How might La Niña impact 2022/23 Argentinian maize production? Grain market daily

Friday, 21 October 2022

Market commentary

- Yesterday, UK feed wheat futures (Nov-22) remained unchanged from Wednesday’s close, closing at £268.65/t. The May-23 contract gained £1.95/t over the same period, closing at £283.45/t.

- Paris rapeseed futures (Nov-22) closed yesterday at €632.00/t, gaining €4.25/t on Wednesday’s close. This was off the back of support in soyabeans due to strong export demand for US origin.

- Yesterday, AHDB published the 2022/23 Early Balance Sheets for wheat and barley, analysing the UK supply and demand for the season ahead.

How might La Niña impact 2022/23 Argentinian maize production?

Argentina is an important global producer of maize, exporting 37.5Mt of maize in 2021/22 which accounted for 18.5% of global maize exports. For the 2022/23 marketing year they are expected to produce a substantial crop of 50Mt and exports are forecasted at 41Mt (Buenos Aires Grain Exchange, USDA).

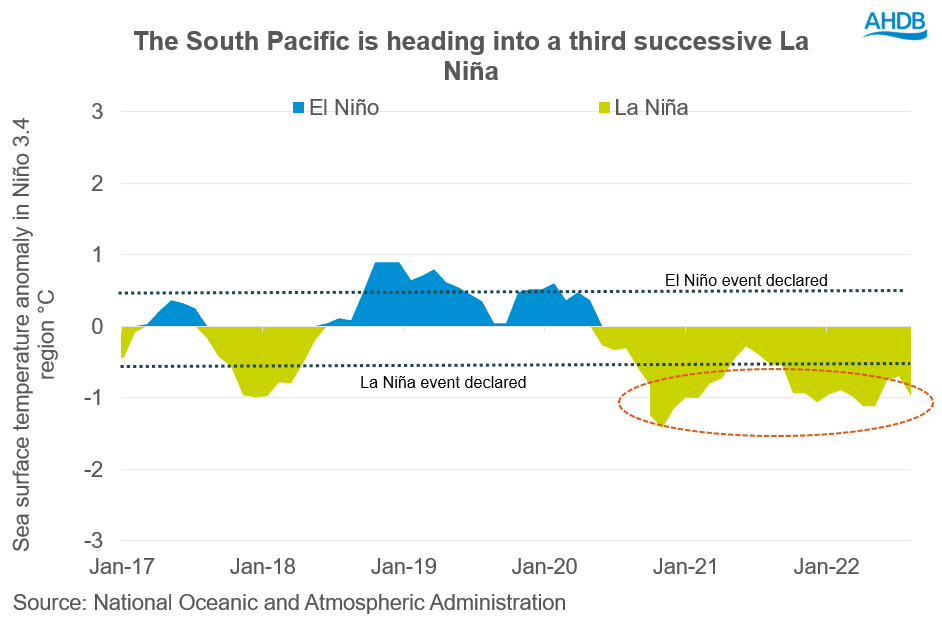

However, currently much of Argentina is in exceptional drought, and despite rains forecasted for the coming week there is a 75% chance of a La Niña event from December to February. This weather event causes dryness for parts of South America and there is a 60% chance it could continue into January to March (National Oceanic and Atmospheric Administration, Columbia Climate School).

Currently, Argentinian maize plantings for 2022/23 are estimated at 17% complete (as at 19 October) and due to the recent dry weather this is down 9.3% compared to the same point last year (Buenos Aires Grain Exchange). This delayed planting combined with the impacts of the La Niña going forward could potentially mean Argentinian maize production could be revised down from current estimates. This could have the potential to further support global grain prices if there aren’t any significant changes to demand outlook for this season.

Impact on Argentinian production

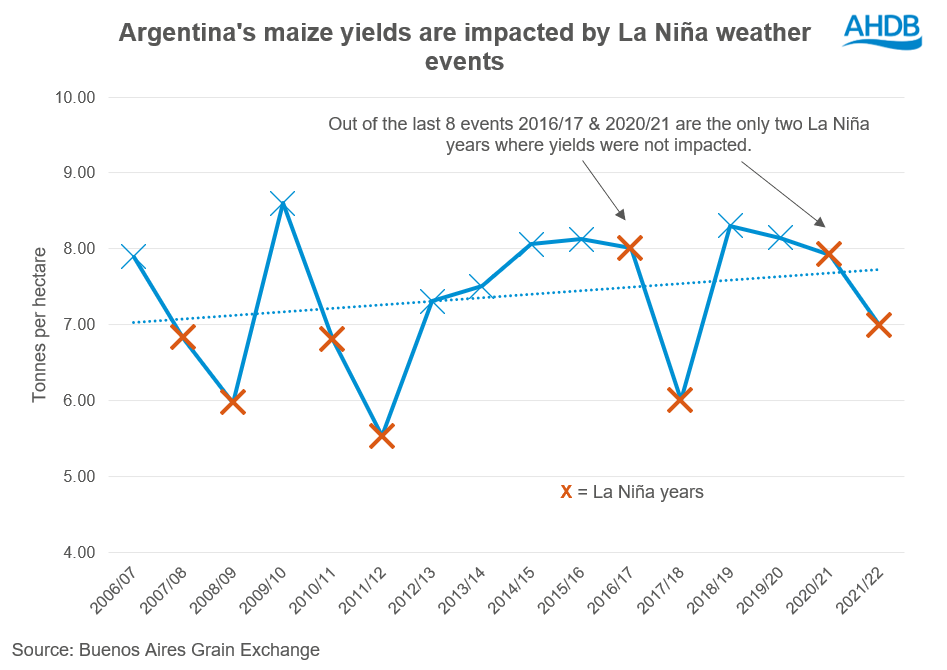

Due to the nature of the La Niña weather event, in most cases it can have adverse effects on Argentinian maize yields. Six out of eight of the last La Niña weather events that have occurred between 2007 and 2021 have had yields below forecasts and trendline expectations.

This was especially the case in 2011/12 and 2017/18 with yields reduced by 21% and 25% on the year, respectively.

In data going back two decades it shows that Argentina’s maize yields have slowly been improving. Over the last 15 years yields have never reduced below 7.3t/ha in a non-La Niña year, indicating there is a correlation between La Niña events and reduced maize yields.

Although this correlation is strong, 2016/17 and 2020/21 were La Niña years and yields were not severely impacted.

Conclusion

If Argentina remains dry due to La Niña there is potential for yields to be reduced, and with that their production could be revised down. With global maize supply already dampened due to the war in Ukraine and adverse weather in the US and EU, we could see markets further supported in the second half of this season from this La Niña event, which could filter into domestic grain prices.

However, global recession concerns could lead to demand destruction. This may limit gains going into 2023, but this is a key watchpoint.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.