GB harvest progresses at pace & AHDB outlooks are now live: Grain market daily

Friday, 12 August 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £272.80/t yesterday, up £3.80/t on Wednesday’s close. The Nov-23 contract closed at £247.30/t, up also £3.80/t over the same period.

- Paris rapeseed futures (Nov-22) settled at €660.00/t on Thursday, up €1.00/t on the Wednesday’s close.

- Although market sentiment has been slightly pressured following the continuation of exports from the Ukraine out of the Black Sea they still remain volatile. Short term markets are feeling support from the hot and dry weather in the US and EU.

- The weather outlook also meant Chicago soybean futures (Nov-22) closed at $532.18/t, an increase of $7.62/t with concerns over crop development in this key period.

GB harvest progresses at pace & AHDB outlooks are now live

Our latest harvest report is now available here: harvest progress in Great Britain.

Below there are some key highlights listed from the latest report.

- This year’s harvest progress is excellent so far, with 63% of the total GB harvest complete, far exceeding the five-year average.

- To date, an estimated 65% of total GB winter wheat area has been harvested with better yields on heavier lands due to greater moisture retention.

- Winter oilseed rape harvest is 95% complete and GB winter barley harvest is complete. Spring barley harvest has been driven by progress in the southern half of England, at 23% completion.

- Combine fires are a worry, with hot, dry weather experienced by all regions last week.

- Grain storage is an issue due to the fast harvest pace with lorry and driver shortages slowing progress for some, but little drying needed and the focus is on cooling the grain.

Cereals and Oilseeds Agri Market Outlook: Summer 2022

We have now published the cereal and oilseeds outlooks for the 2022/23 marketing year, which gives an overview of the coming season ahead. Below there are highlights from the analysis but be sure to read the full articles on Agri Market Outlook page on the AHDB website.

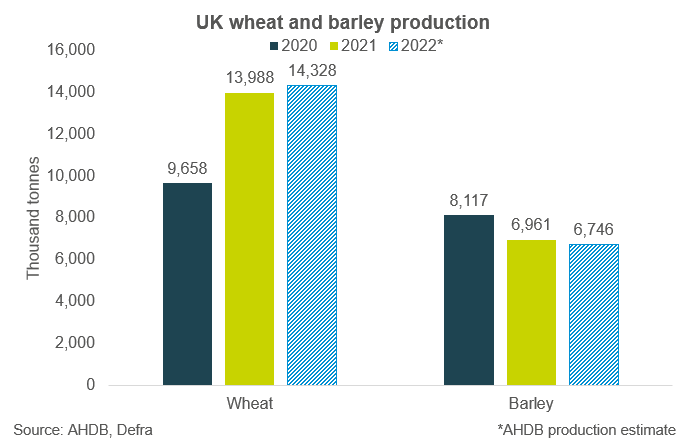

Wheat

With the rapid start and progression of harvest, coupled with an increased wheat carry-over stock from last season on higher imports and a larger crop, we start this season (2022/23) with a plentiful wheat supply.

With the latest Planting and Variety survey results pegging the UK wheat area for harvest 2022 at 1.807Mha (1% up y-o-y), wheat production for 2022 is forecast at 14.328Mt.

Barley

The domestic barley balance begins this season tighter, with rebounding demand from the brewing, malting and distilling sector (BMD). Demand is expected to remain strong this season for barley, especially from the BMD sector, with increased distilling capacity coming online in Scotland.

UK barley area, production is estimated to be lower than in 2021 at 6.746Mt. The UK looks to remain a net exporter of barley for the 2022/23 season. Though, imports are currently forecast near 2021/22 levels to meet malting barley demand.

Demand for cereals

Animal feed production is expected to decline this season (2022/23), largely driven by a squeeze felt in the poultry and pig sector. Last season, pig feed production was higher, due to a backlog of pigs on farm waiting to be slaughtered because of labour shortages.

With the price of gluten soaring over recent months, millers may look to importing more high protein wheat. In terms of demand, flour production is expected to remain relatively stable. However, if inflation continues to rise, we could see this have an impact on consumer demand.

Domestic demand from the bioethanol sector is expected to be strong over this marketing year, supported by the UK and European E10 fuel mandates.

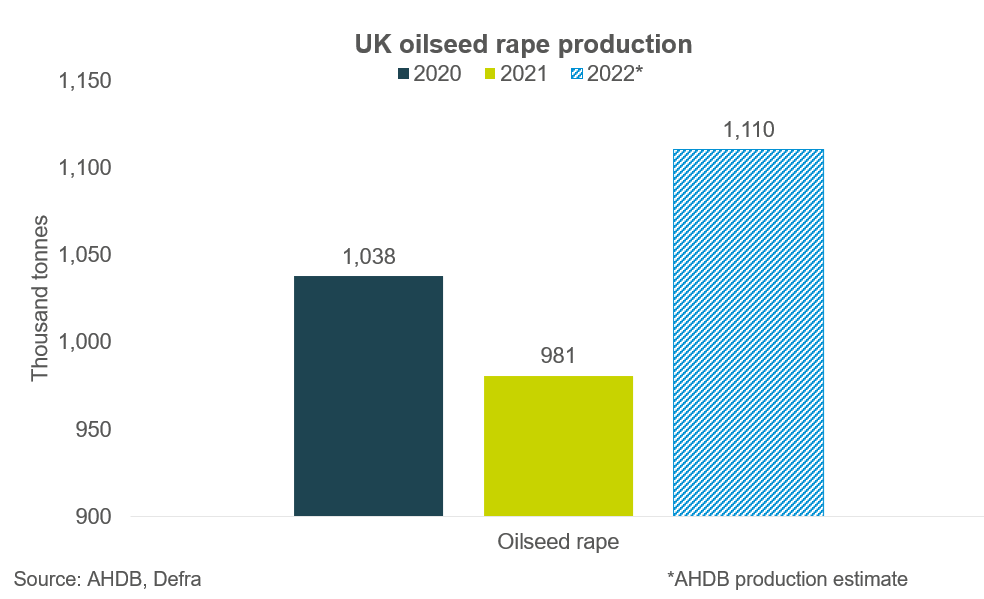

Oilseed rape

For this marketing year it’s expected that rapeseed production will increase to 1.1Mt, up from 981Kt produced last year.

UK will remain in a supply deficit. However, imports for 2022/23 will slightly be subdued from the all-time high of 956.1Kt recorded in 2021/22.

It’s still expected that Europe will supply the UK with a large proportion of rapeseed imports. With Australia, and potentially Uruguay, supplying the UK in the second half of the marketing year.

There is potential for UK crushing to decrease with the Cargill planting closing in Hull. However, this is still in consultation and even if it were to close in December it’s halfway through the 2022/23 marketing year and wouldn’t impact crushing demand substantially.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.