Inflation caps gains despite tight global supply: Grain market daily

Wednesday, 15 June 2022

Market commentary

- While the majority of global grain markets closed down yesterday, UK feed wheat futures resisted some of the downward pressure to close up. The Nov-22 contract gained £1.35/t from Monday’s close to settle at £310.85/t yesterday.

- With Ukraine remaining ‘offline’ in terms of major trade, it is expected that Asian markets will look to buy wheat from elsewhere from next season, including France and Romania, according to Refinitiv sources.

- Nov-22 Paris rapeseed futures settled at €769.00/t on Tuesday, up €9.00/t from the previous sessions close.

Inflation caps gains despite tight global supply

Despite the cereal supply and demand situation remaining tight, gains have been somewhat capped on the back of rising global inflation rates.

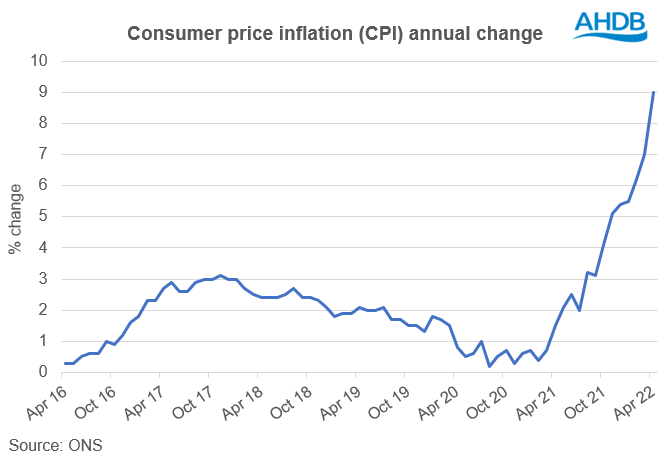

With the ongoing war in Ukraine impacting energy and food prices, as well as COVID restrictions in some parts of the world lingering, inflation rates have been increasing quite considerably. Domestically, looking at the latest data we have, consumer price inflation (CPI) increased by 9% on the year in April. From January to April, CPI was an average of 7% higher than the same period last year. The Bank of England is currently expecting inflation to rise to around 10% for the full year. That said, if inflation rates continue to rise as they have been doing, then this could be moved further.

High inflation over recent months is not just a domestic issue, with increases also seen in the EU and considerably so in the US too.

So what does this mean for UK cereal markets going forward? Rising global inflation is pushing stock and commodity markets lower. While this may be the case, the ongoing tight global supply picture is creating a price floor to markets at the moment. If supply fundamentals become even tighter, then this would likely override some of the pressure from rising inflation rates. However, if there is larger than anticipated global supply next season, then this would add further pressure to markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.