Has the loss of demand inflated stocks across Europe?

Wednesday, 17 June 2020

By Patty Clayton

A key factor in the recovery in dairy product pricing through 2020 will be the level of stocks relative to demand. Stocks typically build during the peak production period, but with the disruption to demand across Europe through March and April, the question is whether this has led to higher than normal stocks.

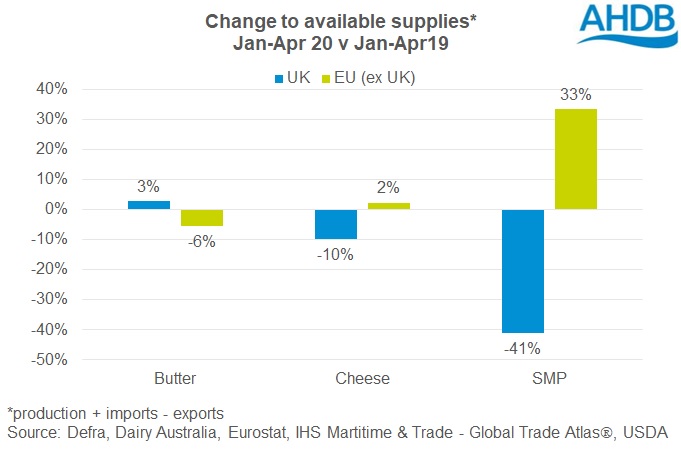

Different trends have occurred in how available supplies[1] have changed year-on-year in the EU and the UK. The EU (excluding UK) has seen a build-up of skim milk powder (SMP), with minor changes in available supplies of both cheese and butter. In contrast, the UK has seen drops in the available supplies of SMP and cheese, and a small increase in butter supplies.

SMP

In the EU the large increase in available supplies of SMP has resulted from both higher production and lower exports compared to the previous year. High export volumes of intervention stocks in 2019 explains some of the drop we’ve seen in export volumes this year. However, exports have also been hampered by the closure of Asian markets in the first quarter of the year due to coronavirus.

In the UK, SMP production volumes were lower this year, despite the disruption to fresh milk markets. A lack of drying capacity and significantly higher retail sales of cheese meant most of the milk was diverted to cheese in preference to SMP.

Cheese

Available supplies of cheese supplies have seen a marginal increase in the EU. There has been a small increase in production, but lower export volumes in April have pushed up availability.

In the UK, the main reason for lower supplies has been the drop in cheese imports. Although Brexit stockpiling inflated 2019 volumes, imports this year are down 20% from year earlier levels and 9% compared to the same period in 2018. This will be a direct consequence of the lockdown as imported cheese is primarily destined for foodservice and industrial demand, with most retailers requiring ‘Red Tractor’ (domestically produced) cheese. There was an increase in Cheddar production as well, likely in response to the higher retail demand, although this was offset by lower production of other cheese varieties such as territorials and blue-veined varieties.

Butter

In the EU, butter production in the first 4 months of 2020 was up year on year. However, a lower level of imports, combined with strong exports have meant available supplies are down by 6% compared to last year.

In the UK, the small increase in available supplies is due to reduced exports. This is more a reflection of elevated exports in 2019 in preparation for a potential hard Brexit in March than any significant adjustment to trade levels.

[1] available supplies are calculated as (production + imports – exports). This figure includes volumes sold and volumes held in inventory as consumption data is not readily available for all markets.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.