Feed demand shifts as prices rise: Grain market daily

Wednesday, 19 January 2022

Market commentary

- May-22 UK feed wheat futures gained a further £1.75/t yesterday to close at £213.50/t. That is a second consecutive day of gains after dropping almost everyday last week.

- Chicago and Paris wheat futures (May-22) also recorded gains yesterday to close at $282.99/t and €265.75/t, respectively.

- Wheat markets, and subsequently maize markets, have rallied on the back of concerns surrounding Russian and Ukrainian relations which could disrupt global wheat trade. Also, strong US export data offers support.

- Paris rapeseed futures (May-22) dropped €25.00/t yesterday to close at €687.00/t, the lowest price since 21 December 2021. However, a rally in crude oil, a supported palm oil market and strong soyabean demand, could limit losses to rapeseed today.

Feed demand shifts as prices rise

Last week saw the release of updated GB animal feed production numbers up until November 2021. Focusing on the four main cereals (wheat, barley, oats, and maize), animal feed usage season to date (Jul-Nov) is up 2% year-on-year at 2.16Mt. This said, maize usage in GB animal feed is down 29% year-on-year, although only down 6% from the 5-year average (2016/17-2020/21).

This is unsurprising considering the current price levels of imported maize versus domestic cereals. Yesterday, the AHDB quoted imported Ukrainian maize at £245/t in our import parities survey. This is more than a £35/t premium to domestic delivered feed wheat into East Anglia.

Oats on the other hand, have had a strong start to the year in GB animal feed rations. At 50.0Kt, July to November oat use is up 89% on last season and 118% on the 5-year average.

Oat use became more popular towards the latter half of last season, as the price discount to wheat and barley stretched. This popularity has seemingly continued into this season.

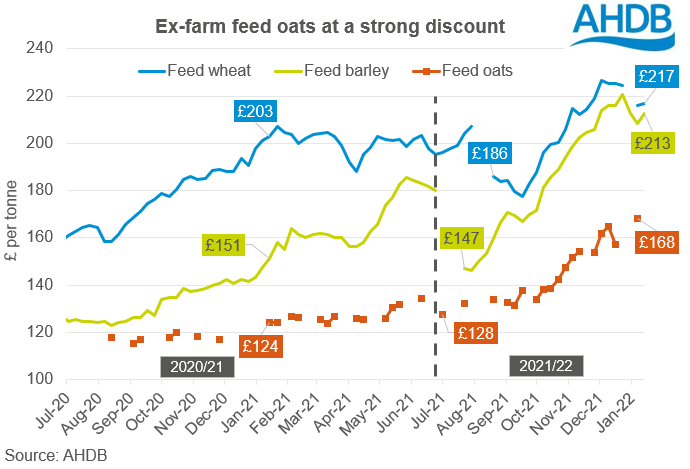

Oats have been gaining in value alongside other grains since the start of the marketing year. The latest average UK ex-farm feed oat price in the AHDB’s corn returns survey was £168/t (06 Jan) compared to £128/t at the start of the marketing year. This is also the highest average ex-farm oat price quoted in the AHDB corn returns survey since August 1994, when oats began being reported. Despite the rise in value, oats have remained very competitive against other feed grains due to a general upwards shift in feed grain markets.

The discount from feed wheat to feed barley has really squeezed. On the 13 January 2022 ex-farm feed barley prices were valued at just £4.50/t below feed wheat compared to £51.60/t discount at the same point last year. With compounders, and indeed farmers, already accustomed to using a higher proportion of oats due to the shift at the end of last year, coupled with the relative price discount to other feed grains it is likely oats will remain popular throughout the season. This said, the current rate of uplift may be limited by availability, although fed on farm use will likely be elevated too.

As a result of strong demand, and if global feed grain markets remain raised, oats values will likely remain strong too.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.