Lack of bullish drivers from the latest USDA report: Grain market daily

Friday, 9 February 2024

Market commentary

- UK feed wheat futures (May-24) closed at £168.75/t yesterday, losing £2.50/t from Wednesday’s close. While new crop futures (Nov-24) lost £2.65/t over the same period to close at £187.35/t yesterday. The subsequent loss in new crop futures yesterday means that both the May-24 and Nov-24 contract are at all-time lows.

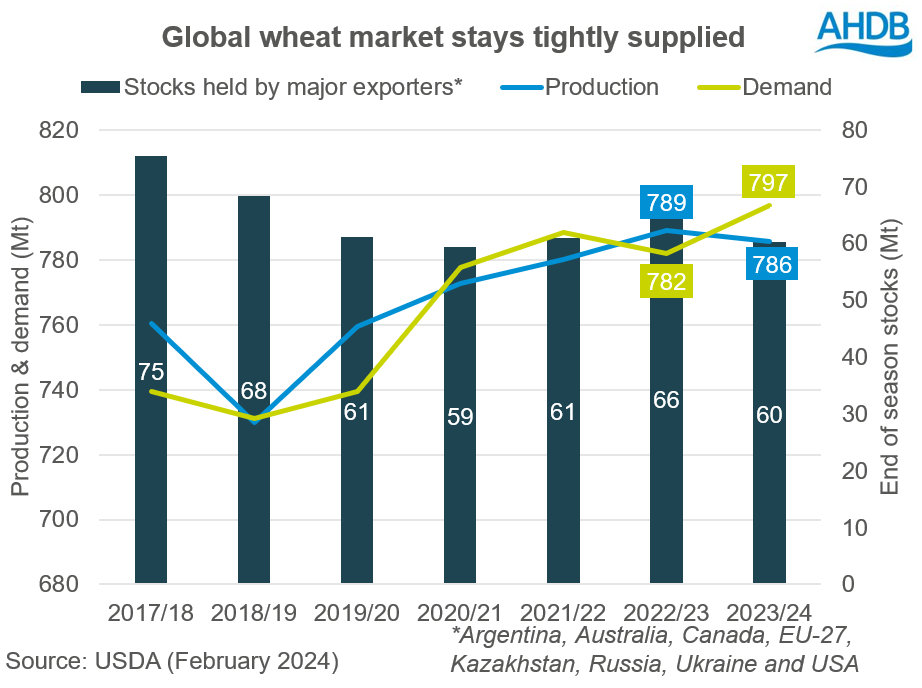

- Competitive Russian wheat exports remain the key catalyst for the depressed European wheat market as Russian wheat prices have continued to slide. Paris milling wheat futures (May-24) closed at €204.50/t yesterday, falling €4.50/t from Wednesday’s close.

- Russian wheat (11.5%) reportedly priced at $218/t FOB (approx. £173/t) yesterday, down over $7/t from last week. Current prices are far below the believed Russian export price floor of $270/t as pressure to reduce inventories outweighs the depressed market (LSEG).

- Paris rapeseed futures (May-24) closed at €412.50/t yesterday, gaining €1.75/t from Wednesday’s close. The new crop futures contract (Nov-24) closed at €418.25/t yesterday, gaining €3.25/t over the same period.

- Marginal support for soyabean prices in anticipation of the USDA’s February WASDE in addition to supply concerns for palm oil supported the oilseeds complex. Furthermore, gains in Brent crude oil futures prices also supported the vegetable oils market.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Lack of bullish drivers from the latest USDA report

There were no bullish drivers in this month’s World Agricultural Supply and Demand Estimates (WASDE), published by the USDA last night.

In the run-up to the WASDE’s release, oilseed markets moved sideways while pressure on global wheat markets continued. Ahead of the release, analysts were expecting, on average smaller global stocks for soyabeans but negligible revisions for global maize and wheat stocks.

