseed markets

Rapeseed

New crop rapeseed supplies look set to remain tight in Europe. This is supporting new crop rapeseed prices compared to other oilseeds.

Global oilseed futures

Rapeseed focus

UK delivered oilseed prices

Old crop oilseed prices fell or were broadly static last week, while new crop prices rose.

All prices moved lower in the in early part of last week due to speculative traders re-positioning ahead of Wednesday night’s USDA report. Prices then rose sharply in response to the report, which showed a smaller than expected US soyabean area. Old crop prices retreated again as speculative traders booked profits, but new crop prices held onto their gains.

Nov-21 Chicago soyabean futures closed at $464.30/t on Thursday, up $20.76/t from 26 March. The contract rose a further $1.93/t yesterday to $466.28/t, the contract’s highest price to date.

US farmers intend to plant 35.5Mha to soyabeans this year. This is 5% more than last year but far less than the 8% rise the industry expected, according to a poll by Refinitiv. Higher prices could change some farmers’ minds, driving further soyabean acres. If this area is confirmed, the market is worried the US could produce a smaller crop than is needed.

The Brazilian soyabean harvest is now 78% complete (AgRural). While this is still behind last year’s pace of 83% complete, the advancing harvest means increasing confidence in production estimates. This could remove some risk premium from old crop prices.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.