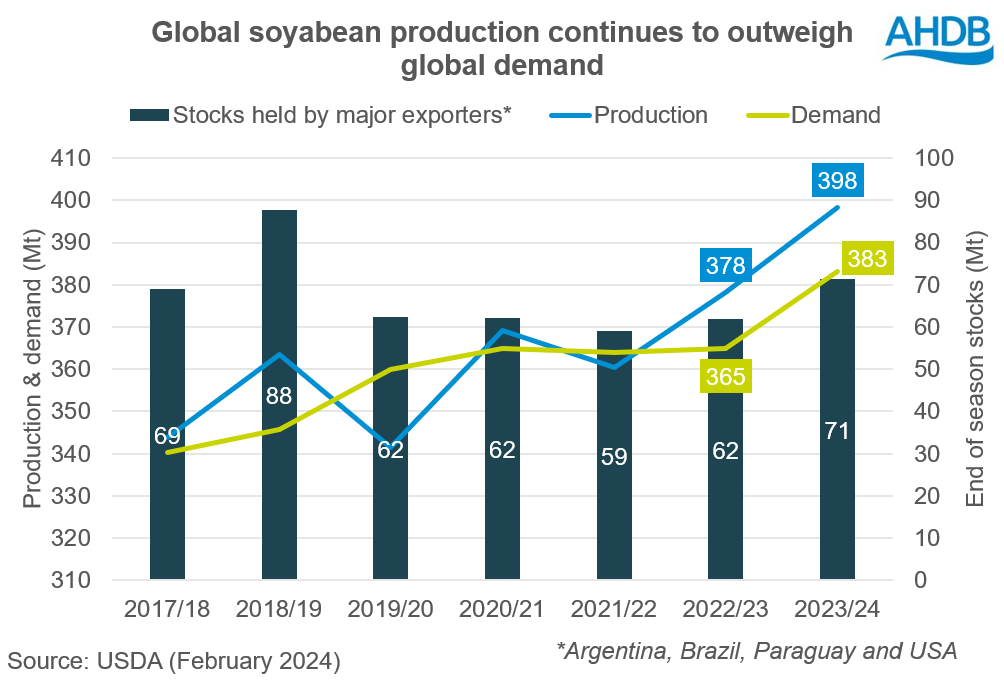

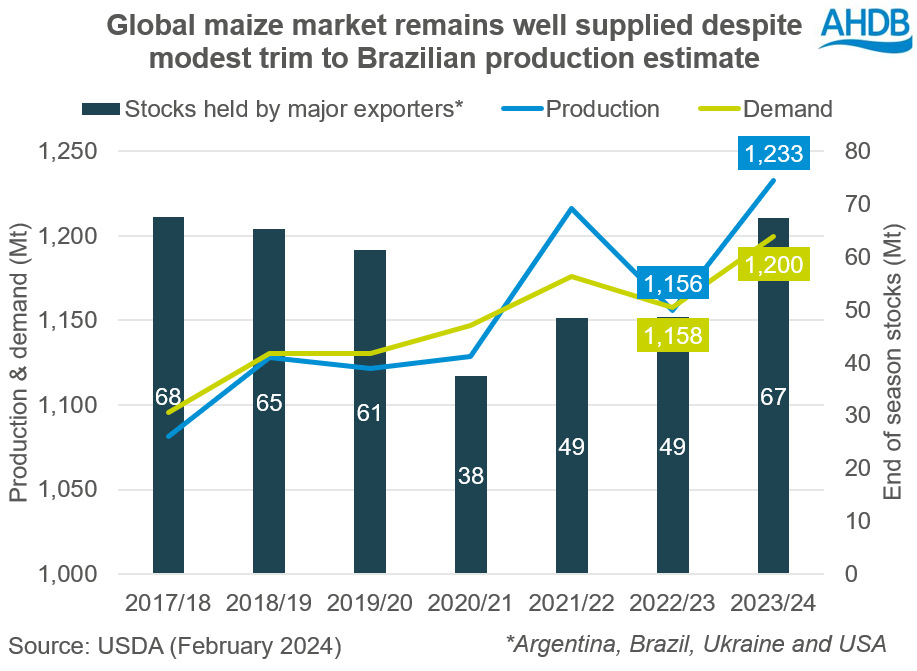

However, global ending stocks for soyabeans rose 1.4 Mt to 116.0 Mt, the largest on record. While global ending stocks for maize and wheat fell by 3.2 Mt and 0.6 Mt respectively, US ending stocks for both grains rose unexpectedly.

As a result:

- Chicago soyabeans futures (May-24) gained $0.83/t to close at $440.79/t.

- Chicago maize futures (May-24) lost $0.59/t to close at $175.20/t.

- Chicago wheat futures (May-24) lost $5.14/t to close at $218.24/t.

Due to the time of the WASDE’s publication, there is only a limited window for trading in Europe after publication. Therefore, this may explain why European markets have not responded to the same measure as US markets.

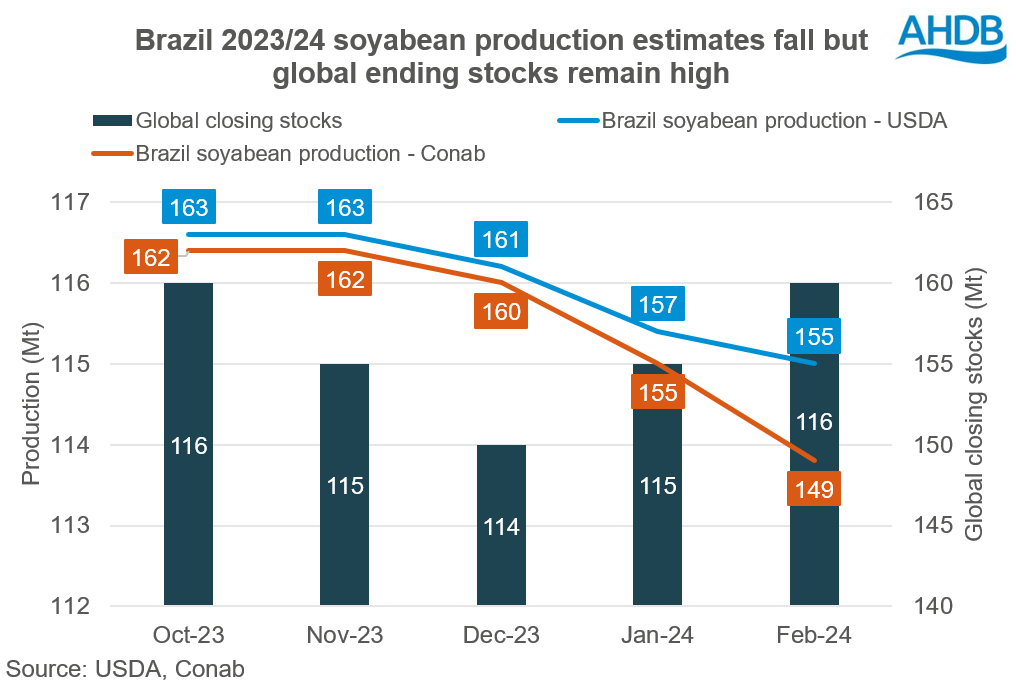

Decreased Brazilian soyabeans stir no surprise

Brazil’s soyabean crop has been trimmed for the third month in a row by the USDA by 1.0 Mt to 156.0 Mt. Despite a higher planting area, yields are lower due to the unfavourable growing conditions. This downgrade of production appears cautious relative to Conab’s latest revision to 149.4 Mt. However, the USDA forecasts global soyabean stocks to rise 12.5 Mt over 2023/24. Therefore, this allows for a significant buffer against further reductions.

With strong soyabean production in Argentina and heavier US stocks, the heavy global supply continues the bearish outlook.

To review the latest global supply balances for soyabeans, maize, and wheat, and how they differ from January’s estimates, please see the drop-down links below:

As discussed above, global soyabean end-of-season 2023/24 stocks have been revised upwards by 1.43 Mt to 116.0 Mt. Production continues to outweigh global demand with a large year-on-year rise in end of season stocks expected. Compared to the January WASDE, 2023/24 exports and demand have seen a marginal downward revision, while opening stocks rise by 1.7 Mt.

Since January’s WASDE report, global maize production has reduced by 3.16 Mt to 322.1 Mt. This can be largely attributed to the 3.0 Mt subtraction from the Brazilian maize crop to 124.0 Mt, following unfavourable growing conditions across the region. However, this revision appears modest relative to Conab’s recent 113.4 Mt forecast, down 3.9 Mt from Conab’s previous estimate in January.

Global maize demand is relatively unchanged from January’s report.

Global wheat 2023/24 ending stocks fall marginally by 0.6 Mt to 259.4 Mt as modest adjustments to the demand outlook outweigh the minor revisions to the supply picture. Thus, the global wheat balance remains tight.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.